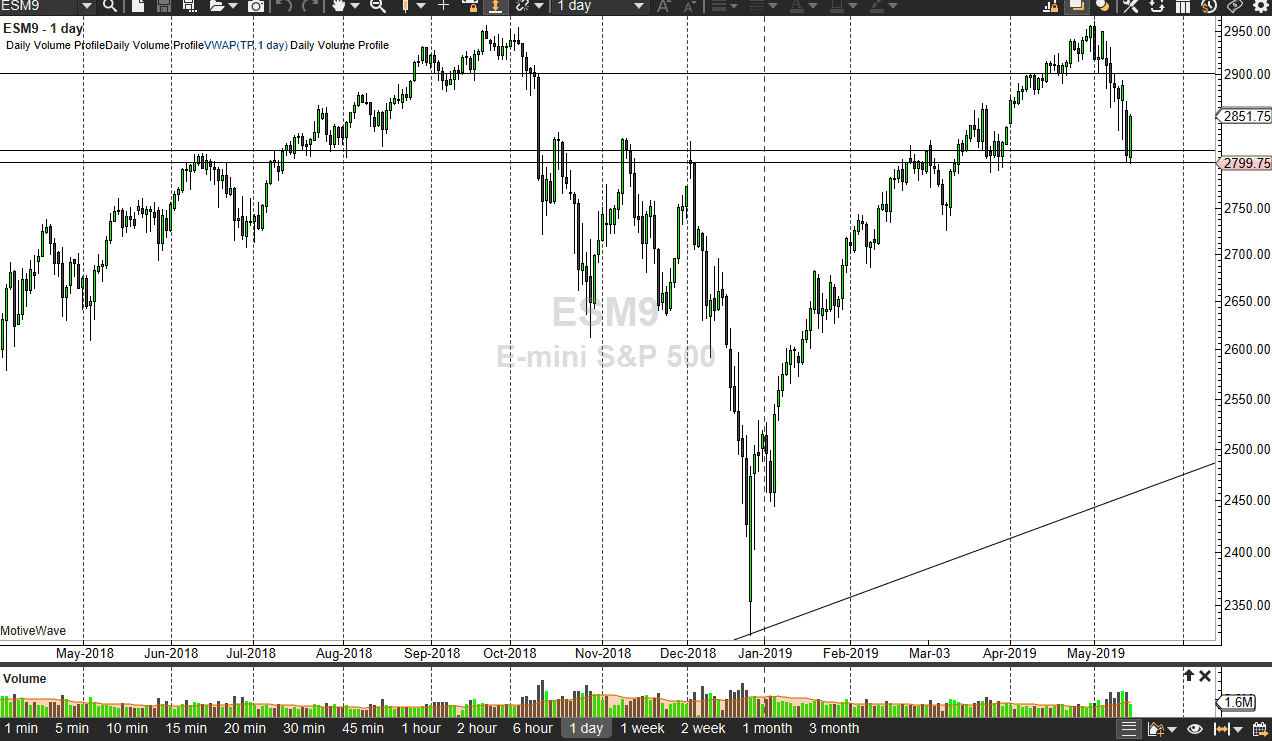

S&P 500

The S&P 500 rallied quite significantly during trading on Tuesday, getting the market to reach towards the losses from the previous session on Monday. This was an excellent turnaround and a market that had been far too oversold as we reached the 2800 level, but the next hurdle is going to be the massive gap that started this whole thing to the downside. Because of this, we are not out of the woodwork quite yet, and therefore you should be cautious. Ultimately, if we can break above the gap it would be a good sign, but one thing that I can’t get around is the fact that we have broken the bottom of a couple of hammers, which is almost always a very negative sign. I think the one thing you can count on is an extraordinarily volatile market going forward, and it’s going to be difficult to think that confidence has come straight back into the fray. It’s only going to take a bit of negative news to send this market right back down. If we break below the 2800 level, then my next target is 2750.

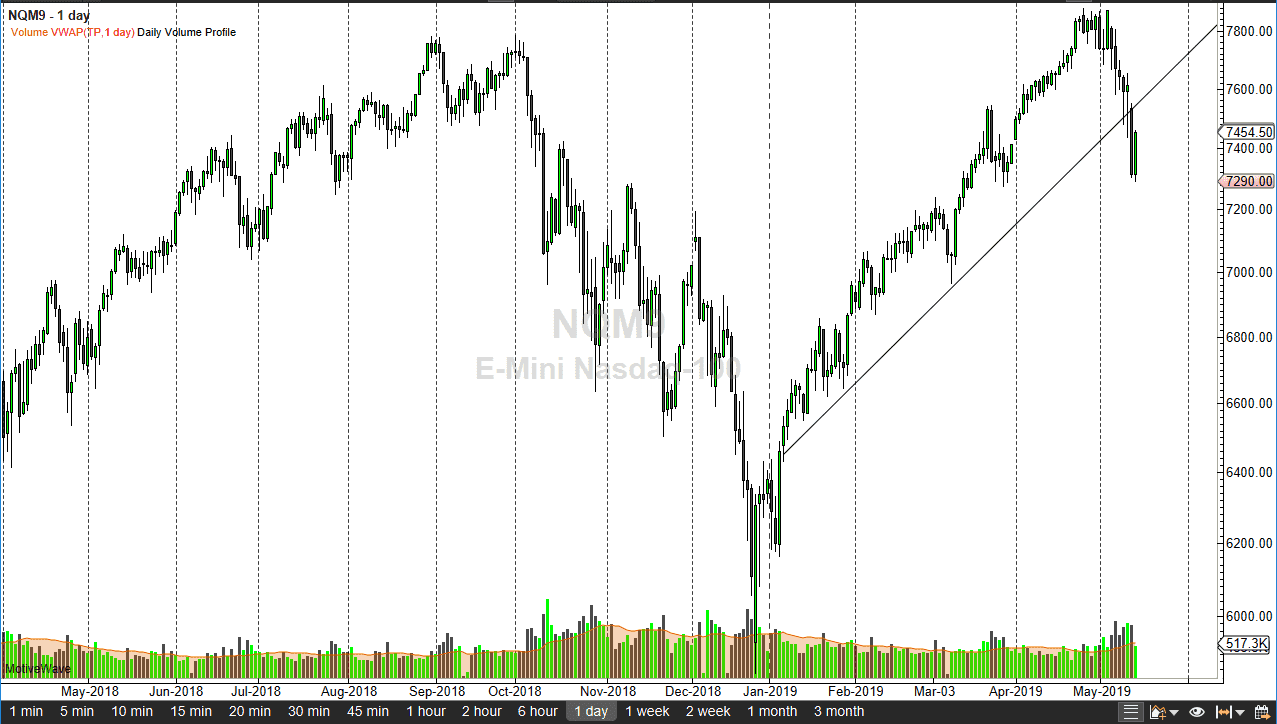

NASDAQ 100

The NASDAQ 100 rallied quite nicely as well but did not gain back all of the losses from the previous session. Remember, the NASDAQ 100 tends to be more of a beta play, so therefore we need to see a lot more confidence to make the NASDAQ 100 rally than the S&P 500. Looking to the upside, there’s still the gap that kicked off the Monday session, breaking below the uptrend line that I have drawn. That being said, it’s not until we break above that gap that one can glean a lot of confidence. I suspect that it’s very likely to find resistance near that gap and of course the bottom of the trend line. It is because of this that I am not completely convinced about the efficacy of the recovery. Beyond that, we have broken the back of a couple of hammers which is always a very negative sign.