USD/MXN

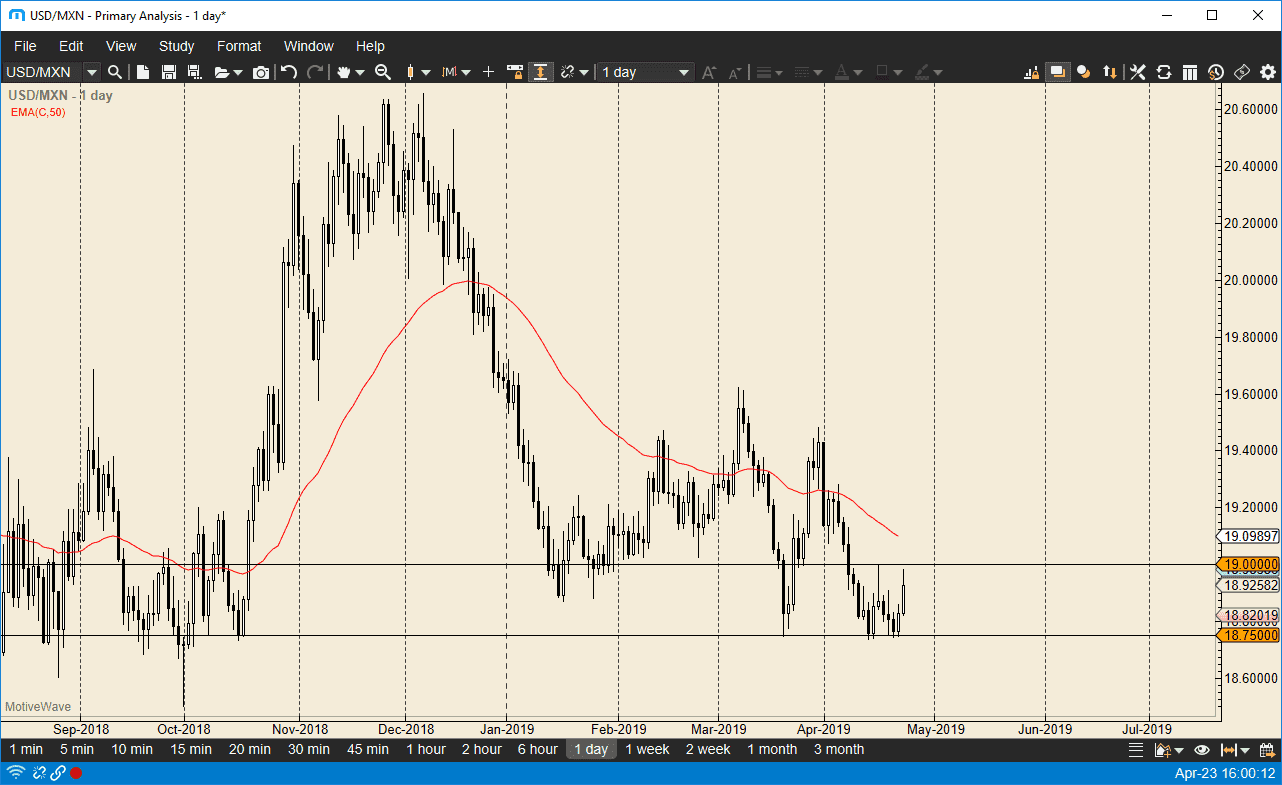

The US dollar initially rallied against the Mexican peso during trading on Tuesday but continues to show a bit of resistance at the 19 pesos level. This large, round, psychologically and structurally important number is starting to carve out a bit of a trading range currently. With that, the market looks as if it is trying to decide whether or not it can break down, or if it’s going to explode higher. It’s interesting to watch this, because the US dollar has shown extreme strength against other currencies, but it seems to be a bit of a mixed bag. I suspect that part of what’s going on here is that the Mexican peso is highly influenced by crude oil, and of course a hunt for yield, something that is very uncommon these days.

With all that being said it’s obvious that the Mexican peso is superior when it comes to the interest rate differential and of course the oil market doesn’t hurt that either. That being said, the 18.75 pesos level is crucial, and therefore we need to pay attention to that level just as much. If we were to break down below the 18.75 level, the Mexican peso will strengthen rather considerably. I suspect that will probably be in congruence with a weakening US dollar against many other currencies. At that point, I would anticipate that the peso may rise to 18.50 against the dollar. However, if we were to turn around and break above the 19 pesos level that could send this market looking towards the 50 day EMA, and then possibly the 19.25 pesos level.

That being said, the short-term chart looks as if we are going to continue to consolidate immediately. We are in a nice range between 19 and 18.75, so my short-term analysis is that we stay here. However, once we break out we have our levels to look towards.