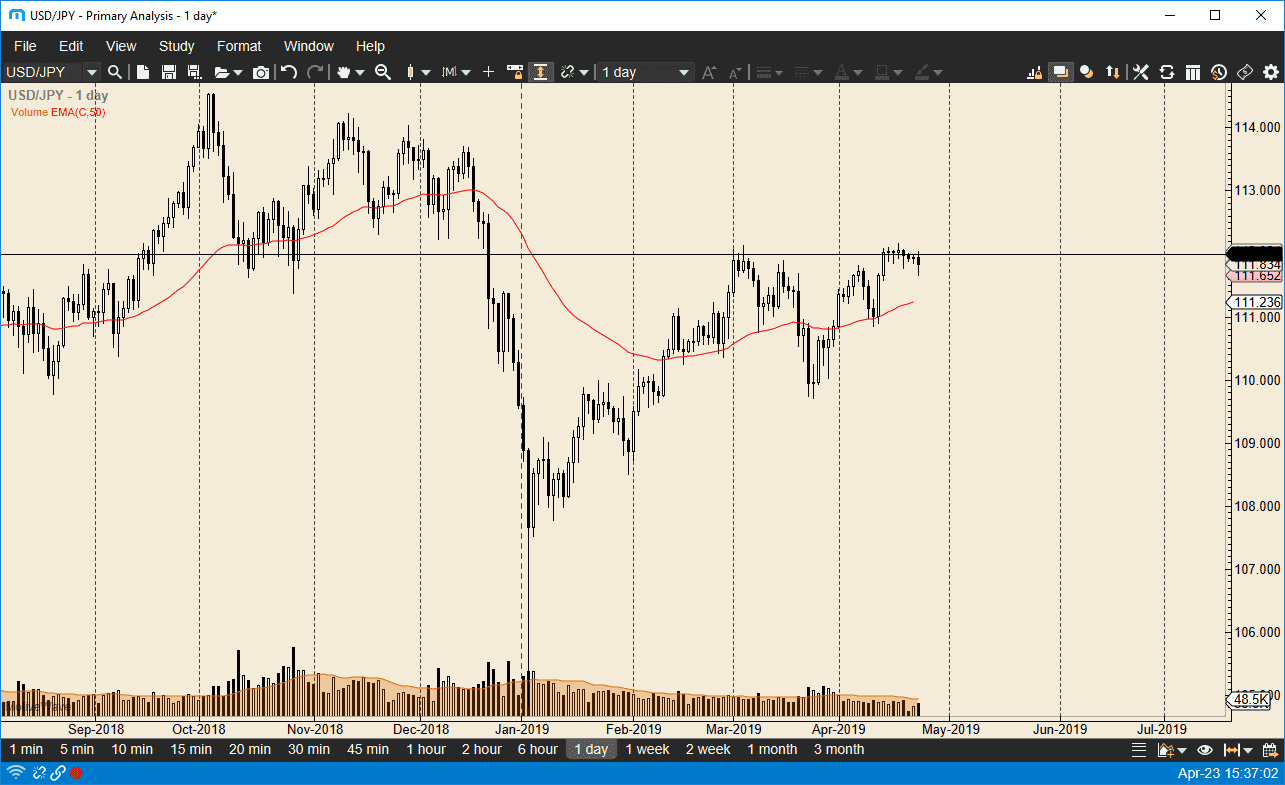

USD/JPY

The US dollar pulled back a bit during the trading session on Tuesday but found buyers again to turn around of form a bit of a hammer. What I do find crucial is that the ¥112 level continues offer resistance, and I think that if we can clear that level handily, and perhaps on a daily close, the market could go as high as the ¥113.50 level. Ultimately, this is a significant area of interest that needs to be paid attention to. To the downside, I see support at the ¥111 level, the ¥150 level, and perhaps even the 50 day EMA which is right in the middle. All things being equal, value is what you should think when this market pulls back as it has been so strong. Selling isn't even a thought currently, as the US dollar has done so well.

