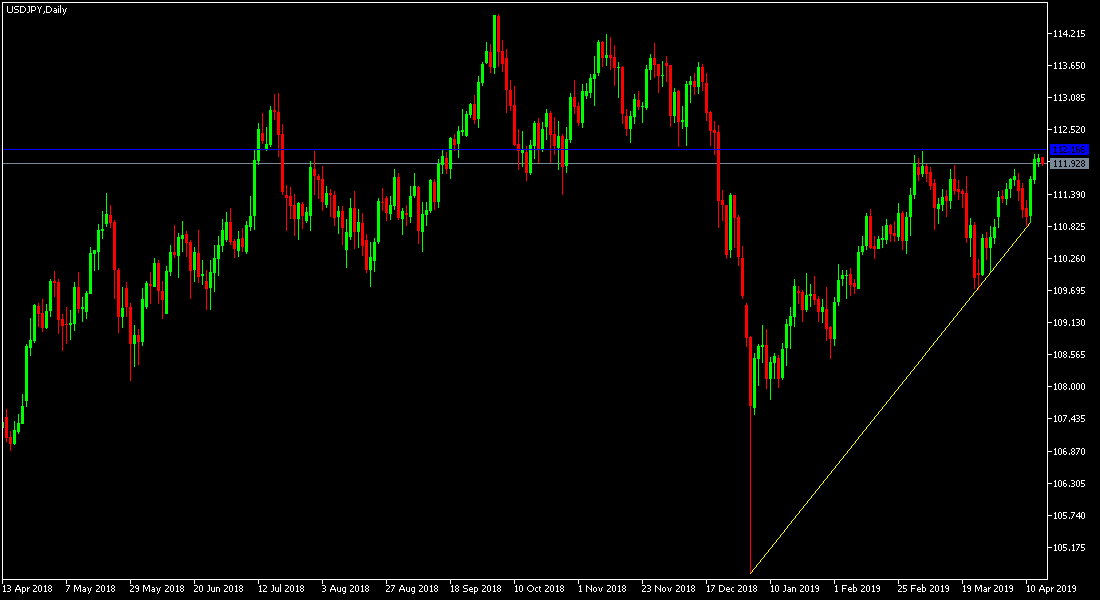

For three consecutive trading sessions, the USD/JPY pair is attempting to stabilize above the resistance level at 112.00. In light of the recent rally, gains didn’t exceed 112.09, the highest level in more than a month. Technical indicators give signals on overbought areas and that the pair at any time will start a downward correction with the selling and profit taking, as investors took risks and abandoned safe haven positions, led by the Japanese yen amid optimism that the agreement to end the trade war between the United States and China, coupled with positive US inflation figures - consumer prices, producer prices and a drop in jobless claims to a 50-year low –which was driving the dollar higher.

The US Federal Reserve, according to the minutes of its latest meeting, may keep interest rates unchanged for the rest of 2019. They would be patient if they thought of raising interest rates, raising expectations that if things worsened for the US economy, the bank might be forced to cut rates rather than raise them.

Overall, the trend remains bullish as long as the psychological resistance remains stable at 110.00. Although the results of US job numbers are mixed, the pair has the opportunity to rise supported by risk appetite and the weakness of the yen as safe heaven amid optimism over the proximity of the US-China trade deal to end the world's largest trade war that threatens the future of the global economy as a whole.

In contrast, as expected, the Japanese central bank kept its monetary policy unchanged with its negative interests, and despite the continuing US-China trade war and its negative impact on the performance of the Japanese economy, the bank has maintained its policy temporarily for the time being.

Technically: As we had previously predicted that the USD/JPY stability above the psychological resistance of 110.00 will increase the bullish momentum. Currently, the nearest resistance levels for the pair are 111.85, 112.60 and 114.00, respectively. On the downside, the nearest support levels are 110.90, 109.85 and 109.00 respectively. We still prefer to buy the pair from every bearish bounce.

In today's economic data: The economic calendar will focus on US industrial production data and the NAHB housing index. The pair will watch with caution and interest the renewed global geopolitical concerns and everything related to Trump's internal and external policy.