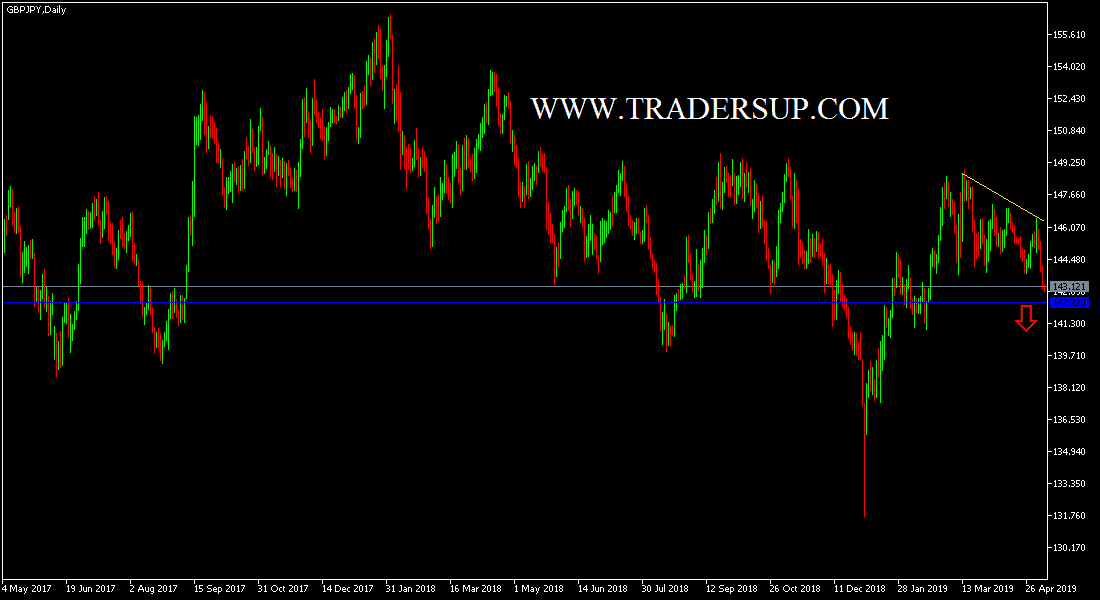

For four straight trading sessions, the GBP/JPY is moving down to the 142.21 support level at the time of writing the analysis, the lowest level for this pair for almost 3 months. On the chart today, the strength of breaking the bullish trend is confirmed, and the pair is turning to the downside. The pair's losses rose as the British skirmishes over the management of the Brexit file and the future of May as Britain's prime minister are at stake. Along with Trump's threats to raise tariffs on China tomorrow, which confused the financial markets, which had expected to resolve the trade dispute between them soon with the continuation of trade negotiations between the two sides. These developments have contributed to investors move to the safe haven assets led by the Japanese Yen.

The Bank of England announced its monetary policy, raised the outlook for growth and inflation of the UK and hinted at the possibility of raising interest rates, but linked the move to the future of Brexit, which is still vague, which prompted the pound not to take advantage of the new hawkish tone of the bank. The pair's attempts to rise are facing weaker risk appetite and the pound continues to be negatively affected by the bleak future of Brexit. Attempts to ascend the pair without any positive developments for the Brexit path will not be possible. The Japanese central bank has maintained its negative interest rates monetary policy to support the Japanese economy, which is facing the consequences of the global trade war.

The pound did not react very much with the EU agreeing to postpone the Brexit to the end of October instead of the date of the previous postponement, because Britain's internal political division may hinder May's efforts to get the Brexit deal approved to ensure that the country does not leave the union without an agreement, which will be catastrophic for the British economy and the Pound.

Losses of GBP didn’t stop because of Brexit’s developments were many, successive and contradictory. It was normal for the pound to depreciate against other major currencies.

Technically: The GBP/JPY correction and stability below 144.00 will threaten the upside move and warn of a stronger bearish move as it will support the break of the trend, and the pair's next support levels will be 143.60, 142.45 and 141.00 respectively. Currently the nearest resistance areas are 143.80, 144.50 and 146.00 respectively. It remains best to sell the pair at every rebound as the Pound’s future remains uncertain as Brexit negotiations continue.

In today's economic data, the pair is not looking for any significant data today. It will be in a state of waiting and watching for Brexit negotiations . It will also focus on the uptake of safe havens.