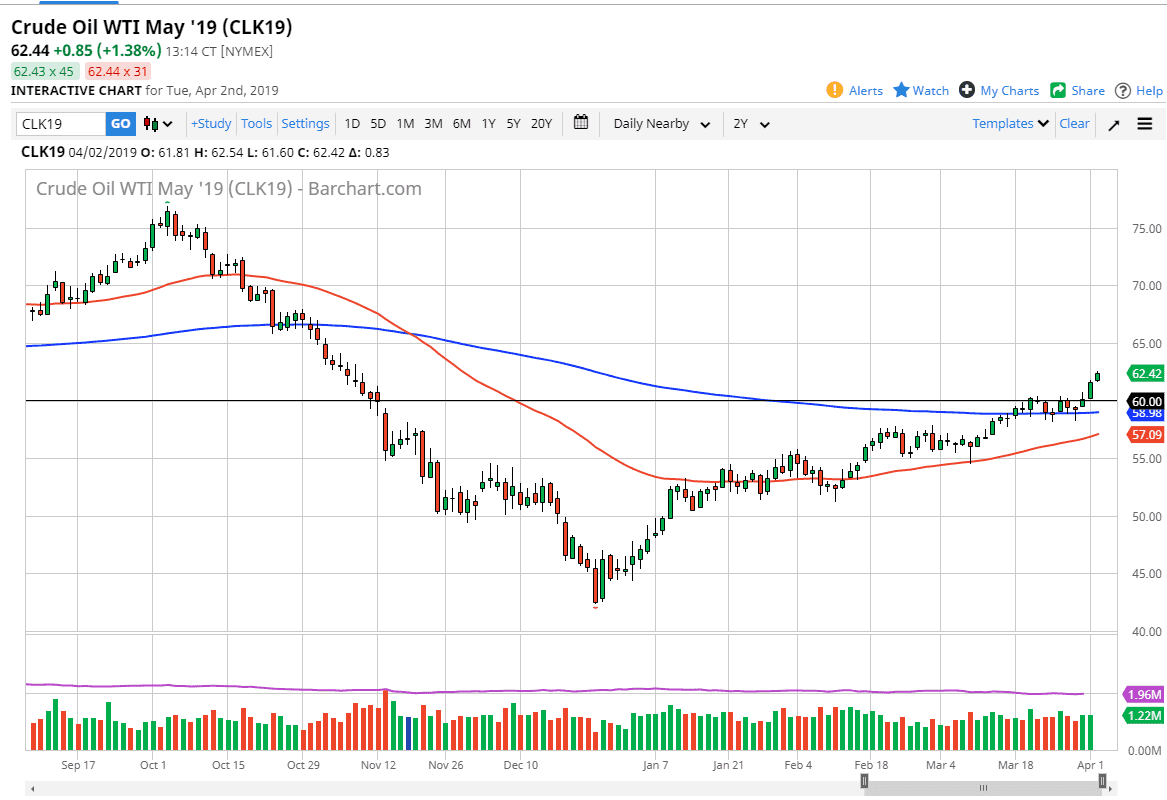

WTI Crude Oil

The WTI Crude Oil market rallied again during the trading session on Tuesday, as we continue to see the break out take effect. At this point, it’s probably not wise to jump in and start buying right away. However, I do believe that short-term pullbacks should be nice buying opportunities, as breaking above the $60 level was of course crucial. The 200 day EMA underneath near the $59 level will define the trend overall, so I suspect as long as we can stay above that area the buyers are still going to be hanging about.

Keep in mind that the OPEC countries don’t meet until June, so that continues to put a bit of a bullish factor into the market as they won’t be boosting output until they meet. That being said, we have also broken above a gap at the $60 level which of course is a bullish sign as well. Look for value, then take advantage of it.

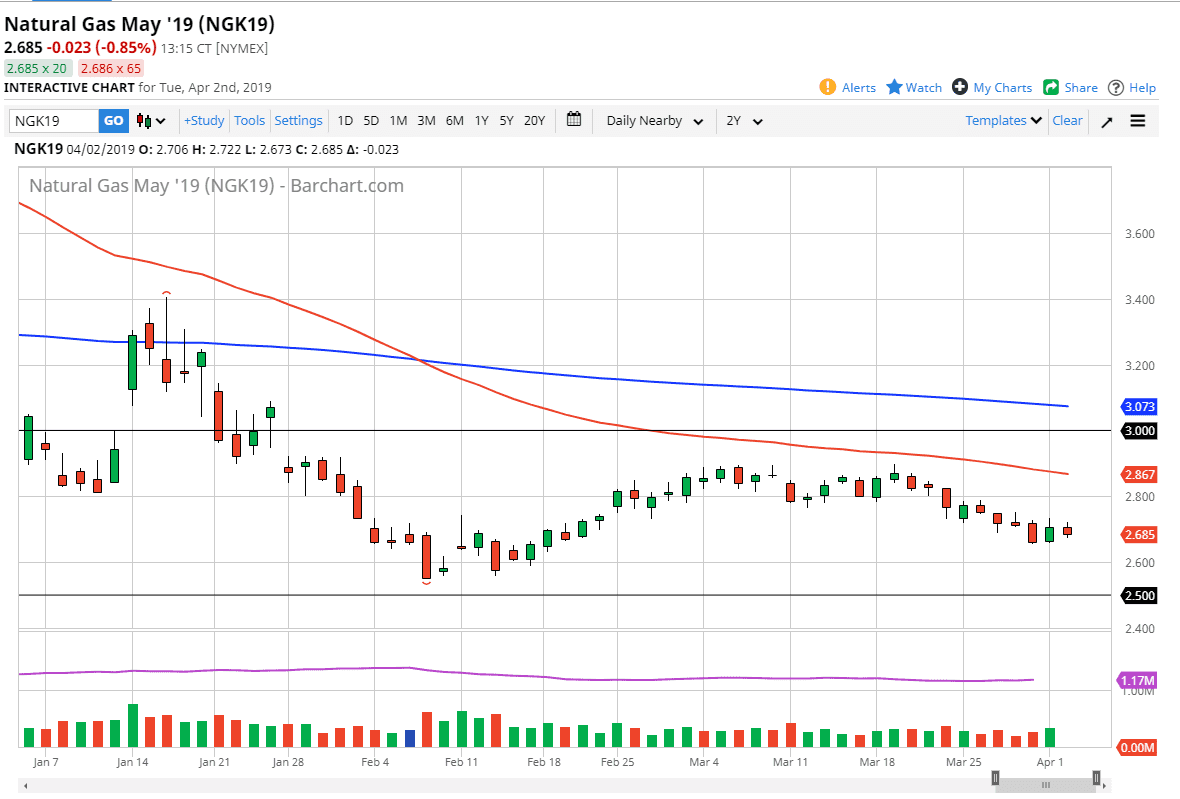

Natural Gas

Natural gas markets have gone back and forth, showing signs of lackluster trading during the day on Tuesday. The $2.69 level is the bulk of where we had been trading, and we are simply drifting towards the support level underneath. I believe that support level starts at the $2.60 level, which extends all the way down to the $2.50 level. Above here, we have massive resistance at the $2.90 level that extends all the way to the $3.00 level. Since we are in the middle of this market, I think you have to look to ultra-short-term charts if you want to put any money to work, or you simply have to wait until we get to one of the outer reaches to put money to work. I will be choosing the latter of the two options.