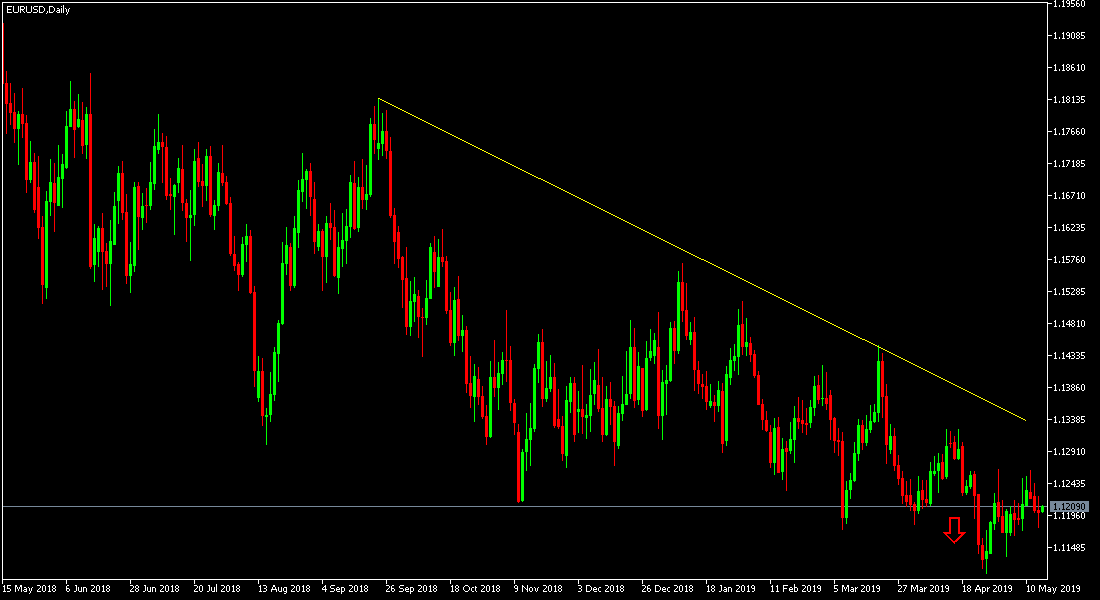

The resurgence of German economic growth and stability in the Eurozone was offset by the weakness of the ZEW Economic Sentiment Index for Germany and the Eurozone. This was opposed to the expectations of improvement, which added to the pressure on the Euro, which has suffered a crisis of confidence since the start of the slowdown of the Eurozone economy. This was led by Germany in response to the continuation of trade wars, which pushed the EUR / USD to move towards support level 1.1177 before stabilizing around 1.1200 psychological support at the time of writing this analysis, which supports the strength of the bearish trend that is dominating the pair.

The US dollar gains increased as investors became more attracted to it as a safe heaven after Trump's latest threat to impose more tariffs on Chinese products worth 200 billion. China has responded by imposing tariffs on $ 60 billion of US imports. The stability of the pair around and below the support level 1.1200 supports the continuation of the bearish trend for the pair. The Euro did not benefit from the high inflation in the euro area, as factors for this rise are still temporary. The dollar gained stronger momentum with positive US job numbers, adding jobs more than expectations and a drop in unemployment to a 49-year low.

The Federal Reserve Board kept the interest rate unchanged as expected, pointing out that it is unlikely to raise or lower interest rates in the coming months amid signs of renewed economic health while at the same time inflation is still unusually low. The Bank's policy statement highlighted its continued failure to raise the annual inflation rate to at least 2%. Referring to a drop in inflation, the statement may have raised expectations that a change in the next federal interest rate is a rate cut to stimulate inflation or growth.

As we mentioned earlier, we now emphasize that the divergence of the economic situation and the monetary policy between the US and the euro area will remain a strong influence on any chances for the pair to correct above.

Technically: We had expected and recommended in the previous analysis for a long time to sell the pair from every ascending level. The EUR / USD is now bearish, and currently the nearest support levels for the pair are 1.1165, 1.1050 and 1.0975, respectively. On the upside, the German-led Eurozone's negative economy weakened the correction opportunity further. The nearest resistance levels are 1.127, 1.1340 and 1.1420 respectively.

On the Economic Data: Today's economic calendar will focus on US data releases, housing starts, jobless claims and the Philadelphia industrial index.