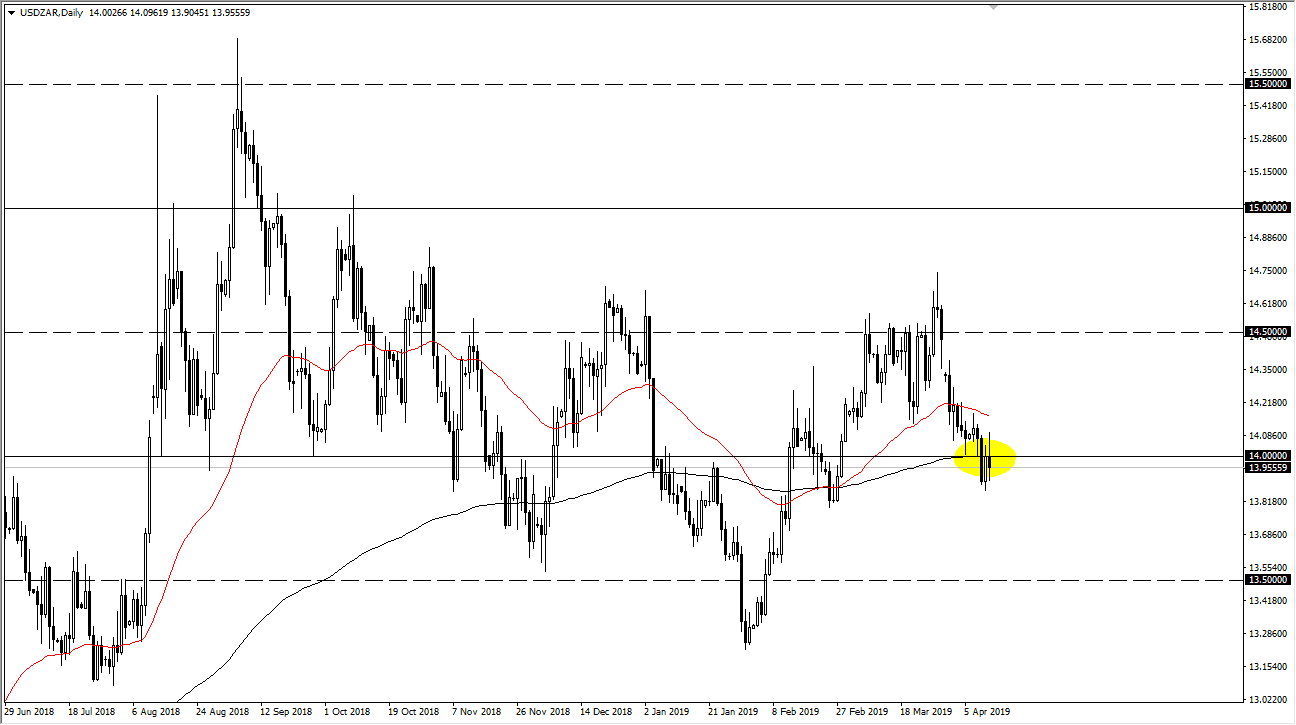

The US dollar went back and forth during the trading session on Friday against the South African Rand, just as we have seen quite a bit of mixed action against the US dollar in general. Looking at this chart, it’s obvious that we are chewing up around the 14 Rand level. At this point, the market still hasn’t filled the gap above, so it’s very likely that the market will try to go higher, but we also have the 50 day EMA just above as well, so that could cause some resistance. Looking at this chart as well, you can also see that we have a lot of volatility, so one thing you can count on is a lot of choppiness overall.

The 14 Rand level of course will attract a lot of attention due to the round figure, but we have also seen the lot of action at this level previously. Beyond that, there is also the 200 day moving average slicing right through the candle stick so obviously there are a lot of moving pieces here. One thing that you think about when it comes to the South African Rand is whether or not we have risk appetite or not. In other words, if money is flowing into emerging markets, the South African Rand does very well. Obviously, works in both directions as we flight to quality will have money flowing out of South Africa and other countries such as Brazil. Money almost always goes into the US dollar at that point, as it is the currency needed for trading treasuries.

If we break down below the 13.80 Rand level, then I think the market drops to the 13.50 Rand level. If we break above the top of the 50 day EMA, then I think will go looking to fill that gap that I mentioned previously, which extends all the way to the 14.50 Rand level.