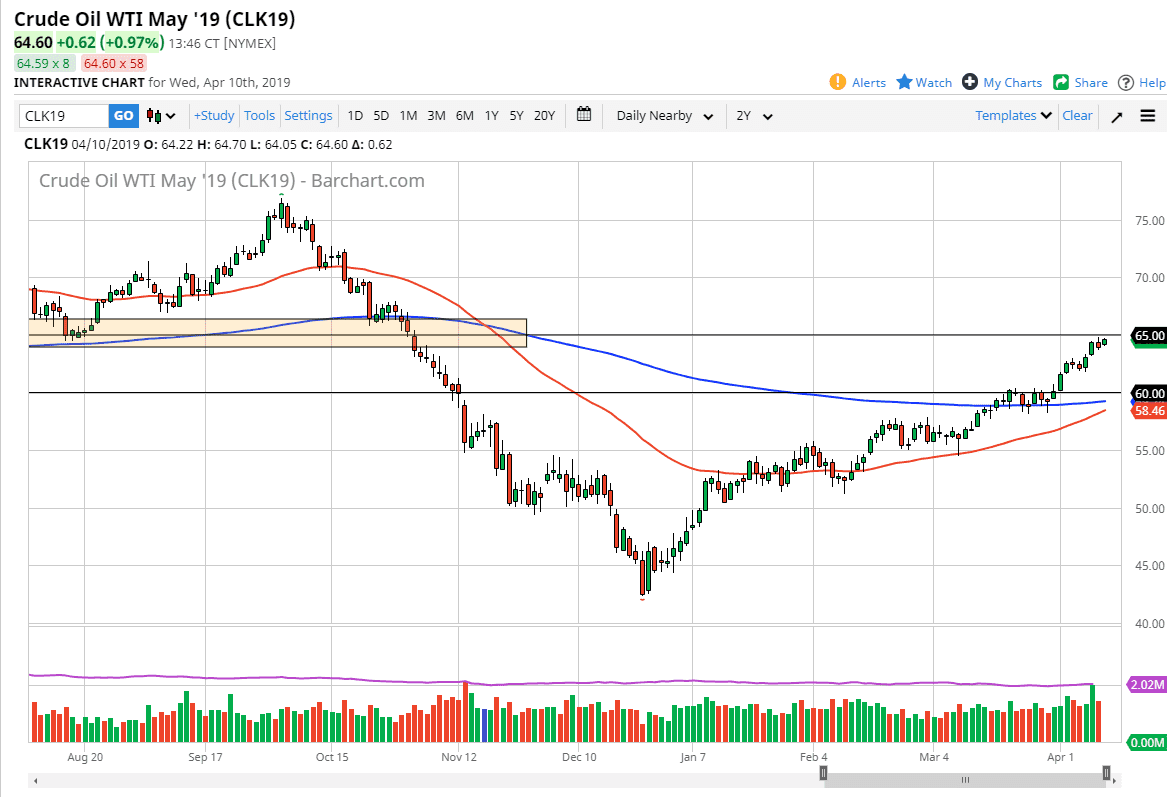

WTI Crude Oil

The WTI Crude Oil market had a slightly positive session as we awaited the Federal Reserve Meeting Minutes. Overall though, we are pressing a major resistance barrier in the form of $65, an area that was massive support previously. We formed a shooting star during the trading session on Tuesday and have not broken above the top of it. If we do break above the $65 level, it’s very likely that we could continue to go higher. However, I think it’s much more likely that we pull back from here and look for value underneath. One of the most interesting areas for me is going to be $62.50. If we can find some support there I’d be more than willing to buy. In fact, were getting rather close to getting a “golden cross.”

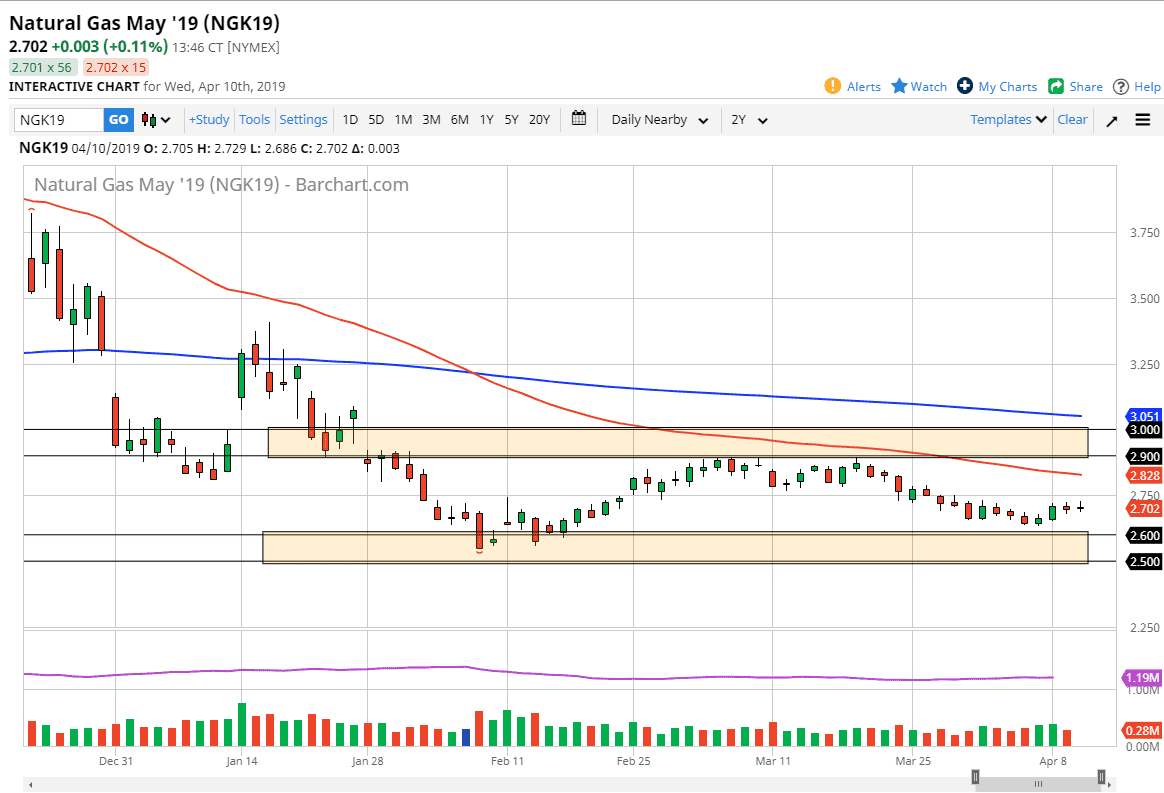

Natural Gas

Natural gas markets continue to do very little as we are not necessarily near a support or resistance area. The markets have been consolidating for some time now. The resistance of course is down at the $2.60 level still, extending down to the $2.50 level. The resistance above is at the $2.90 level that extends to the $3.00 level. Overall, I think we stay in this range for quite some time, so the fact that we are trading around $2.70 doesn’t really give me much faith in one direction or the other. I know that the inventory number comes out, and that can have a short-term effect but probably fleeting at best.

Until proven otherwise, we have to assume that the range that has been such a huge part of the natural gas market continues. The $2.75 level could cause a little bit of resistance on short-term charts but only for a few cents to the downside would be my guess.