The US dollar initially tried to rally during the day on Friday but then rolled over again as we continue to see a lot of weakness against the Mexican peso. That being said it was also Good Friday, if you can’t read too much into the move during the day but it does jive well with the overall attitude of this market so at this point it’s probably just yet another signal that we may be getting ready for a significant move.

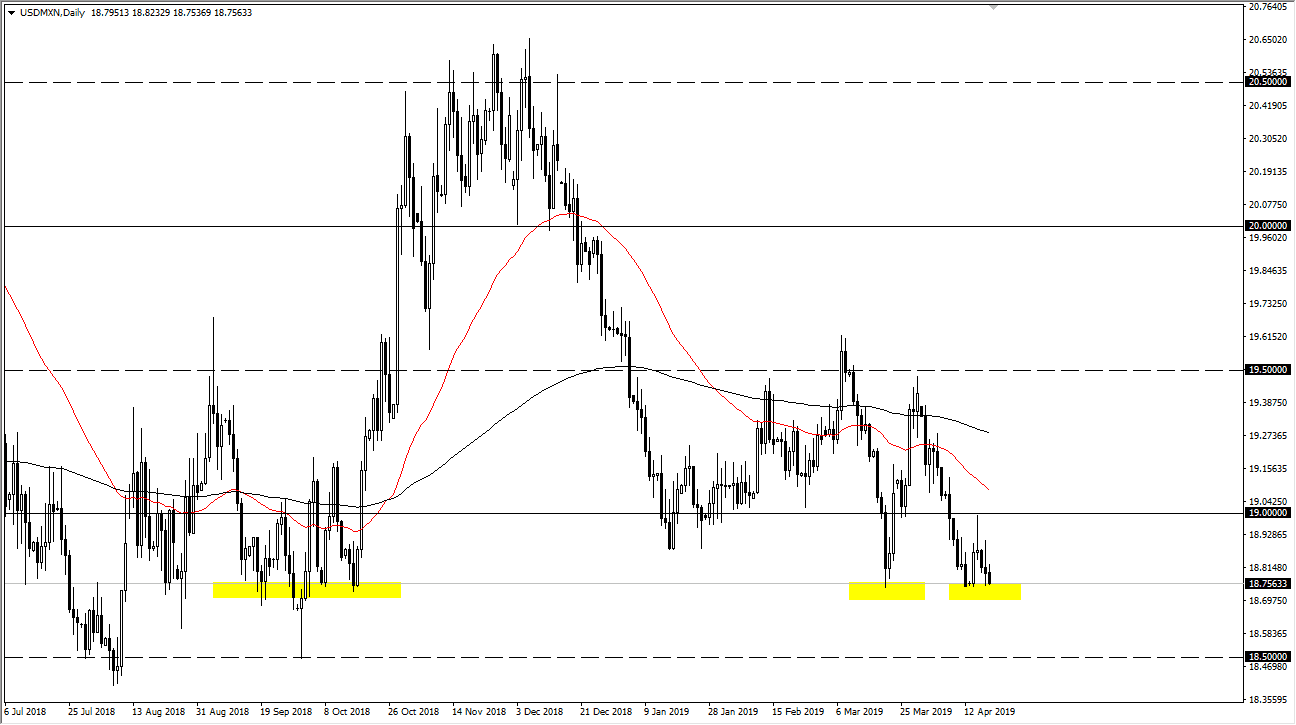

When you look at the chart, the 50 day EMA, pictured in red, is drifting lower quite rapidly, and of course the 200 day EMA, pictured in black, is starting to roll over as well. In other words, the market is starting to pick up negative momentum, which is quite interesting considering that a lot of other currencies around the world aren’t quite as strong against the greenback.

Looking at the chart I see the 18.75 pesos level as offering short-term support, but quite frankly it looks very likely to give way and let the market roll over. We have recently seen the market try to break above the 19 pesos level only to spike, form a shooting star, and then roll over again. By doing so, it looks very likely to continue the downward momentum, and I believe that the initial target will be the 18.50 pesos level below which has been important in the past. I would be a buyer unless we form some type of significant bounce or supportive candle in that area or managed to turn around and break above the 19 pesos level, which would show a bit of strength. Currently, I believe that this market will continue the momentum lower.