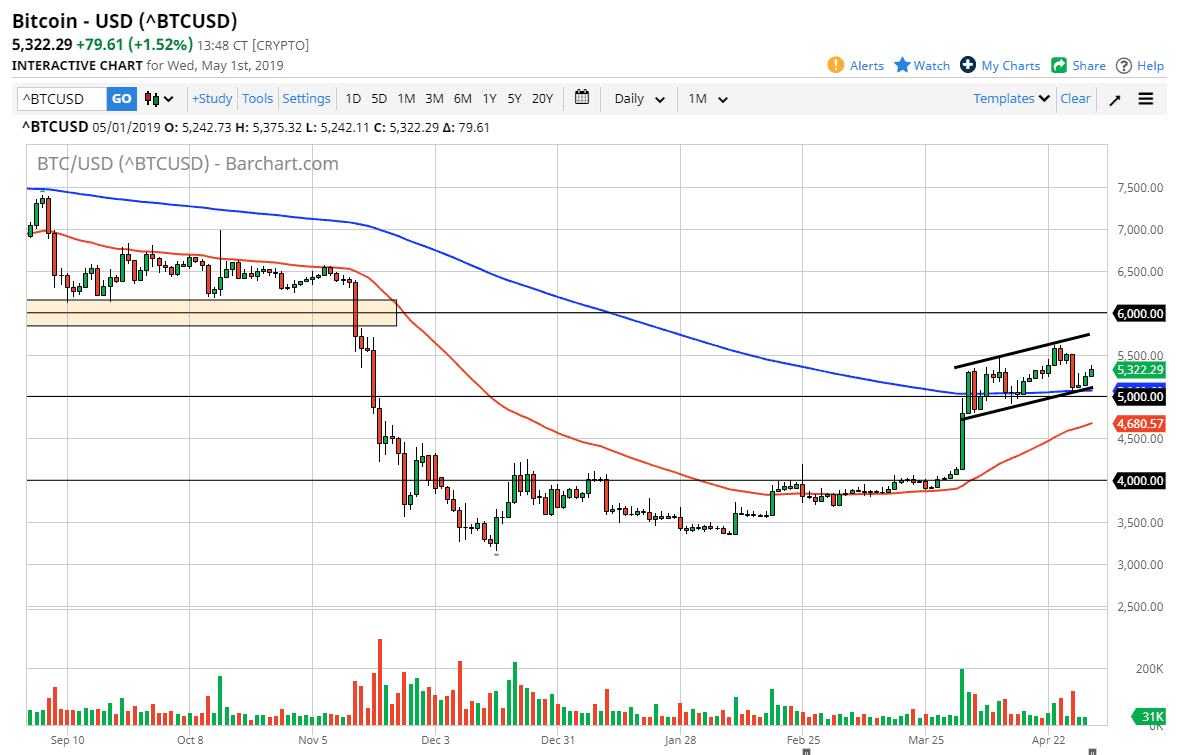

Bitcoin markets rallied a bit during the trading session on Wednesday again, as the 200 day EMA sits just below the market. We have been driving higher in an up trending channel, which of course is bullish and the fact that we have clear the $5000 level shouldn’t be ignored either. With all that being the case, it’s very likely that we are going to see plenty of value hunters underneath, as it is all but obvious at this point that accumulation has continued and it looks like we are trying to reach towards even higher levels. In fact, we are getting relatively close to the 50 day EMA turning high enough to cross the 200 day EMA, in a phenomenon known as the “golden cross.”

That “golden cross” could send longer-term money into the marketplace, getting people involved in what should be a larger move. Buying on dips continues to be a strategy that a lot of traders are using, and quite frankly there’s no reason to think that there won’t be a continuation of this value hunting. Even if we were to break down below the $5000 level, and I don’t necessarily expect that, there should be plenty of support at the 50 day EMA below, which is currently near the $4635 level. As far as selling is concerned, I think that we are a bit late for that, as although these dips will occur occasionally, it’s not enough to get me excited.

When I look at the longer-term charts, it seems that we are essentially in a bit of an “accumulation phase”, which is when the so-called “smart money” is accumulating an asset cheaply before what is known as the “market up phase.” Ultimately, expect volatility but at the end of the day it certainly looks as if the buyers are starting to flex their muscles.