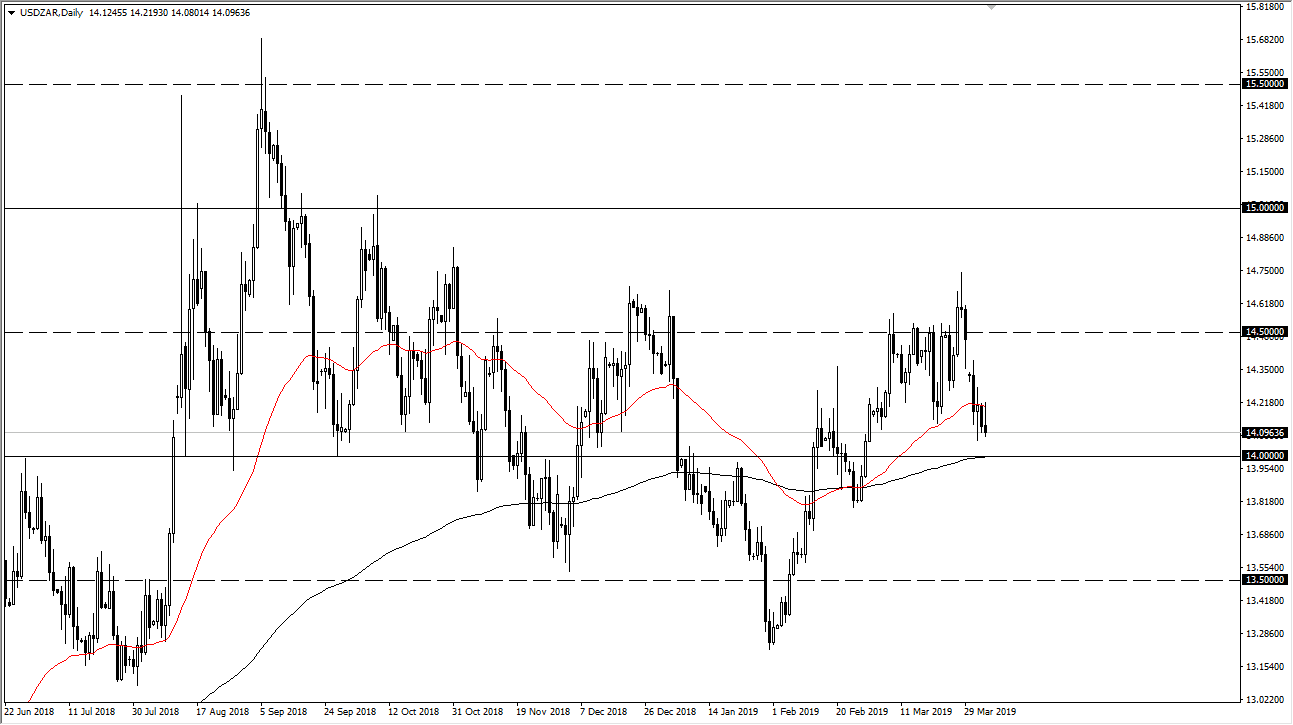

The US dollar initially tried to rally against the South African Rand and many other currencies around the world during trading on Thursday. However, in the USD/ZAR pair, we ran into trouble at the 14.22 Rand level as it coincides with the 50 day EMA. We started selling off their and immediately showing selling pressure. That being the case, it looks as if we are going to continue to struggle and perhaps roll over towards much more significant support just underneath at the 14.00 Rand handle.

That being said, we are getting ready to get the US jobs figure on Friday, and that of course will have a lot to do with where the US dollar goes from here. There will be a lot of volatility, so I suspect that in the exotic currency such as the South African Rand, it’s probably best to wait to see where the day ends up on the close. Ultimately, we have to pay attention to the 14.00 Rand level as it is the scene of the 200 day EMA, which of course makes a huge amount of interest to be paid attention to there.

At this point, I believe that the daily candle stick is going to tell the story, because if we find support at the 14 Rand level, then we have buyers. Otherwise, if we can break above the top of the range for the trading session and close above there on Friday, then it’s probably a buying opportunity to try to fill the gap from the beginning of the week which is closer to the 14.50 Rand level. Otherwise, I feel we are essentially in a “holding pattern” in this pair. Remember, exotic currencies can move much quicker on these Nonfarm Payroll Fridays sessions, so this is why it’s better to wait until Monday morning to react to the daily candle stick.