The US dollar has been grinding back and forth against the Canadian dollar, which of course isn’t much of a surprise considering just how interconnected the two economies are. Remember, even though the Canadian dollar is highly sensitive to the oil markets, the reality is that the world’s largest producer of crude oil is now the United States, so the old correlations may not hold up as stringently as once believed.

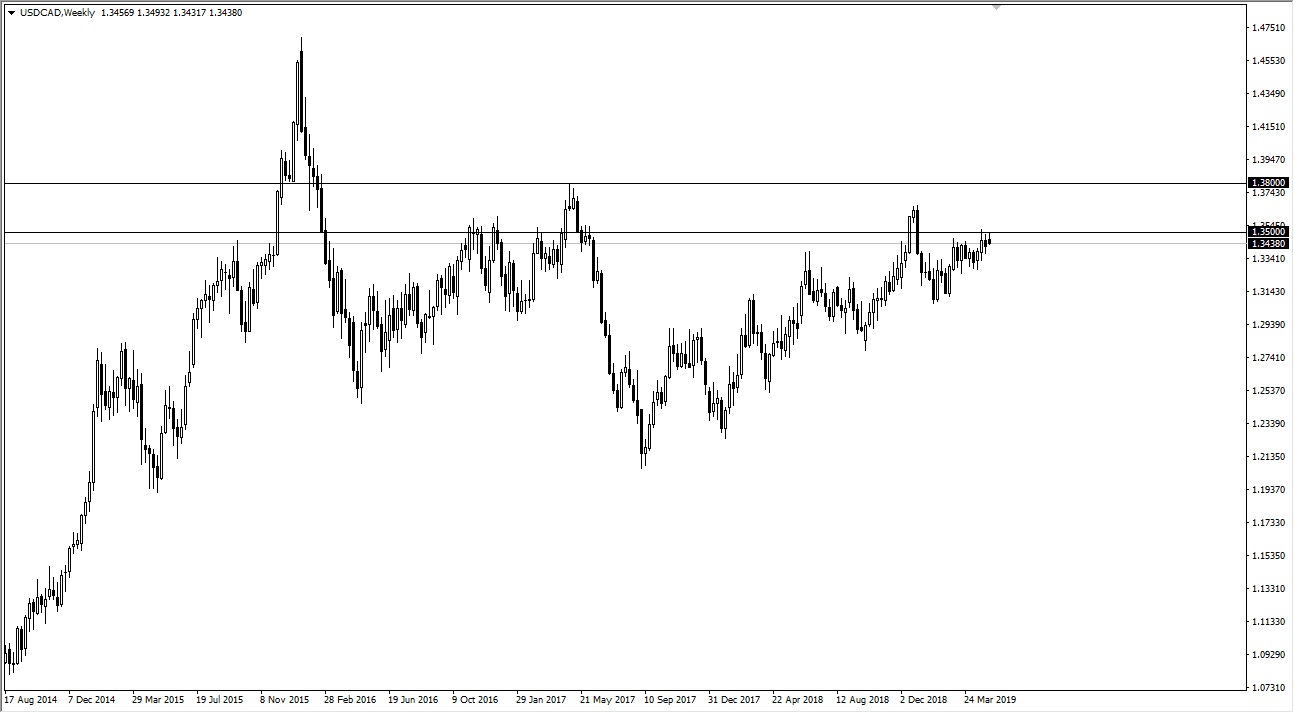

That being said, we have seen a nice grind higher for the last couple of years. However, we are approaching an area that could cause a lot of longer-term resistance. I see the 1.35 level as massive resistance that should continue to cause selling pressure, and I think it extends at least 300 pips. This isn’t to say that we can’t go higher, just simply that continued selling pressure at the 1.35 level does in fact make a lot of sense.

I’m not looking for the month of May to be especially brutal, quite frankly it would not surprise me at all to see this market trade in a 200 PIP range between the 1.33 level and the 1.35 handle. Remember, both of these economies are highly intertwined so one of them has to do something somewhat special in relation to the other to get a huge move. Granted, crude oil markets can and do move the Canadian dollar in the sense that you can find pressure from other currencies, so there is a little bit of a knock on effect, and even though the situation has changed a bit, typically it’s negative influence from the crude oil market that you get on the Loonie. After all, the United States dollar is trading for a lot of different reasons, so in this particular pair oil typically hurts the Canadian dollar more than it helps it.

All things being equal, I think we will struggle to break higher, but if we did somehow clear the 1.38 level this market could really start to pick up momentum.