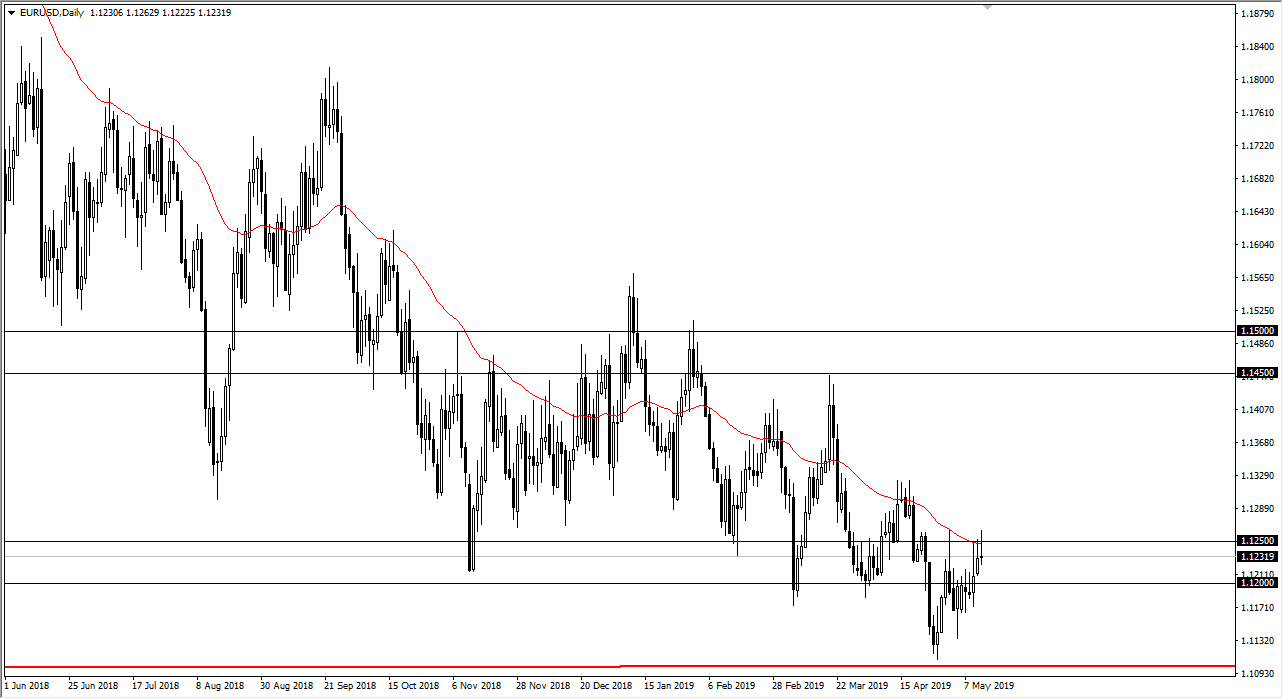

EUR/USD

The Euro initially rallied during the trading session on Monday, as people were starting to react to the escalated trade war tensions, but the fact that China retaliated should not have been a surprise at all. What was truly interesting is that money flowed away for the United States initially, but then the old correlations of buying US treasuries in times of fear came back into vogue, and therefore the demand for US dollars picked up again. With that, we ended up forming a bit of shooting star as we couldn’t break above the 50 day EMA, as well as the 1.1250 level.

At this point, it’s likely that we will roll over and go looking towards 1.12 level, as we continue the overall downtrend. Looking at this chart, I still preferred to sell short-term rallies that show signs of exhaustion, as we simply cannot seem to hang onto gains for longer-term move. Even as we have rallied over the last several sessions, we have given back most of the gains by the time everybody went home.

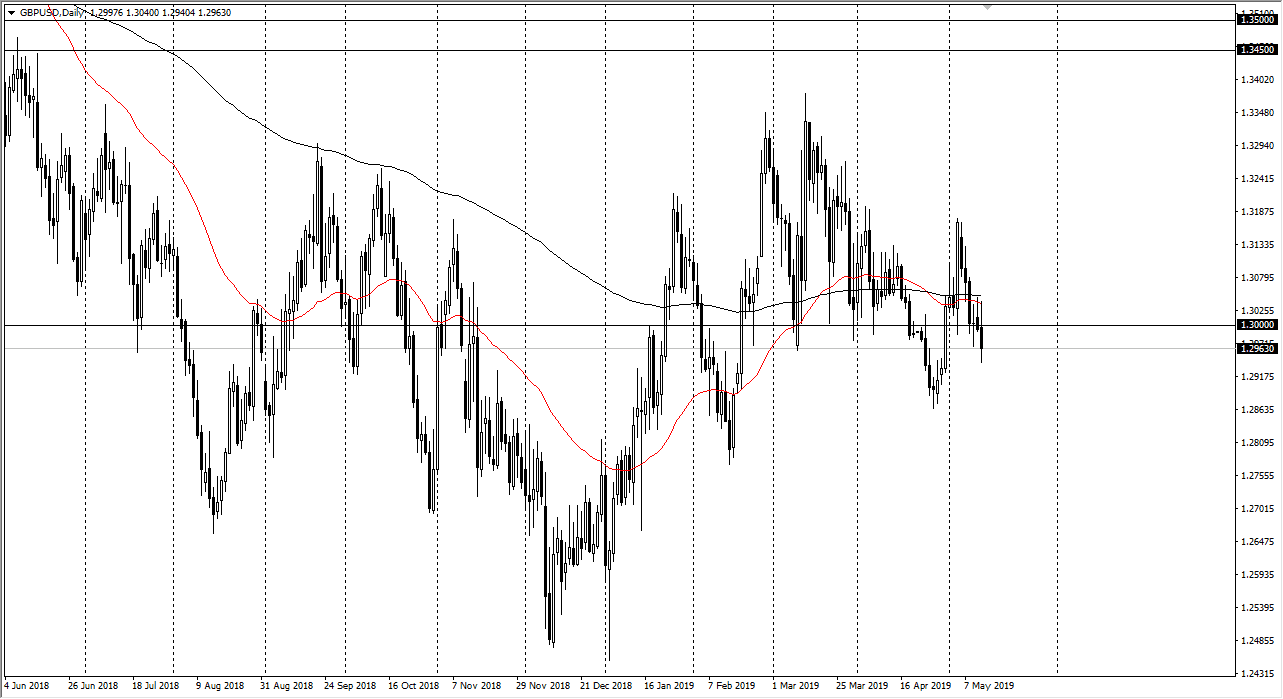

GBP/USD

Obviously, the British pound continues to be very difficult to deal with as we have all of the issues with the Brexit. However, what’s going to take center stage now is going to be the US/China situation, so as things deteriorate, you can probably expect the US dollar to pick up a bit of momentum. However, just about the time we stop worrying about the Brexit, there almost certainly be a headline that throws things around there as well. Simply put, this is one of the more difficult currency pairs to trade right now but I do like the idea of buying the British pound for the longer-term move as it is historically cheap. I suspect that the 1.29 level will be tested for support, and then possibly even the 1.28 level. If those areas hold, then a bounce could be coming in the short term buying opportunity may present itself.