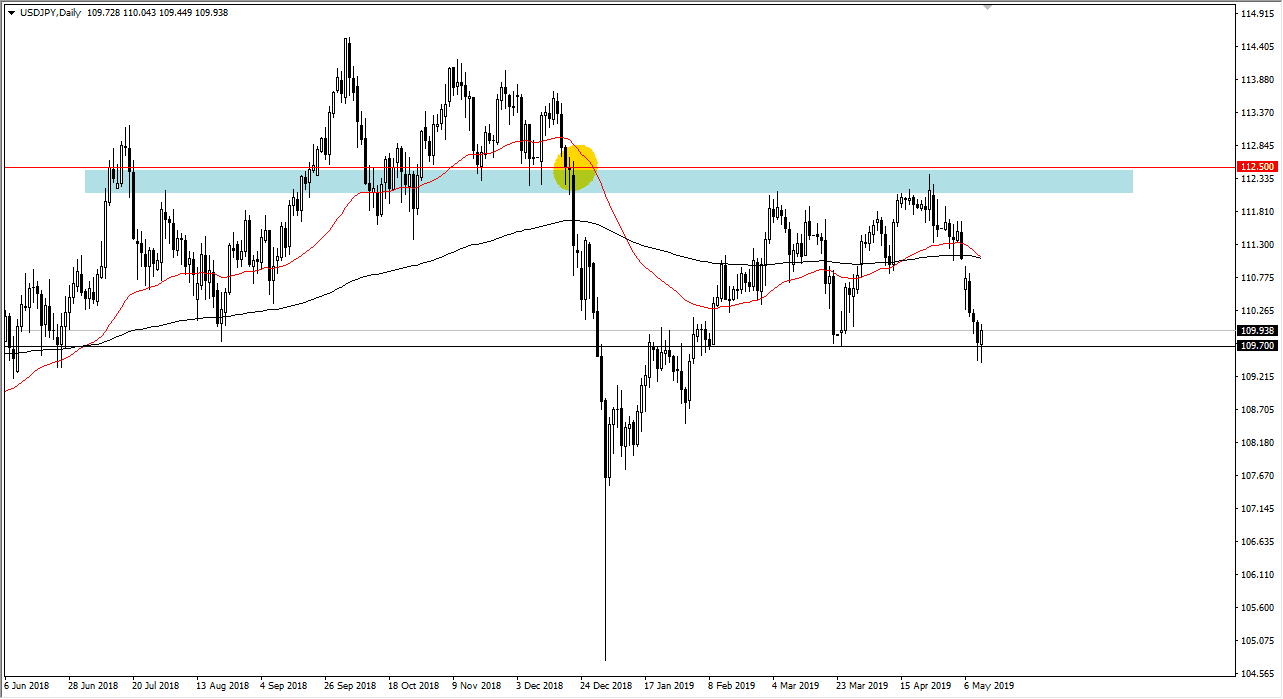

USD/JPY

The US dollar initially pulled back during the trading session on Friday, breaking down below the ¥109.70 level, but then turned around to recover just as the stock markets did. At this point, the market has formed what would amount to a 48 hour hammer, and it looks likely that you can find buyers underneath going forward. The stock markets rallying tends to help this market, and as a result I think that given enough time we could go higher to look at filling the gap above. That gap is at the ¥111 level, and therefore I suspect that’s where were going.

However, if we break down below the lows of the last couple of sessions, we could then go to the ¥109 level, and then eventually the 100 a young level after that. At this point, the markets look as if they are trying to make a stand and going into the week and it looks as if we are going to go higher.

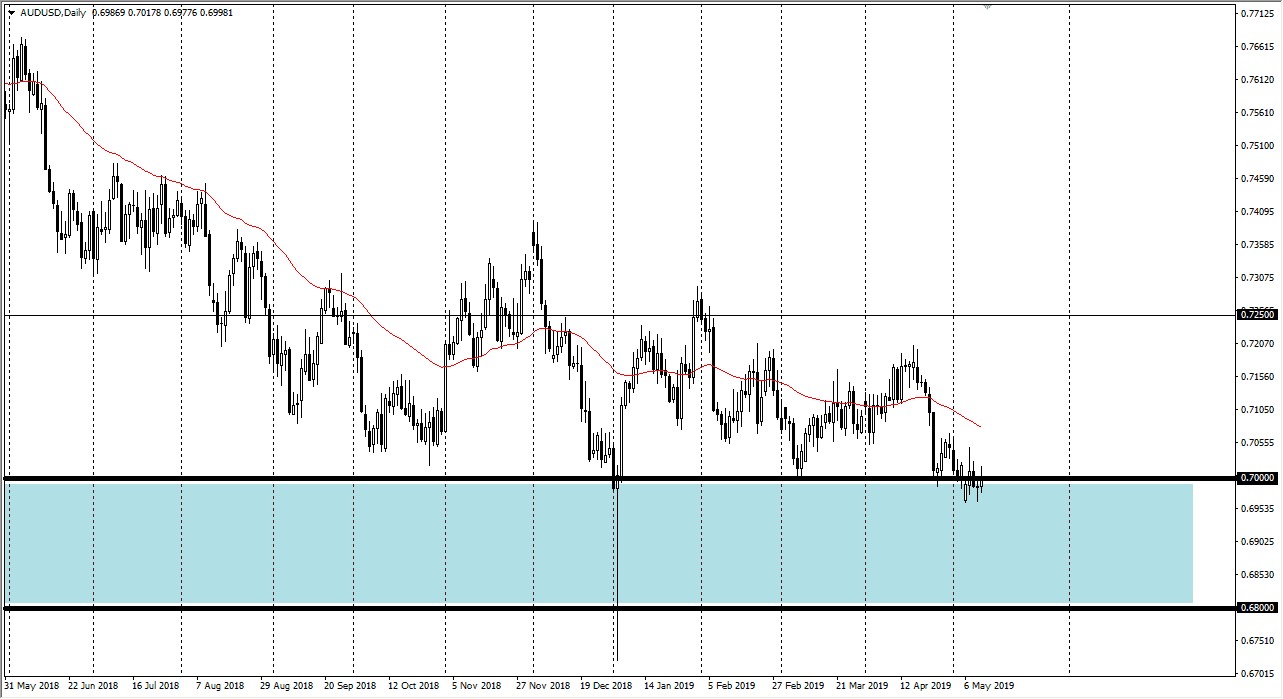

AUD/USD

The Australian dollar rallied a bit during the trading session as well, breaking above the 0.70 level, but gave back the gains above that level. By doing so, it looks as if the market is trying to pick up its feet a little bit, but what I pay attention to the most in this market is that there is a 200 PIP range underneath that is massive support. In other words, I don’t have any interest in shorting this market, at least not until we break down below the 0.68 level. That being the case, if the market falls I will probably ignore it. However, if we break above the 0.7050 level, then I believe the buyers will come in to reach towards the 0.72 level.