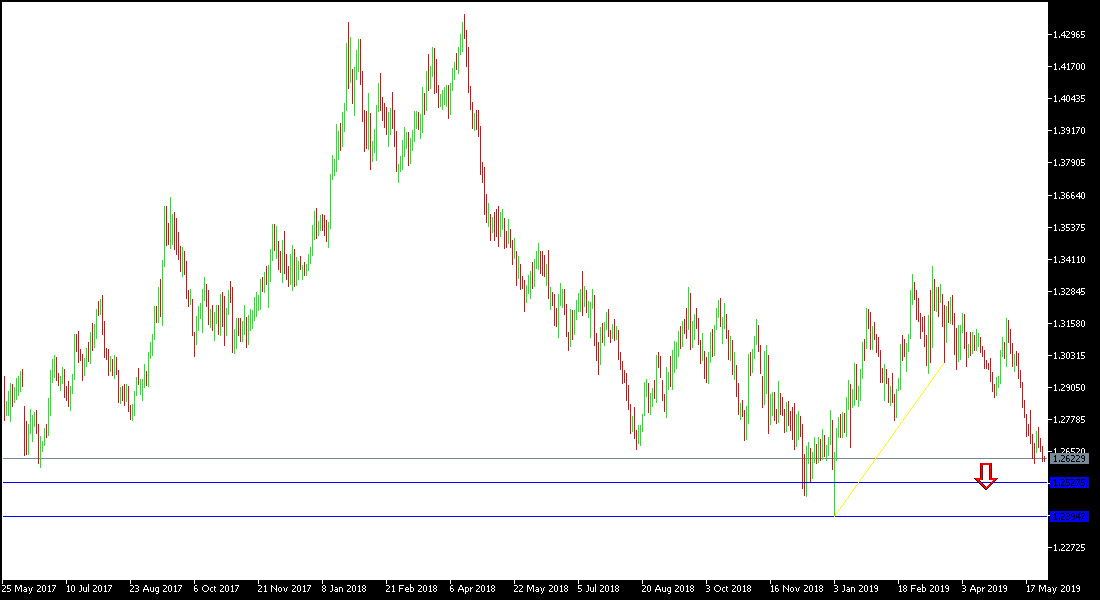

Ahead of the release of important US economic growth figures, the GBP / USD pair continues to struggle with a stronger bearish momentum towards the 1.2611 support level, its lowest level for more than 4 months, before settling around 1.2635 at the time of writing. The pair's bearish momentum increased after an unexpected landslide victory for a party supporting Brexit at any situation in the EU election, raising expectations that Britain could leave the EU without a deal.

It was no surprise that British Prime Minister Theresa May announced her resignation, as the continued failure in the management of the Brexit file and the increasing pressure within her party and from the opposition led to May’s announcement. All eyes are now on her successors at a sensitive and critical time for the UK, with expectations strongly suggest the former British Foreign Secretary, who is a Brexit enthusiast, even if it was with no deal.

The pair's recent move consistently confirms our expectations for a strategy to sell the Sterling from every rising level. Stronger gains for the US dollar recently were from growing trade tensions between the US and China and investors resorting to the dollar as a safe haven.

The Bank of England announced its monetary policy, raising the outlook for growth and inflation in the UK, and hinted at the possibility of raising interest rates, but linked that to the future of the Brexit, which is still vague, which prompted the pound not to take advantage of the bank’s new hawkish tone. The foggy future of Brexit until the moment still adds to the pressure on the Sterling.

Since the UK vote to exit the EU, we have always recommended selling the pound against other major currencies, and noted that Brexit will not end overnight, and not easily, as some believe, so as not to spread the infection among the rest of the EU. Sterling gains will remain good opportunities to sell.

Brexit developments from time to time will continue to contribute to the volatility of the pair's performance.

Technically: The establishment of the GBP/USD below the 1.3000 level will support the bearish correction for the pair. The nearest support levels might be 1.2600, 1.2520 and 1.2445 respectively, which confirm the strength of the bearish correction. On the upside, the upward correction will not be able to rise above without stability above 1.3000 resistance. I still prefer selling the pair from every ascending level. Its gains may be in the wind for any negative development of the future of the Brexit.

The economic calendar today is going to focus on the US GDP, Unemployment claimants, pending houses sales and the commodity trade balance data.