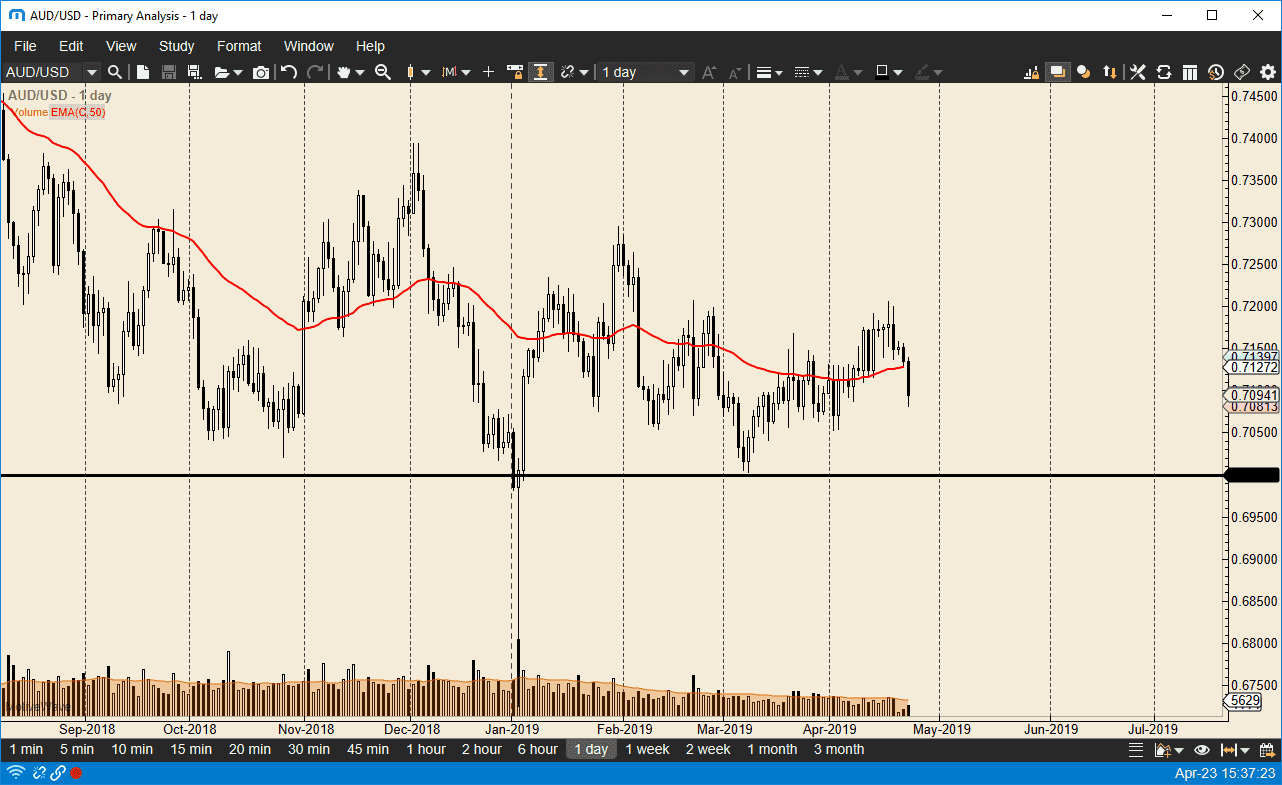

AUD/USD

The Australian dollar has fallen rather hard during trading on Tuesday, but I do believe that there is plenty of support just below to keep this market afloat. I have been buying this market on short-term dips for some time now, and I do think that it’s a market that can be taken advantage of in that sense. I don’t like the idea of shorting this market, but I don’t like the idea of buying and holding either. What I continue to do in this market is look at dips as value that I can take advantage of, and then bank 20 or 30 pips. This isn’t exactly the most exciting way to trade but being profitable doesn’t necessarily have to be exciting. The 0.70 level underneath is massive support that extends back years, so therefore it’s a great place to trade off of or near.