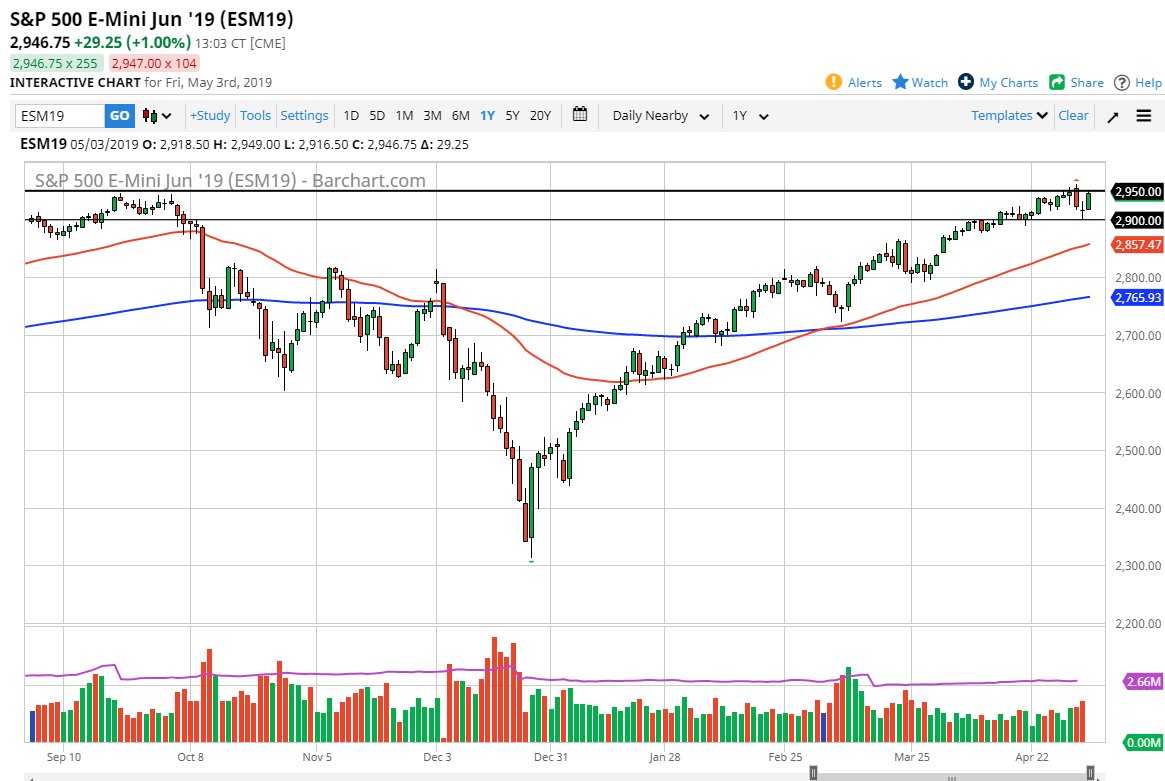

S&P 500

The S&P 500 rallied quite significantly during the trading session on Friday, after the jobs number came out. You can see that we in fact went straight up in the air, as we reached towards the 2950 level. Keep in mind that the jobs number pretty much confirmed everything we already knew, so it was more or less a situation where the market breathe a sigh of relief and simply went long again. It is with the overall trend, so now I suspect that it’s only a matter time before we break out to the upside. That’s not to say that it’s going to happen right away, and it wouldn’t surprise me at all to see a little bit of a pullback before the buyers came back in and started lifting the market again. Longer-term, I fully anticipate that we are going to go towards the 3000 level above.

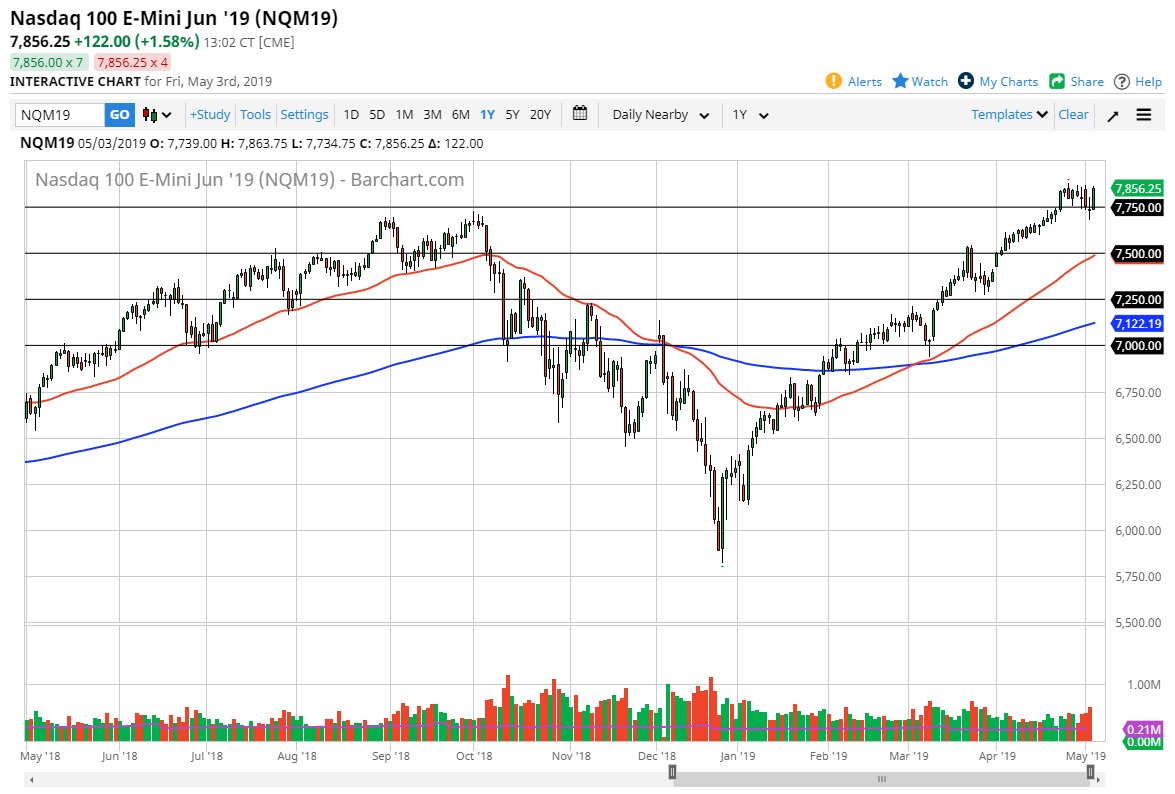

NASDAQ 100

The NASDAQ 100 rallied quite significantly as well, using the 7750 level as support and gained roughly 100 points by the time we get towards the end of the day. It looks as if we are ready to break out, so short-term pullbacks should be buying opportunities as I believe the NASDAQ 100 will go looking towards the 8000 handle. Pullbacks at this point continue to offer plenty of value, but if we break down below the lows of the Thursday session, we could drift down towards the 7500 level which I believe is even more supportive.

Remember, the NASDAQ 100 is highly sensitive to Asia, so pay attention to the markets over there as well. This includes Korea, Japan, and of course China. If they do well, then the NASDAQ 100 typically does well.