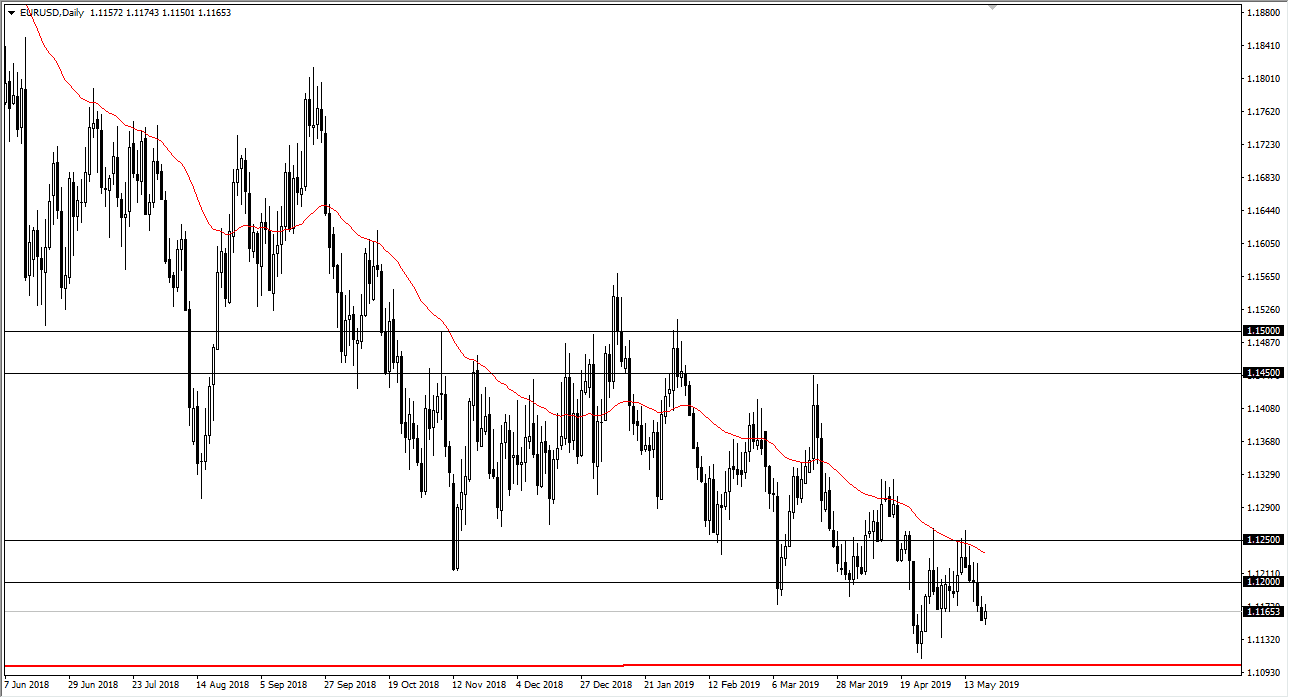

EUR/USD

The Euro went back and forth during the trading session on Monday to kick off the week, as the 1.1150 level has offered a bit of support, as it is in the middle of the consolidation area that we are currently bouncing around in. The 1.11 level underneath is massive support, and the 1.12 a level above is massive resistance. With that being the case, I think that short-term range bound trading will continue to be what we deal with, so using both of those levels to trade off of will probably be the best way forward. However, even if we break above the 1.12 level I would then start looking to sell this market near the 1.1250 level. After that, then you can start to talk about buying and holding but in the short term it certainly looks as if there are plenty of reasons to start shorting.

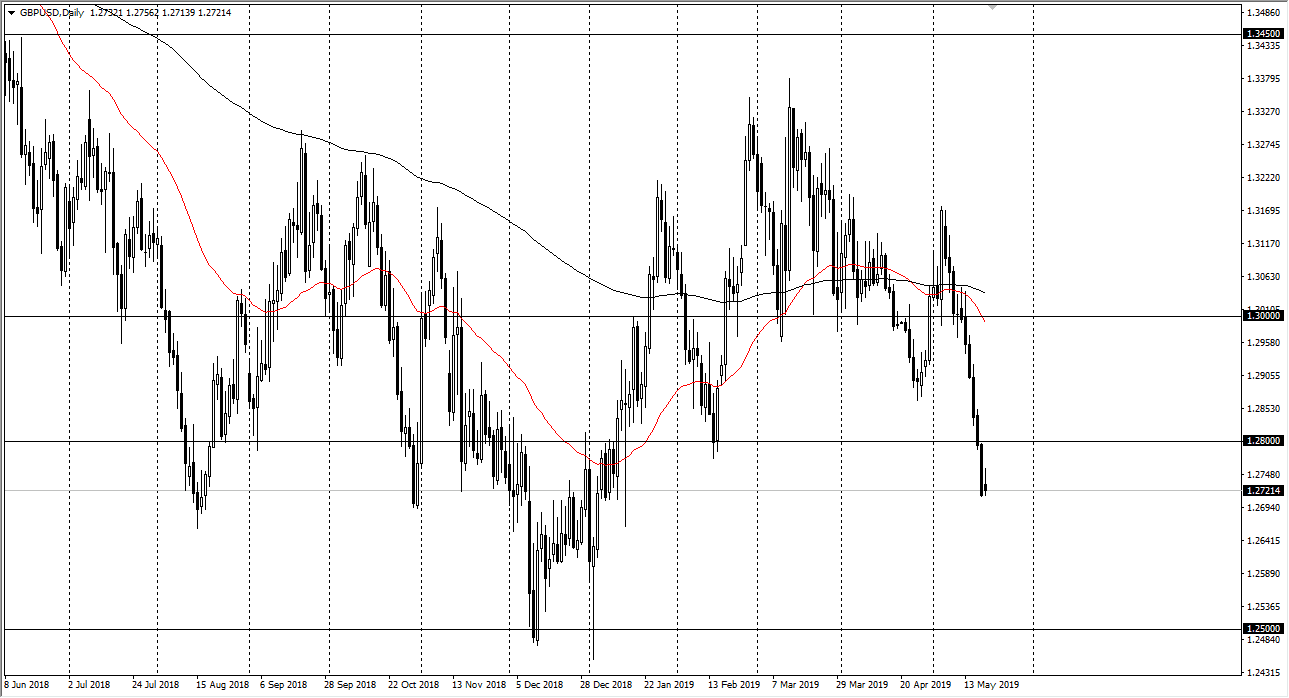

GBP/USD

The British pound initially rallied during the trading session on Monday, but then rolled over to form a bit of an inverted hammer. We are sitting just above the 1.27 handle, an area that of course is crucial. I think there is significant amount of support that extends all the way down to the 1.25 handle, so if we do break down I’m not necessarily looking to short this market, I just wait for opportunities to find buying opportunities underneath, as we are at extraordinarily cheap and low levels from longer-term standpoint. That being said, we will either form a supportive candle that we can take advantage of on a daily candle stick, or perhaps some type of buying opportunity on a break above the highs from the trading session on Monday.