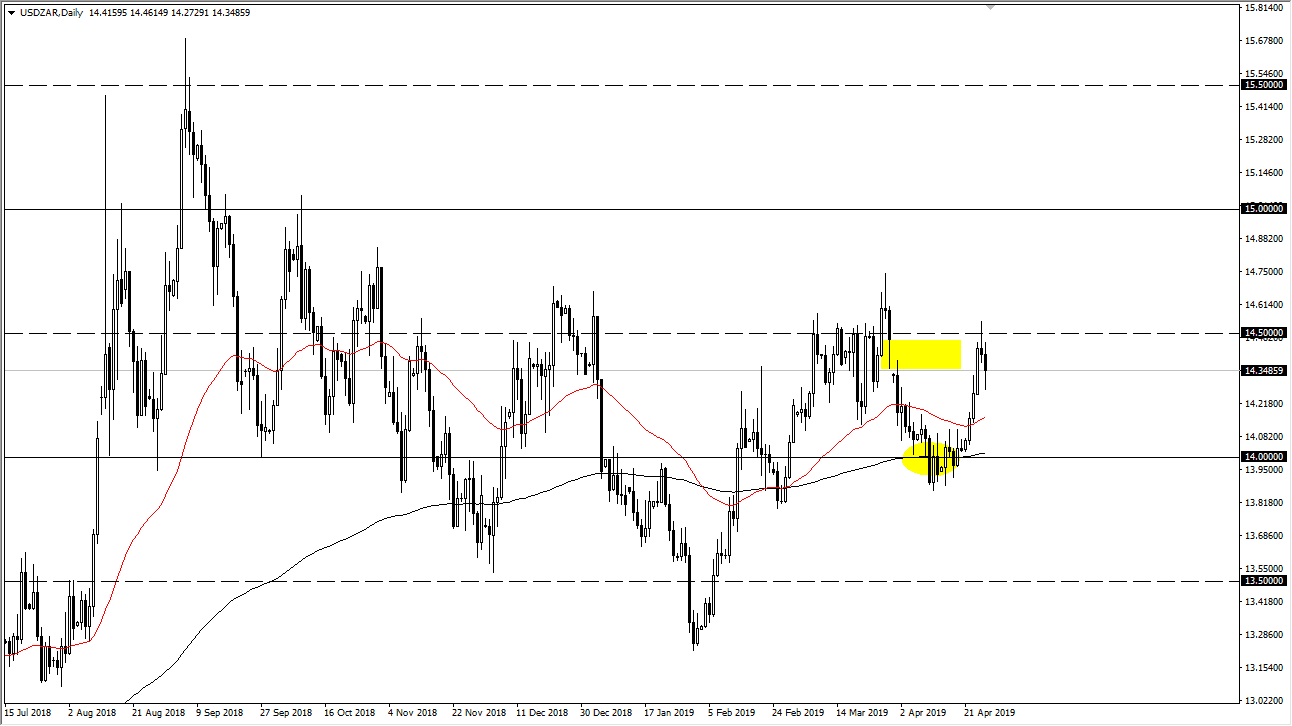

The US dollar initially tried to rally during the trading session on Friday but found the area near 14.50 Rand to be a bit difficult to break above. After that, we break down below the bottom of the shooting star for the previous session, which of course is a sell signal. At this point, the market looks as if it is going to favor the South African Rand over the US dollar in the short term, mainly because we may be in more of a “risk on” type of situation. The South African Rand is a great way to play the emerging markets, because although it is an emerging market, it is structurally sound enough to invest in without a lot of concerns, at least that’s the way it’s always been.

However, political instability has been a bit of a problem as of late. Because of that, it’s very likely that the South African Rand will continue to be very volatile. The 14.50 Rand level has been important previously, and the fact that we formed a shooting star on Thursday is of course a significantly bearish signal. At the same time, I can see the 14 Rand level underneath offering significant support as we have bounced from there. Based upon the price action over the last couple of trading sessions, it looks very likely that we will continue to see a bit of a drift lower. That drift could go looking towards the 50 day EMA initially, which is closer to the 14.20 Rand level. The 200 day EMA is at the 14 row level, and as a result the downside is probably somewhat limited, which of course makes sense considering that there are a lot of questions about the global growth situation. The alternate scenario is that we break above the top of the Thursday shooting star, which sends this market looking towards the 14.75 Rand level.