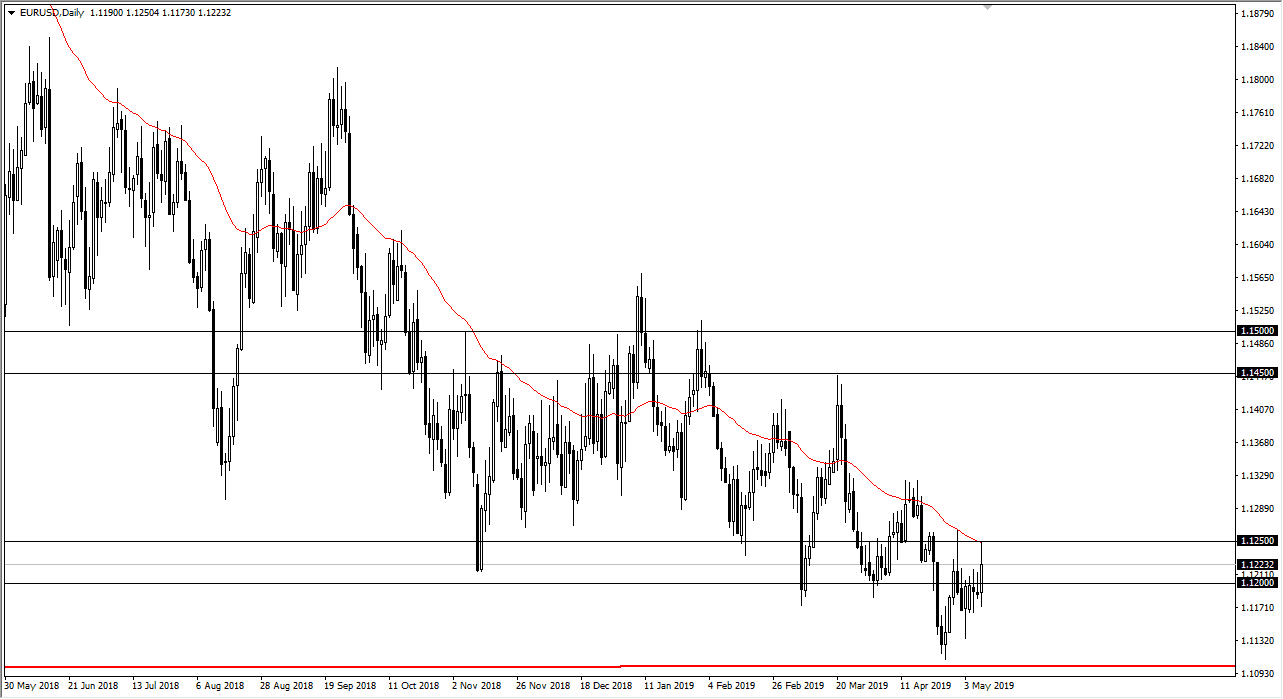

EUR/USD

The Euro rallied a bit during the trading session on Thursday, as we are approaching the US/China trade relations negotiations. If this market is doing anything at this point, I would consider it to be consolidating. We have seen a lot of noise in the financial markets as of late, and while the pair may not be driven solely due to the US/China situation, right now that’s the only game in town. This is basically going to be a “risk on/risk off situation”, meaning that the US dollar will pick up strength if there is a lot of fear in the marketplace. That could happen on Friday. The best way to think about Friday session is going to be one that is very much like an FOMC Meeting, but we don’t know exactly what time it happens. All things being equal though, if we stay below the red 50 day EMA I suspect that we will probably continue to drift lower more than anything else.

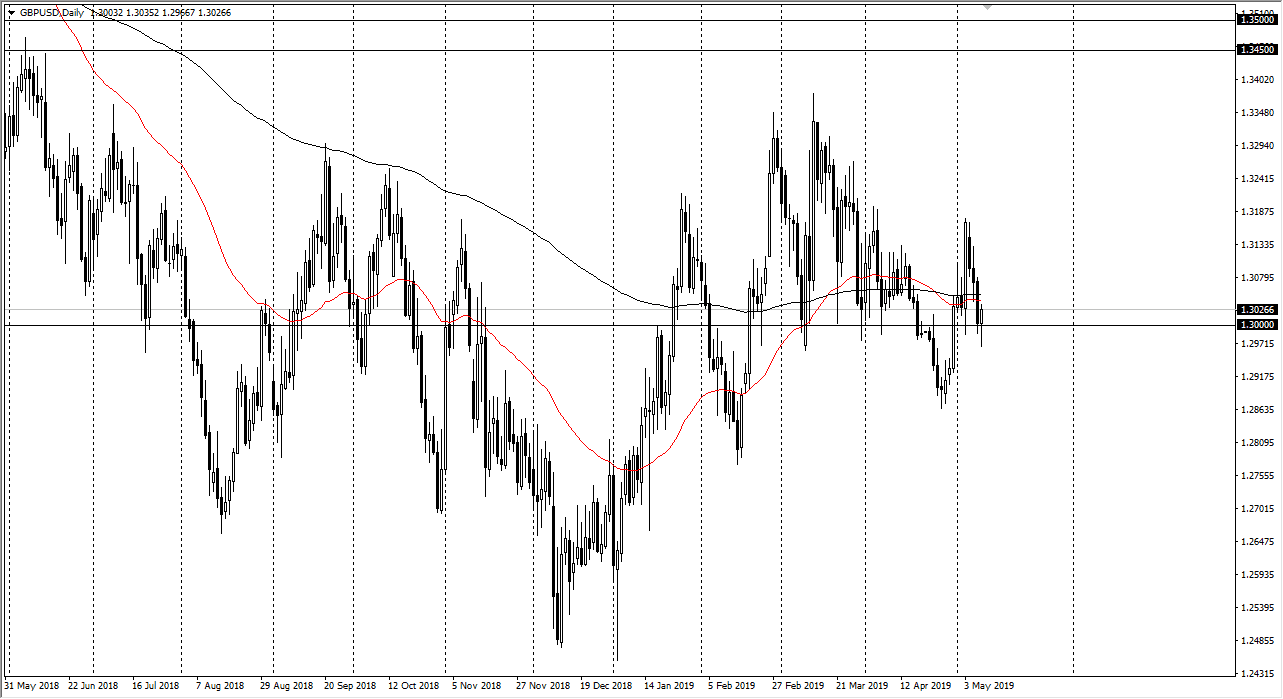

GBP/USD

The British pound recovered quite nicely during the day to form a hammer at the 1.30 level, so that is a good sign. However, there’s a lot of headline risk out there when it comes to the British pound so keep that in mind. One thing is for sure, we have seen British pound strength in general, not just against the US dollar. The GBP/JPY ended up forming a bit of a hammer as well, so I think we may see a short-term recovery for Sterling.

To the upside, I would anticipate that we will see a lot of resistance to the 1.32 handle. I don’t think we’ll get above there in the short term, but longer-term I do think that we go higher. I believe we continue to go back and forth in general, in a somewhat tight range. However, it looks like the next few hours might be positive more than anything else.