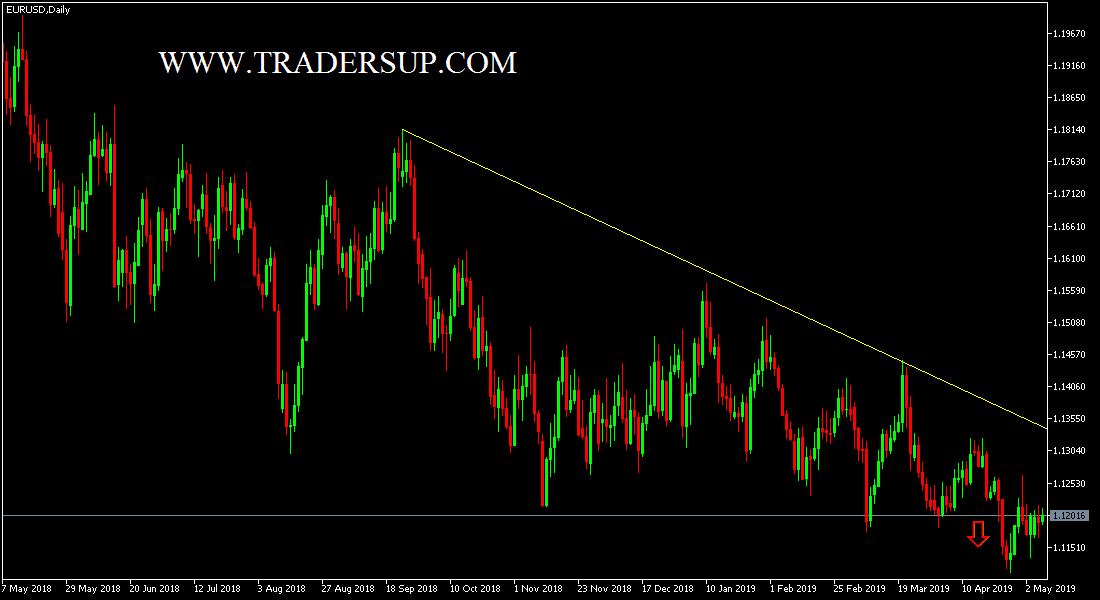

According to the technical indicators of the EUR / USD on the daily chart, the price reached stable saturation areas below the 1.1200 support level. A bearish consolidation zone is warning that the correction will be near, but the rebound will depend on the return of confidence in the EUR again. The single European currency is negatively affected by the continued slowdown of the Euro-zone economy under global trade wars. The European Union has again lowered its forecast for economic growth in the euro zone this year and next year, as uncertainty due to global trade disputes and the weakening of the auto industry continues to hinder production. The European Commission cut its growth forecast this year in 19 countries using the euro to 1.2% from 1.3% in its previous forecast in February. Growth projections for 2020 were reduced to 1.5% from 1.6%. At the same time, they said domestic demand continued to improve in Europe for the seventh year in a row.

The Euro did not respond favorably to the results of service sector figures for the Eurozone economies. The PMI for services in the Euro area was stronger than the industrial PMI and continued to point to expansion in April. German PMI improved to 55.7, slightly higher than 55.6. It was the strongest reading of the index since last September. The services index for the Euro area fell to 52.8, but still exceeds expectations at 52.5. Sentix investor sentiment jumped to 5.3, well above expectations of 1.1. Retail sales in the region rose to 0.0%, higher than expectations of -0.1%.

As the Eurozone economy continues to slow, the European Central Bank is not rushing to change its monetary policy. Bank policy makers remain cautious. The bank recently said it had no plans to raise interest rates before the spring of March 2020. At the same time, the US economy is in a much better position, but the Fed has temporarily stopped raising rates. In his meeting to set interest rates last week, Fed Chairman said price action could go either way - raise or cut. Economic data will play a key factor in the movement of interest rates. Recent figures look strong - GDP for the first quarter rose 3.2%, and non-farm payrolls were unexpectedly strong in April. If this positive trend continues, the Federal Reserve may raise interest rates later this year, and the divergence with the ECB is likely to strengthen the dollar at the expense of the Euro.

The most important support for the EURUSD today: 1.1170, 1.1080 and 1.0960, respectively.

The most important resistance levels of the EURUSD today: 1.1275, 1.1340 and 1.1500 respectively.