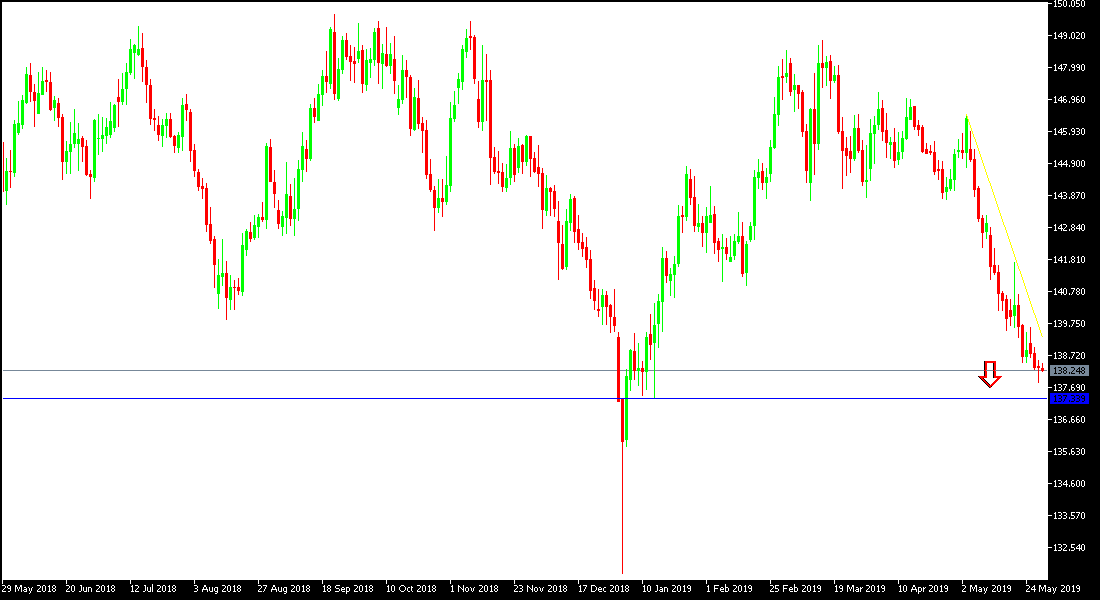

Earlier in Thursday trading, the GBP / JPY pair tried to correct as high as 138.71, but the bounce remains weak and the bearish momentum remains the strongest. The pair’s losses reached the 137.85 support level during yesterday's session, its lowest level in more than four months. The foggy future of the Brexit, along with further gains from the Japanese Yen, still adversely affect the pair. The unexpected results of the victory of a British party in the European Parliament elections, a party that strongly supports the Brexit, even if it came to an exit without a deal, increased the pressure on the pound against other major currencies. The stability of the pair below the psychological resistance at 140.00 will continue to support the continuation of the decline.

It was no surprise that British Prime Minister Theresa May announced her resignation. The continued failure in the management of the Brexit file and the increasing pressure within her party and from the opposition led to May’s announcement. All eyes are now on her successors at a sensitive and critical time for the UK, with expectations strongly suggest the former British Foreign Secretary, and a Brexit enthusiast, even if it was with no deal.

Overall, the JPY continues to make stronger gains from the continuation of the global trade war and investors' flight to it as a safe haven. As we have predicted before, we now confirm that selling the pair from each ascending level will remain the best trading strategy here. The return of the Brexit related fears despite 5 months separating us from Britain's final exit from the European Union, and the strength of the Japanese yen as an ideal safe haven for investors, keeps strong pressure on the pair.

The Bank of England announced its monetary policy, raising the outlook for growth and inflation in the UK, and hinted at the possibility of raising interest rates, but linked that to the future of the Brexit, which is still vague, which prompted the pound not to take advantage of the bank’s new hawkish tone.

Technically: The GBP/USD correction and the stability around and below 140 level will support the bearish correction trend and warns of a stronger downtrend that could reach 138.10, 137.45 and 136.00 respectively. On the upside side without moving with stability above 140 resistance level, the upward correction will not be strong. It remains best to sell this pair at every rebound as the Pound’s future remains uncertain as negotiations continue to push Britain out of the European Union.

On the economic data today: the pair is not looking for any important data today. It will be in a state of waiting and see for Brexit negotiations. It will also focus on the uptake of safe havens.