Last Wednesday’s signals were not triggered as there was no bullish price action at 1.0180 when the level was reached that day.

Today’s USD/CHF Signals

Risk 0.75%.

Trades must be entered prior to 5pm London time today only.

Short Trades

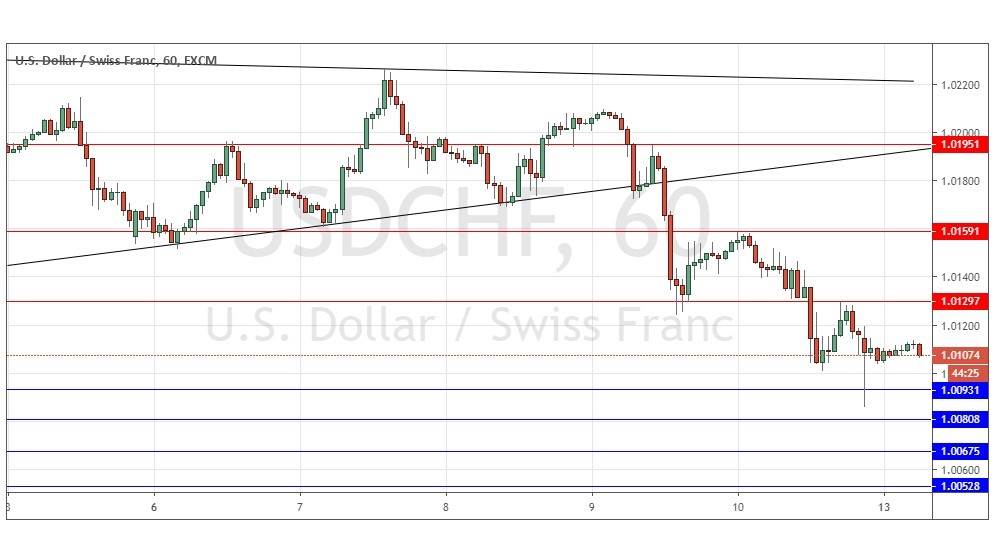

Go short following a bearish price action reversal upon the next touch of 1.0130 or 1.0159.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

Long Trades

Go long following a bullish price action reversal upon the next touch of 1.0093, 1.0081, 1.0068, or 1.0053.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

USD/CHF Analysis

I wrote last Wednesday that this pair looked unpredictable now – the price was contained within a triangle and also a narrow band between nearby support and resistance. There was a residual bullish trend so I thought that it might that long trades from support had more potential, but I took no directional bias.

I was correct to see long trades as having more potential that day as the price rose over the day. However, since Wednesday, the picture has become much more bearish as the price has fallen strongly, with risk-off sentiment in the markets growing, which has boosted the Swiss Franc as a safe haven asset.

Although the technical picture looks quite bearish, we are back in an area between 1.0050 and 1.0100 where there are several closely bunched support levels. If the price breaks through all of them and ends the day below 1.0050, that would be a very bearish sign. I think it is likely that some or all of these support levels are going to hold over the near term, so it would probably be wise not to trade short close to them. There is nothing important due today concerning either the CHF or the USD.

There is nothing important due today concerning either the CHF or the USD.