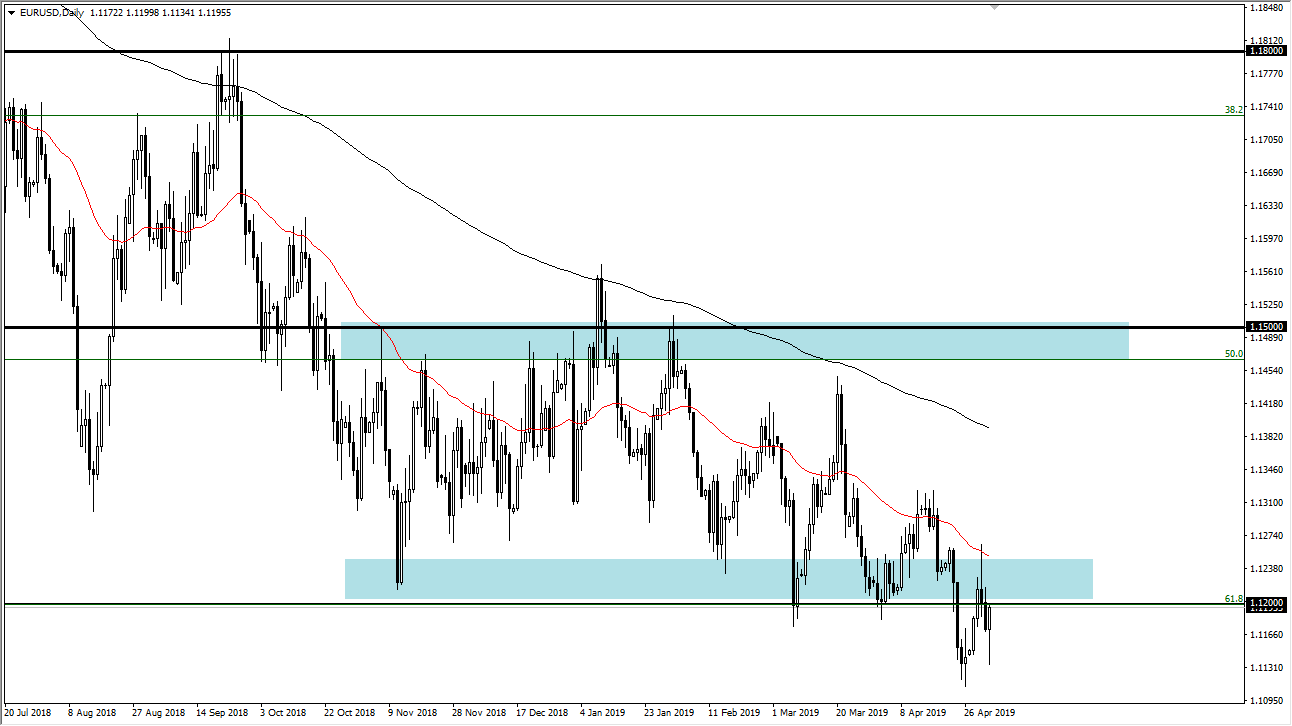

EUR/USD

The Euro pulled back a bit during the trading session on Friday, but then shot higher after the jobs report. We are closing out the day close to the 1.12 level, which of course has a lot of psychological importance built in. The question now is whether or not we can continue to rally, and break out to the upside? For me, I need to see this market break above the highs of the Wednesday candle stick, the shooting star and the scene of the 50 day EMA to get bullish. I suspect that part of the push higher was probably due to short covering going into the weekend. That being said, this is not a candlestick you should completely ignore.

All things being equal I think that the Monday candle stick will be more telling, and I think that short-term exhaustive candles can be sold but I also recognize that if we break above the 1.1275 level, essentially the area I mentioned previously, shorts will have to be abandoned at that point.

GBP/USD

If there is a currency out there that has caused the most losses over the last year, I suspect it’s this one. The market has sliced through the 1.31 level, an area that was massive resistance and we have completely negated a couple of shooting stars, something that you almost never see. Having said that, I think that the market could continue to go higher but obviously we have a little bit of resistance at the 1.32 handle. Quite frankly, the machines are trading this in high-volume, based upon tweets and headlines crossing the wires, and sometimes don’t get it quite right. It is been an absolute nightmare to trade. I suspect we may try to break up higher, perhaps as high as 1.3350, but it would be just as easy for this market to fall apart. This is literally one of the most dangerous currency pairs to trade right now.