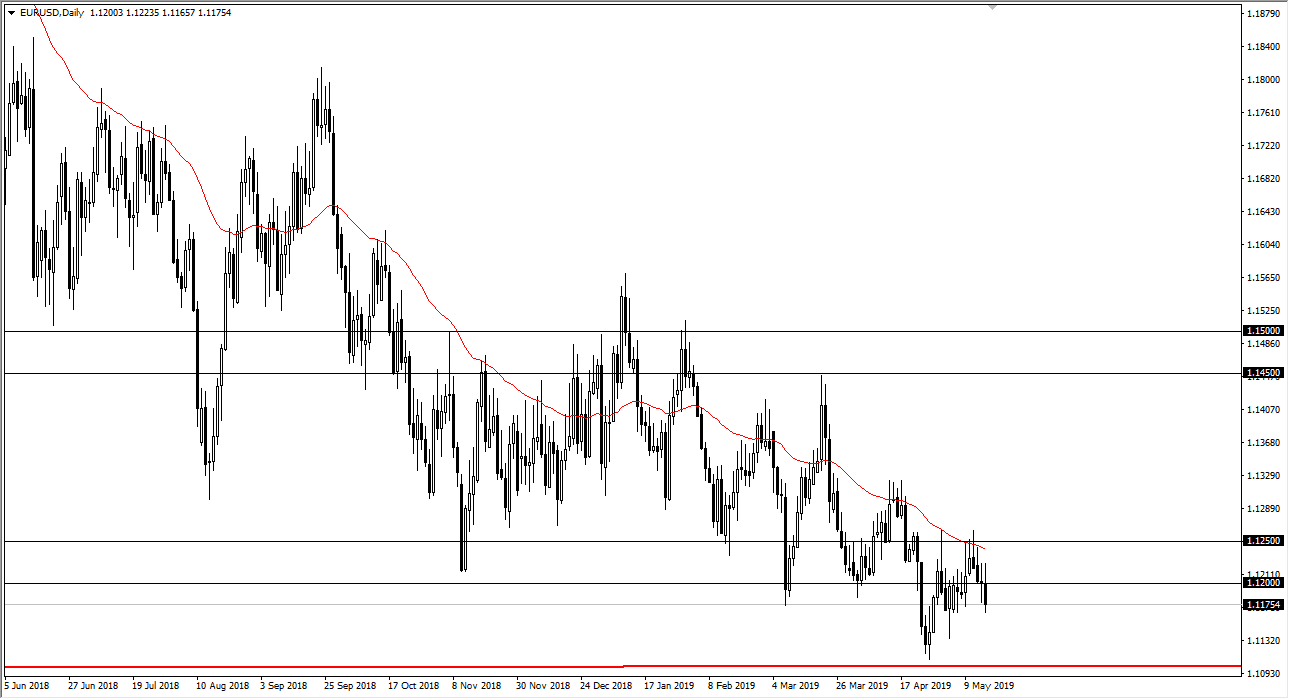

EUR/USD

As you can see, the United States dollar has rallied rather significantly as this pair fell during trading on Thursday. We initially tried to break above the 1.12 handle but struggled to keep gains above there. We have seen several shooting stars in a row, and therefore it’s not a huge surprise that we drift lower. As stocks in America continue to attract money, it also drives up the demand for the US dollar. All things being equal, it makes sense that we continue to see short-term rallies faded in this pair.

The target underneath will be the 1.1150 level, followed by the 1.11 handle. If we can break below there, then this pair could go as low as 1.10 over the longer-term. Rallies to the upside would be treated with suspicion unless of course we can break above the Monday shooting star, which would tear through a lot of resistance.

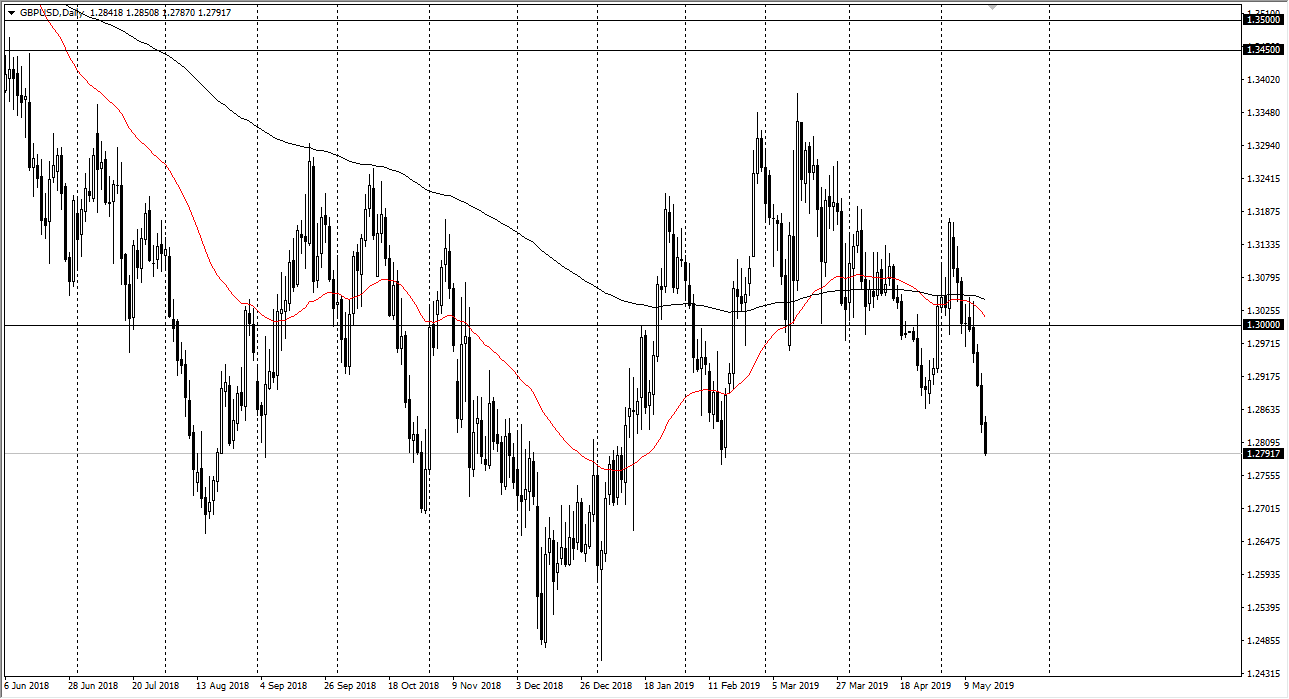

GBP/USD

The British pound has fallen during the trading session on Thursday, reaching down towards the 1.28 handle. This is a market that is definitely oversold, so this point I think it’s only a matter of time before we get some type of constructive bounce. However, simply trying to catch a falling knife is a great way to lose money so I don’t have any interest in doing that. With that in mind, I’m waiting for some type of supportive daily candle to think about buying, but as far as shorting is concerned we have already missed the trade and therefore there’s not much to do in this pair but to sit on the sidelines and wait for an opportunity to find stability so we can pick up a little bit of value in Sterling.