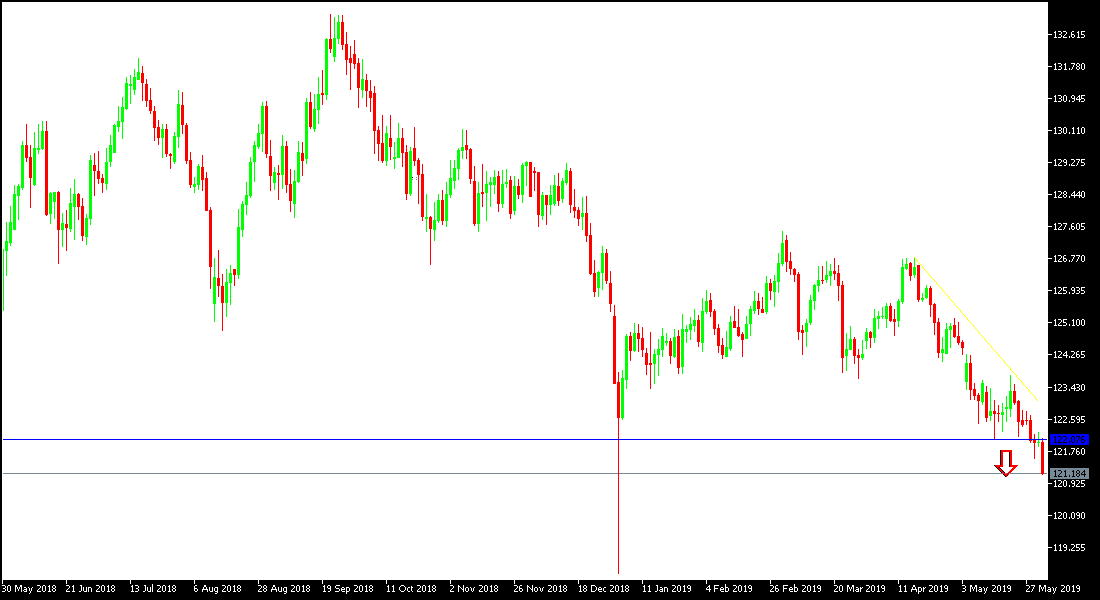

China's industrial output shrank more than expected, adding to investors' fears of the global economic recession and thus supporting the strong investor move to safe haven assets led by the Japanese Yen. The EUR/JPY pair fell strongly today, reaching support at 121.16 at the time of writing. And the lowest for more than 4 months. The continuous bearish momentum for the pair will support testing the psychological support at 120.00 as soon as possible.

Overall, the Japanese Yen is still reaping more gains against other major currencies. A stronger-than-expected victory for anti-EU parties, as well as the continuation of the global trade war and its negative impact on the Eurozone economy will further support bearish pressure on the pair's performance. Overall concerns about the consequences of worsening global trade tensions led by the United States and China will continue to be an important factor supporting the continued gains of the Japanese yen as one of the most important safe haven assets for investors at a time of uncertainty.

The performance of the Euro is under pressure from the continued slowdown of the Eurozone economy, led by Germany, as the global trade war continues.

The Japanese central bank kept the negative interest rate unchanged as expected and kept its accommodative monetary policy in place to support Japan's economy, which is facing the consequences of the global trade war. The European Central Bank (ECB), as expected, kept interest rates as is, and remains concerned that the Eurozone economy will continue to slow down, promising more stimulus if economic conditions worsen more than the current situation, especially if US trade wars continue.

European Central Bank President Mario Draghi announced that the ECB is ready to take further action to help the economy if expectations unexpectedly turn to the worst. Draghi said the bank would take "all necessary and appropriate monetary policy measures" in addition to the steps taken at its meeting on March 7, when it announced new cheap loans to banks and ruled out near rate hikes.

Technically: The recent EUR/JPY move is a bearish correction as shown on the daily chart below. The next support levels for the downside move will be 121.00, 120.20 and 119.00 respectively. In contrast, the nearest resistance levels are currently 122.00, 123.30 and 124.70, respectively. The general trend of the pair is bearish and the upward correction will not be stronger without the risk appetite and the return of confidence in the Euro.

On the economic data front, after the Chinese and Japanese data, the pair will focus on the German retail sales and CPI data. The pair will also be watching for any developments in safe haven appeal led by the JPY in case of more geopolitical worries.