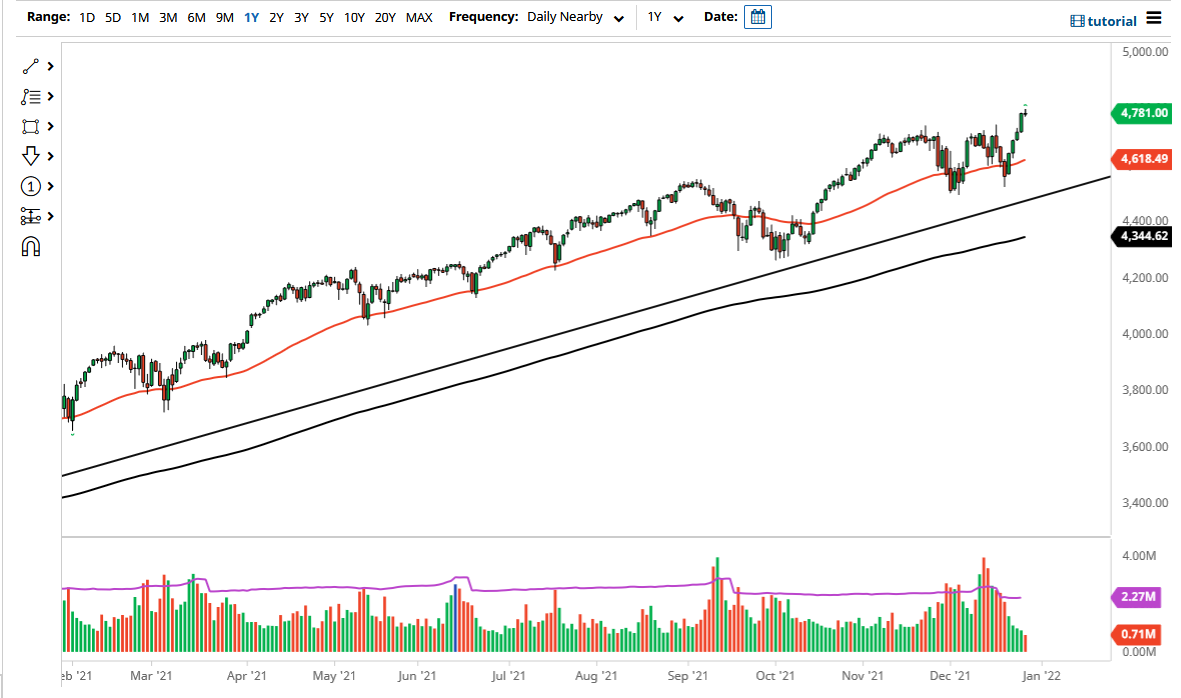

S&P 500

The S&P 500 initially fell during the trading session on Tuesday but turned around of form a bit of a hammer as we continue to press higher. The market looks as if it is trying to build up the necessary momentum to finally break out for a longer-term move, so at this point dips are still to be bought. As long as that’s the scenario, you can probably expect buyers to return as long as we can stay above the 2890 handle. In general, this is a market that continues to grind higher, perhaps trying to reach the 3000 level, which is an area that a lot of Wall Street analysts are looking for. Given enough time, it’s very likely that we are going to see traders try to get there.

That doesn’t mean that we will get the occasional selloff, but until something changes drastically, I suspect that people will continue to look at these pullbacks as an opportunity to pick up the E-mini contract “on the cheap.”

.

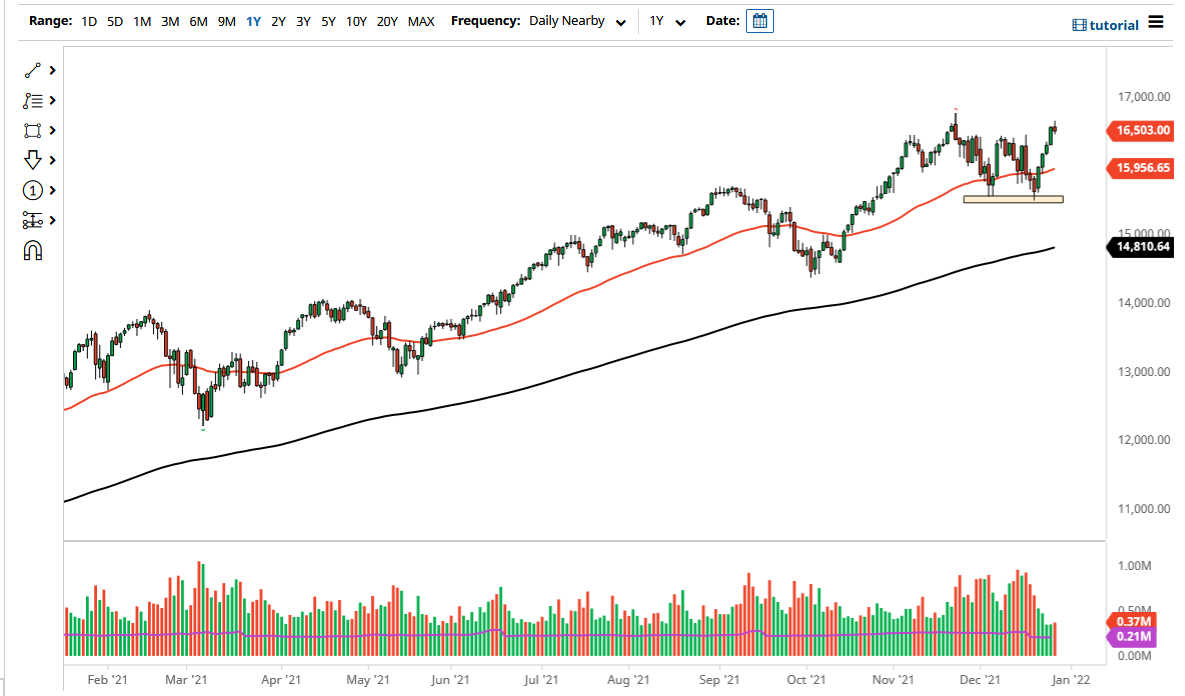

NASDAQ 100

The NASDAQ 100 pulled back as well, but also found support underneath. It tested the 7750 level, an area that of course you would expect to offer support due to the fact that it has recently and it was the scene of a break out. That’s a very good sign, and it looks as if the NASDAQ 100 will continue to try to grind higher. Keep in mind that Alphabet/Google had a bit of a rough day, so the fact that this market continues to see strength is impressive. Apple also has earnings out overnight, so that could have an effect also, but clearly it looks as if the buyers remain aggressive.