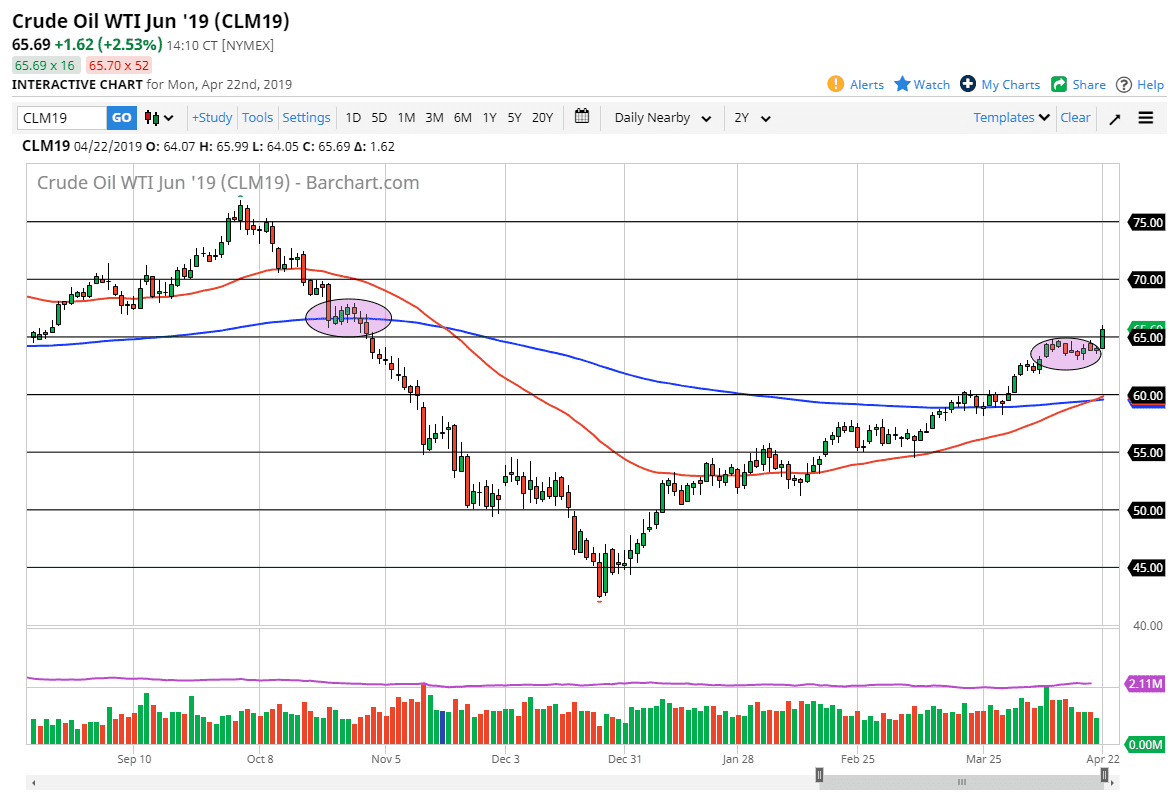

WTI Crude Oil

The WTI Crude Oil market broke higher during Asian trading as word got out that the Trump administration was going to revoke waivers for countries that were buying Iranian oil. This means that sanctions would be levied on certain countries such as China and Japan, and many others. This of course had the markets rocking back and forth, and as a result crude oil markets shot higher.

As the WTI market broke above the $65 level, it cleared a major hurdle. After that, it did stall towards the later part of the day as it was announced that there was going to be roughly a year before that came into effect. However, the technical damage was done. At this point, we have broken through a barrier that the market had been trying to break through for some time anyway, and we most certainly had been in and uptrend. This means is that we were simply looking for a reason to break to the upside. Going forward, behind those pullbacks should continue to be buying opportunities, as the market looks likely to go looking towards the $67.50 level.

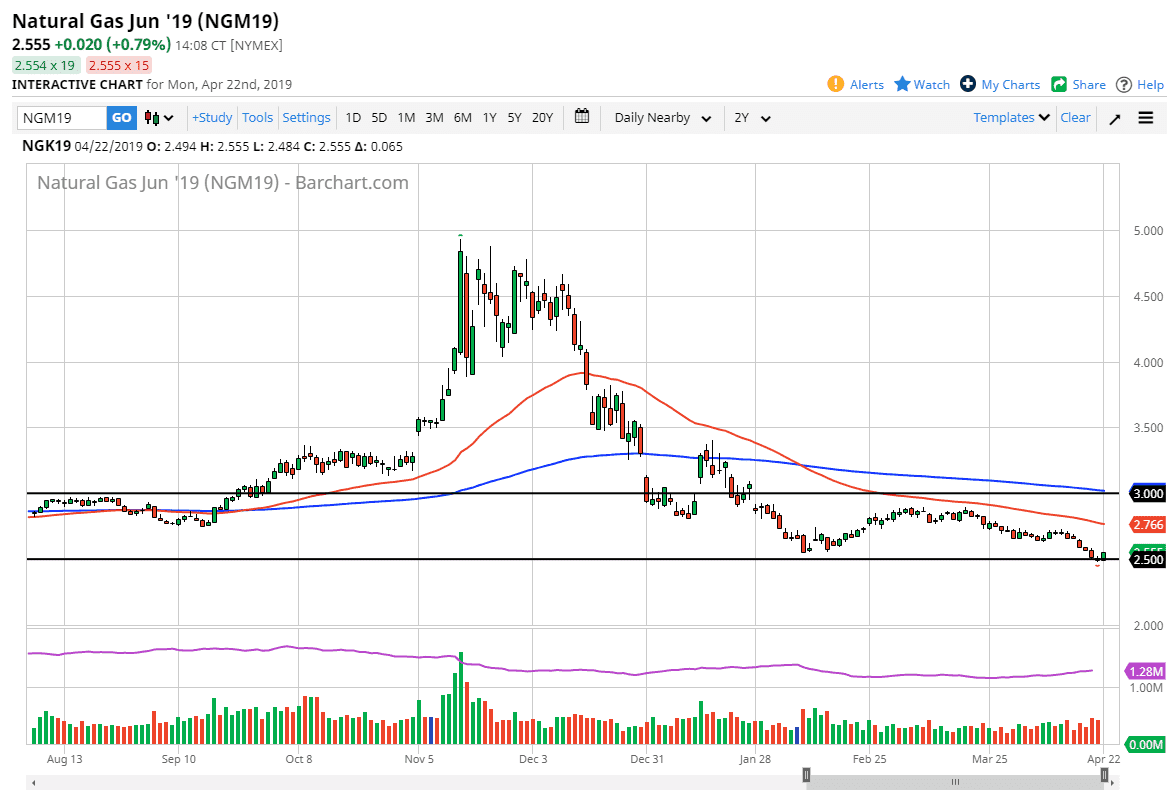

Natural Gas

Natural gas markets continue to meander at very low levels, as we are starting to switch contracts. The $2.50 level is the bottom of the larger consolidation area that goes back a couple of years, and although the level is crucial, we are starting to see the market really grind away at the level and it very well could break. When that happens, it could open up the trap door down to $2.25 below. However, a rally is very possible as well, and we could reach towards the $2.70 level where I suspect that there would be sellers. Looking at the chart, it’s obvious that the downward pressure has been relentless.