The US dollar gapped higher at the open on Monday, as the US president suggested that we were going to see more trade tariffs levied on the Chinese, and the Chinese then suggested that they are going to avoid the meeting. With that, it’s likely that we are going to see a bit of volatility, and when you see volatility exotic currencies take it on the chin.

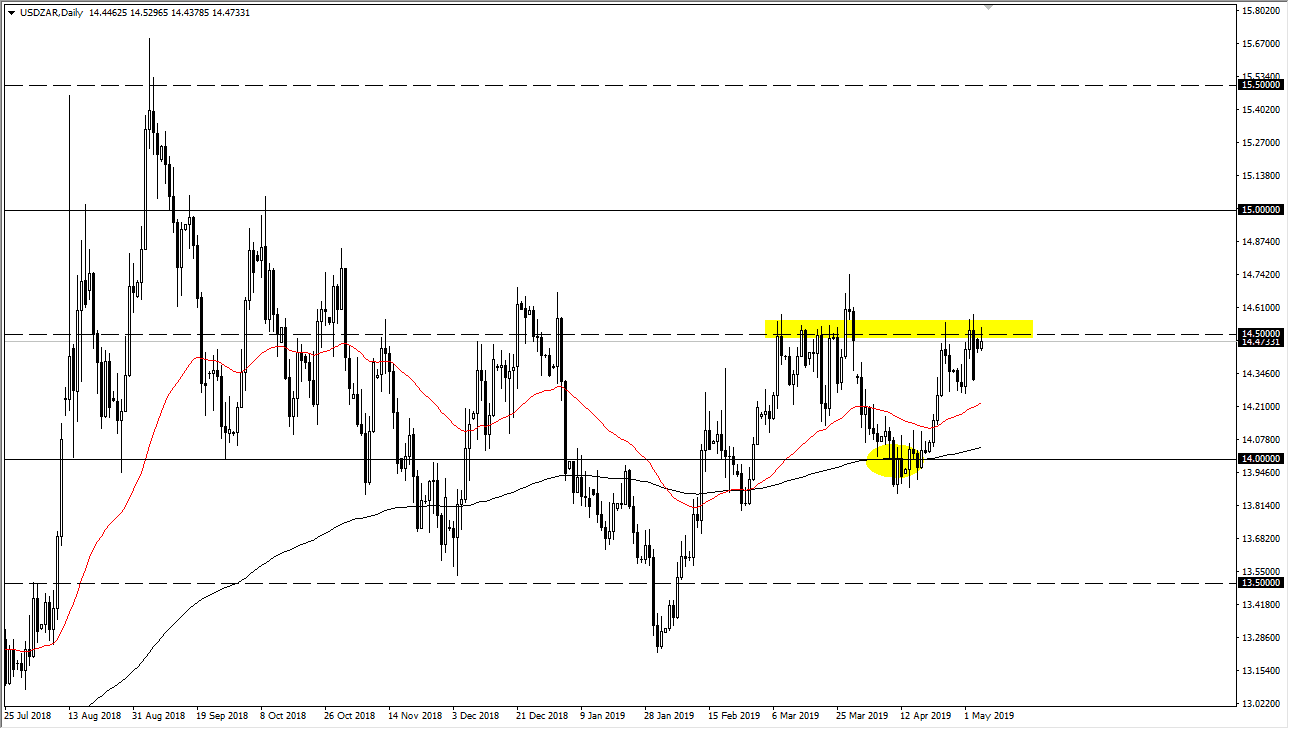

This is mainly due to a run to safety, and in this case it would have been the US treasury markets. U.S. Treasury markets of course require US dollars, so this all kind of works in a long line. The 14.50 Rand level of course is important as it is a round figure, and it is also an area where we’ve seen previous action. The fact that we formed a shooting star also suggests that we are going to roll over. There is support underneath near the 14.30 Rand level, so a pullback to that area will probably attract some buying. However, if we were to break down below that level it’s very likely that we would unwind down to the 14.10 Rand level.

Pay attention to general risk appetite, because if it does pick up a bit and things calm down it’s very likely we will see some type of pullback. I would also direct your attention to last month when we had formed a shooting star just above this area, which showed a lot of selling pressure as well. At this point, I think that in the short term you need to pay attention to both the recent highs and the 14.30 Rand level. This market will course be very volatile, but pay attention to commodity markets, futures markets and the like. If they are all selling off this market will probably rally quite nicely. Of course, the opposite is true as well.