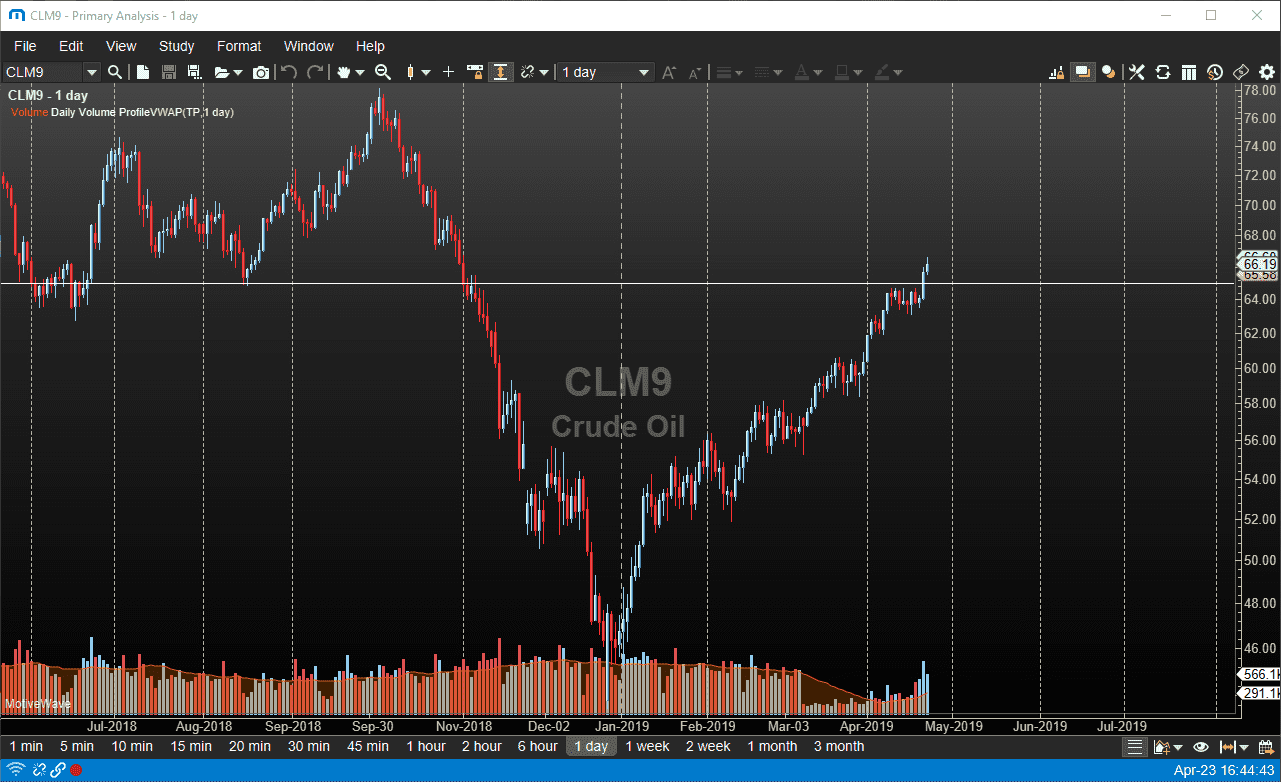

WTI Crude Oil

The WTI Crude Oil market continues to show bullish pressure during the trading session on Tuesday, as we continue to see the $65 level left in the background. At this point, short-term pullbacks should continue to be buying opportunities but it’s not going to be easy to wait. This is mainly because traders tend to like buying these type of breakdowns, because they typically have a lot of momentum. Being patient at this point is one of the most difficult things to do. Overall though, it looks as if the $65 level will probably end up being some type of floor in the market going forward based upon what we have seen. Crude oil is a one way bet at this point, but the $67.50 level is going to offer a bit of resistance, and most certainly the $70 level will.

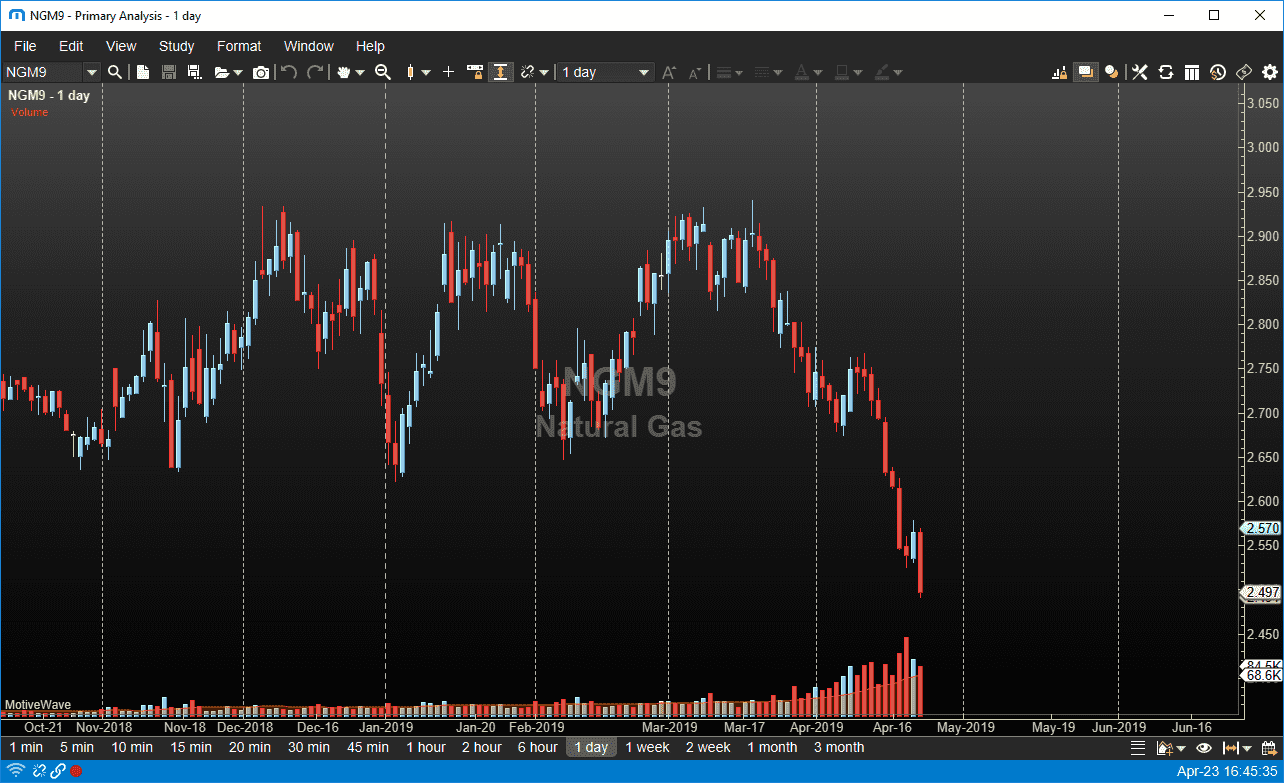

Natural Gas

Natural gas markets broke hard during the trading session on Tuesday, slicing through the $2.50 level. Ultimately, this is a market that is entering new territory because we have broken through what has been a reliable source of support over the last several years. With that being the case, we could send this market down to the $2.25 level, and it could be rather quick in doing so. Natural gas is over abundant and although tanks are running rather empty at the moment, we are now in the build this season, and there is more than enough drilling going on to rapidly fill out those storage units. With all that being the case, I sell rallies and natural gas and have no interest in buying. Quite frankly, this market looks like death.