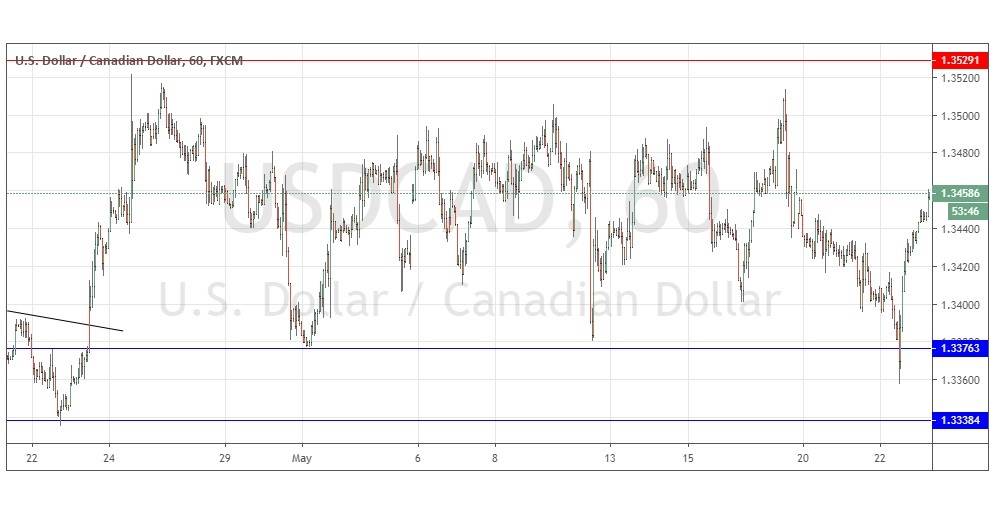

USDCAD remains trapped in a month-long price range

Yesterday’s signals were not triggered, as the bullish price action took place below the support level at 1.3376.

Today’s USD/CAD Signals

Risk 0.75% per trade.

Trades may only be entered between 8am London time and 5pm New York time today.

Long Trades

Long entry after the next bullish price action rejection following the next touch of 1.3376 or 1.3338.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade

Short entry after the next bearish price action rejection following the next touch of 1.3529.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

USD/CAD Analysis

I wrote yesterday that the picture had become more bearish as we approached the two support levels which make up the lower boundary of this range. Long trades from bullish reversals at either of these levels could be a great trade if this range holds.

I took no directional bias on this pair until we break out of this month-long price range.

I had the right approach, as there was a failed bearish breakout from the long-term range which rapidly reversed, but it took place in between the support levels that I had identified down there.

The range survives, and we are right back where we were a couple of days ago – with the price stuck in a long-term range and refusing to break out, so again, looking for reversals at the extremes of the price chart shown below is likely to be the best strategy for trading this currency pair. There is nothing of high importance due today concerning either the CAD or the USD.

There is nothing of high importance due today concerning either the CAD or the USD.