The AUD/USD is trying to keep its stability around and above the psychological support level at 0.7000 to avoid further downward pressure. The pair was affected by the release of China's trade data, with China registering a trade surplus of 94 billion yuan ($ 13.8 billion) in April, well below the forecast of 235 billion yuan ($ 33.7 billion). Today, China's consumer price index and tomorrow's announcement of the central bank's monetary policy statement will be released. From the United States, there will be announcement of weekly jobless claims, the trade balance, the PPI and comments by Federal Reserve Governor Jerome Powell.

The trade war between the United States and China has caused huge losses to the Chinese economy. China's trade surplus fell sharply in April, from 221 billion yuan to 94 billion yuan ($32.6 billion to $ 13.8 billion). Also, Chinese exports fell 2.7% in April, year on year. That was a sharper drop than expectations of a 2.3% decline. The slowdown in China has hurt the Australian economy, with China being Australia's first trading partner.

This week, the Reserve Bank of Australia (RBA) announced its interest rate and expectations were for a quarter-point cut to 1.25%, but the bank kept the rate unchanged at 1.50%. The decision to keep interest rates boosted the Australian dollar by gains of 1.0%. The Australian dollar lost much of its gains after threatening to impose more US tariffs on China's products on Friday. Which will support the wait and see policy by the Reserve Bank of Australia.

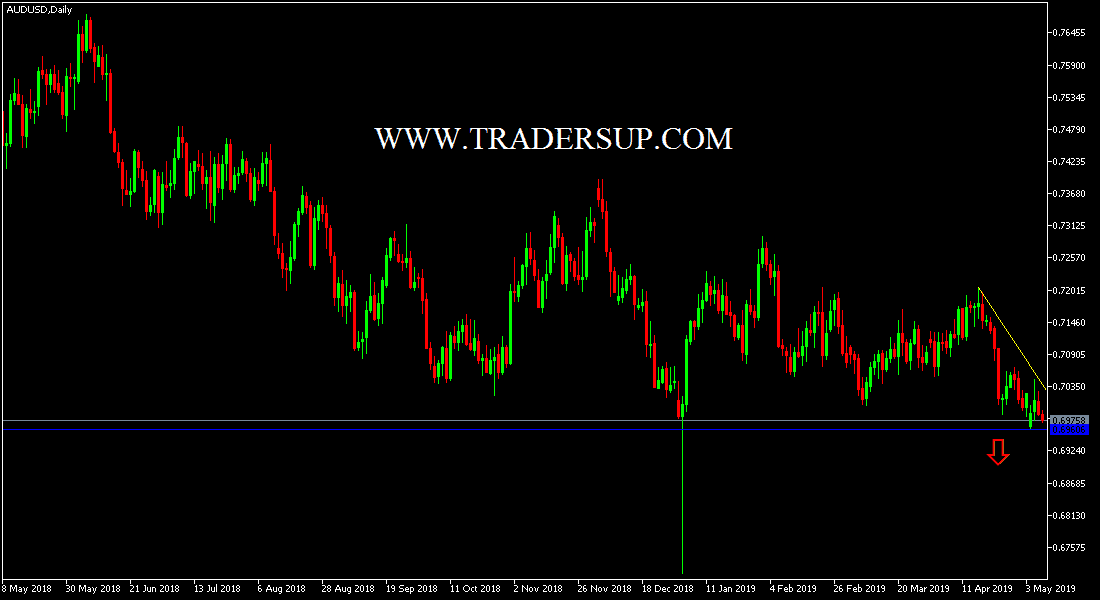

The most important support for the Australian dollar against the US Dollar today: 0.6945, 0.6870 and 0.6800 respectively.

The most important resistance levels of the Australian dollar against the US today: 0.7030, 0.7100 and 0.7185, respectively.