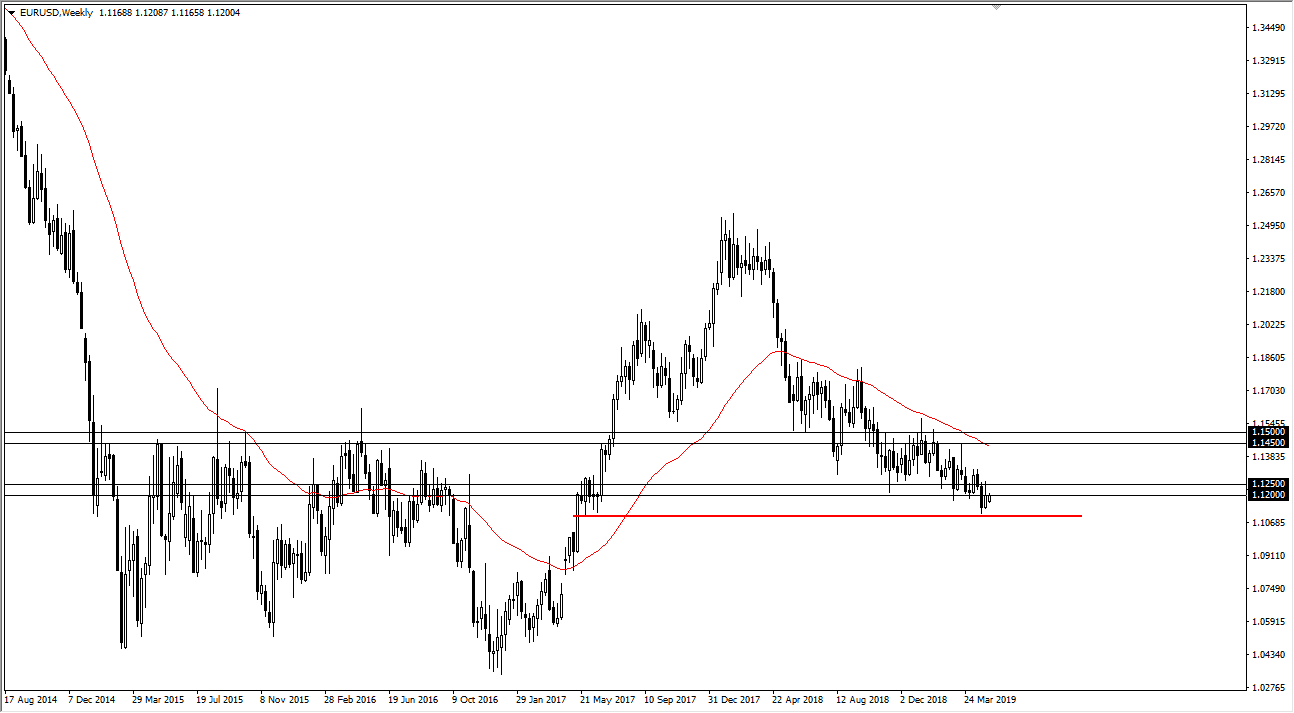

The Euro has been grinding lower against the US dollar for some time now. To be honest, I am a bit surprise that we managed to break below the 1.12 level as it look like it was going to hold. This is because I see so much in the way of support extending down below, and as shown by the red line on the chart. I think at this point we may still be in the middle of a bottoming process, but it’s not until we break above the 1.13 level that I feel that much in the way of confidence will be expressed with the Euro.

We are starting to see the possibility of a significant economic slowdown globally, and that typically helps the US dollar as people park money and US treasuries. Beyond that, we have a lot of issues economically and Europe, although things are starting to finally improve there. I think this is going to be a long and slow drawn out process, so I believe that this month will be very choppy to say the least. If we did break down below the 1.10 level, we could really start to break down drastically but I think that will end up being far too much to get through without some type of financial disaster.

To the upside, we could see this market try to reach the 1.13 level, and then possibly even the 1.14 handle. I do not expect to break out during the month of May though, quite frankly I expect a lot of sleepy and choppy trading. We obviously have more of a downward bias, but in all actuality it isn’t exactly strong. This looks like a downtrend that starting to run out of steam but isn’t quite ready to turn around. If that’s the case, this is going to be a short-term range bound market.