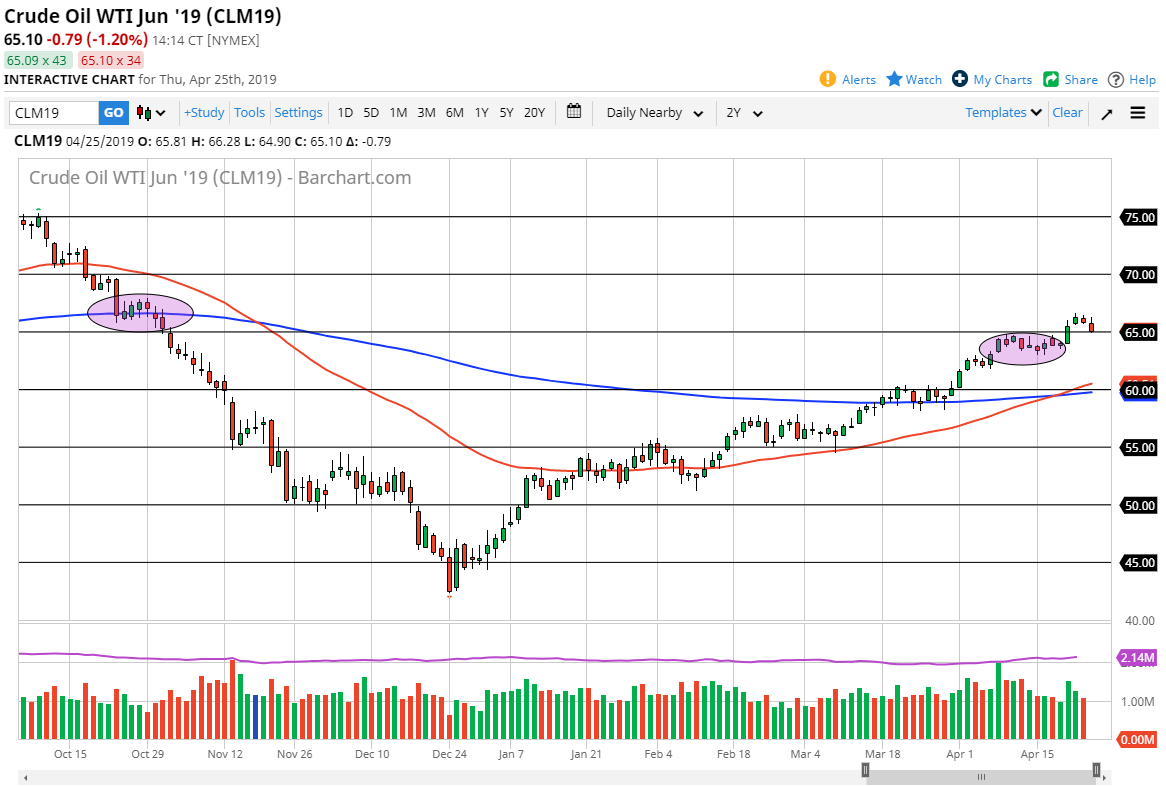

WTI Crude Oil

The WTI Crude Oil market initially tried to rally during the trading session on Thursday but rolled over rather significantly to reach down towards the $65 level. This is an area that was previous massive resistance, so a bounce from there would make a lot of sense. I don’t know whether or not we get it right away, because there is a thick “zone” of potential support extending down to at least the $64 level. With that being the case I’m looking for the first signs of bouncing or strength to take advantage of what has been a very strong move to the upside. Part of the selloff could have been due to the strengthening US dollar, so it’ll be interesting to see how the currency markets get involved. I have no interest in shorting, I’m simply waiting to see whether I can get some type of valuable move lower with signs of support that I can take advantage of.

Natural Gas

Natural gas markets initially pulled back during the trading session on Thursday, but then turned around of form a bit of a hammer. We continue to see a bit of life around the $2.50 level, which is the bottom of the overall consolidation region. Overall, we are oversold, but it’s difficult to buy this market with any type of resiliency. If we break down below the lows of the last couple of days, then the market could unwind rather drastically, perhaps down to the $2.25 level. To the upside, if we get a break above the daily candle stick for Thursday, we could drift towards the $2.60 level, and then possibly even the $2.70 level.