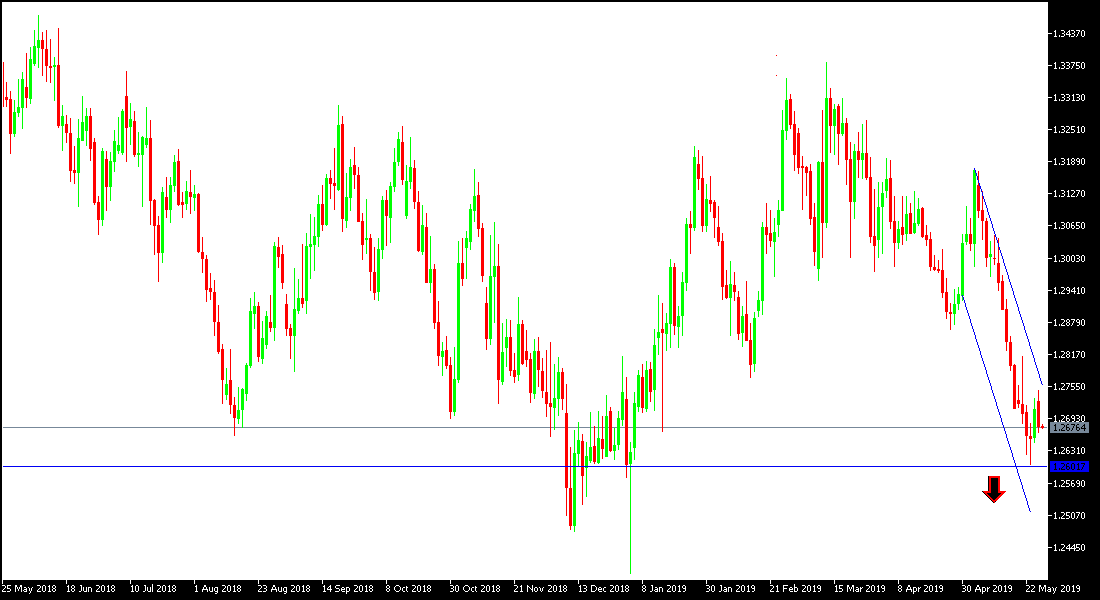

An unexpected landslide victory for a party supporting Brexit over any situation in the EU election has increased pressure on the GBP/USD, which has raised expectations that Britain could exit the EU without an agreement. The pair then moved back towards 1.2670 support in early trading after the gains of the previous session, which reached 1.2747. It was no surprise that British Prime Minister Theresa Mae announced her resignation, due to the continued failure in the management of the Brexit file and the increasing pressure within her party. Eyes are now watching her successor at a sensitive and critical time for the UK. Expectations strongly point to the former British Foreign Secretary and Brexit enthusiast in any situation even if they go out without agreement with the EU. The pair's recent losses have reached the 1.2604 support level, the lowest level since more than 4 months.

The pair's recent move consistently confirms our expectations for a strategy to sell the Sterling from every rising level. Just before the EU elections there are strong expectations that May's survival as prime minister of the country is only a matter of time. Stronger gains for the US dollar recently from growing trade tensions between the US and China and investors resorting to the dollar as a safe haven. The general trend for the pair will remain bearish as long as it remains below the 1.3000 level.

The Bank of England announced its monetary policy, raised the outlook for growth and inflation of the UK and hinted at the possibility of a rate hike, but linked the move to the future of Brexit, which is still vague, prompting the pound not to take advantage of the new hawkish tone of the bank.

The foggy future of the Brexit until the moment still adds to the pressure on the Sterling. Although the European Union agreed to postpone Britain's exit from the EU until the end of October after it was scheduled for mid-month in the previous postponement, but the pair was not influenced by this and remained stable under downward pressure because the division within the British House of Commons and even the British government still exists.

Since the UK vote to exit the EU, we have always recommended selling the pound against other major currencies and Brexit will not end overnight, and not easily, as some believe, so as not to spread the infection among the rest of the EU. Sterling gains will remain good opportunities to sell.

Brexit developments from time to time will continue to contribute to the volatility of the pair's performance.

Technically: GBP/USD breaking below 1.3000 will support the bearish correction for the pair and the nearest support levels may be 1.2680, 1.2600 and 1.2545 respectively, which confirm the strength of the bearish correction. On the upside, the correction will not be able to rise the upward correction without the stability above 1.3000 resistance. I still sell the pair from every ascending level as gains may be in the wind of any negative Brexit development.

The economic calendar today will focus on the announcement of US consumer confidence.