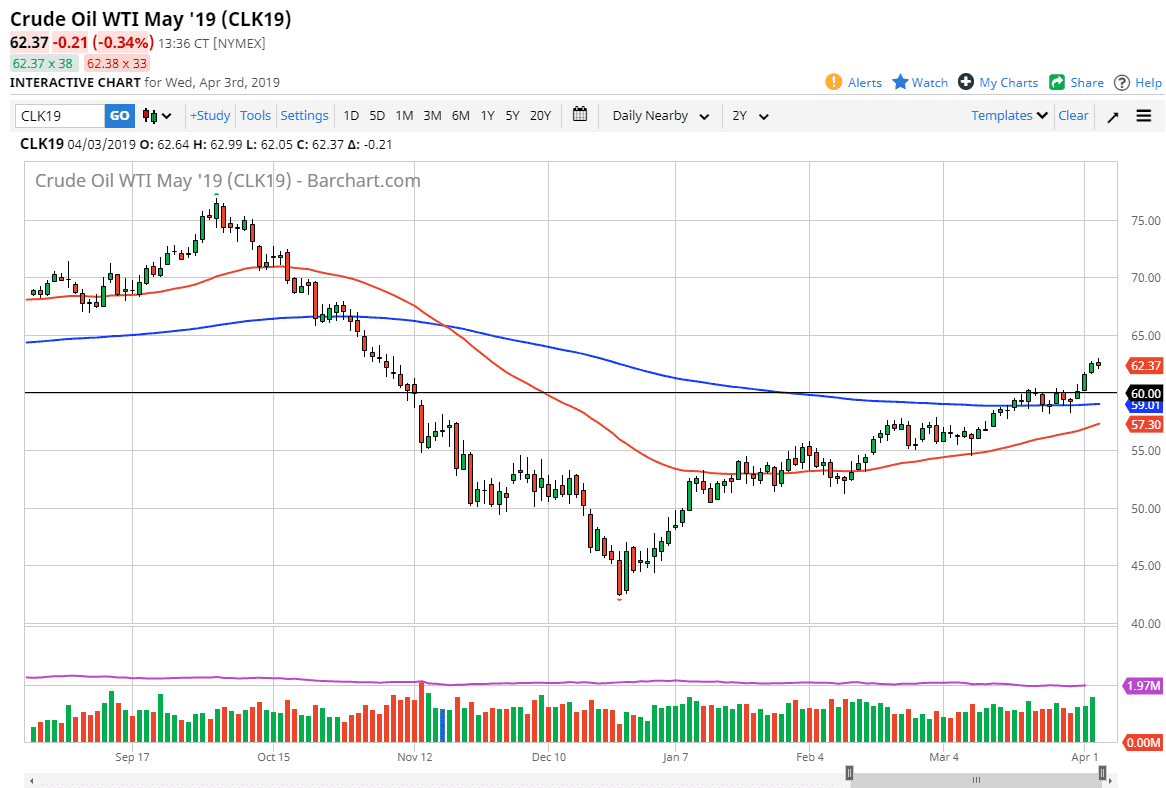

WTI Crude Oil

The WTI Crude Oil market went back and forth during the trading session on Wednesday, as we reached towards the $62.50 level. Ultimately, this is a market that has broken out as of the last couple of days, and now that we have jumped as high as we have, it’s very likely that we will get a pullback to retest that resistance near $60. That being said, while I am expecting a bit of a pullback from here, I like the idea of going long on pullbacks as they offer value. Alternately, we could break above the highs of the trading session on Wednesday, sending the market towards the $65 level. Overall, this is a market that I think is getting ready to break much higher, so therefore buying pullbacks should continue to be the way to play crude oil. I have no interest in shorting this market.

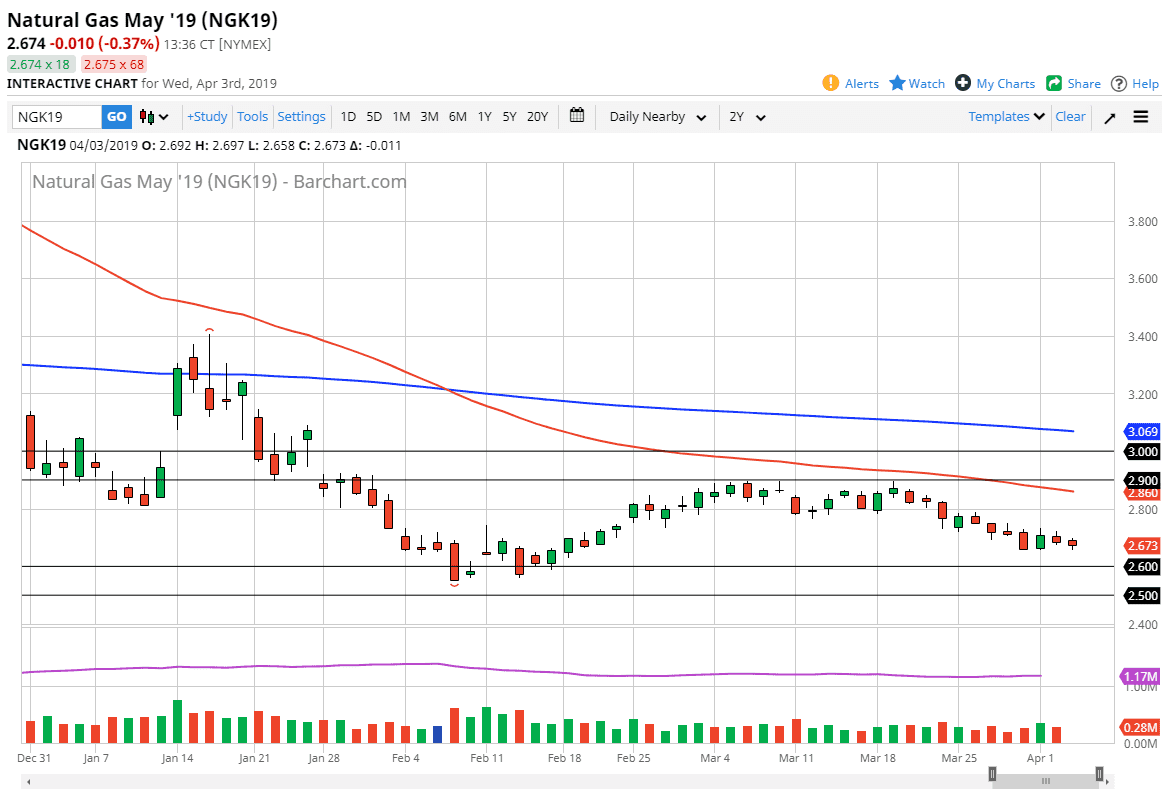

Natural Gas

Natural gas markets drifted a little bit during the trading session on Wednesday, as we continue to see downward pressure. The market has massive support below starting at the $2.60 level and extending down to the $2.50 level. This is a market that is well defined between there and the $2.90 level that extends to the $3.00 level.

It seems very unlikely that we are going to break out of this range, so it’s only a matter of time before we get an opportunity to go back and forth from the highs and the lows of the range. At this point in time it’s likely that we will drift towards that buying opportunity, but only for short-term moves. I think that we stay in this range for the rest of the year.