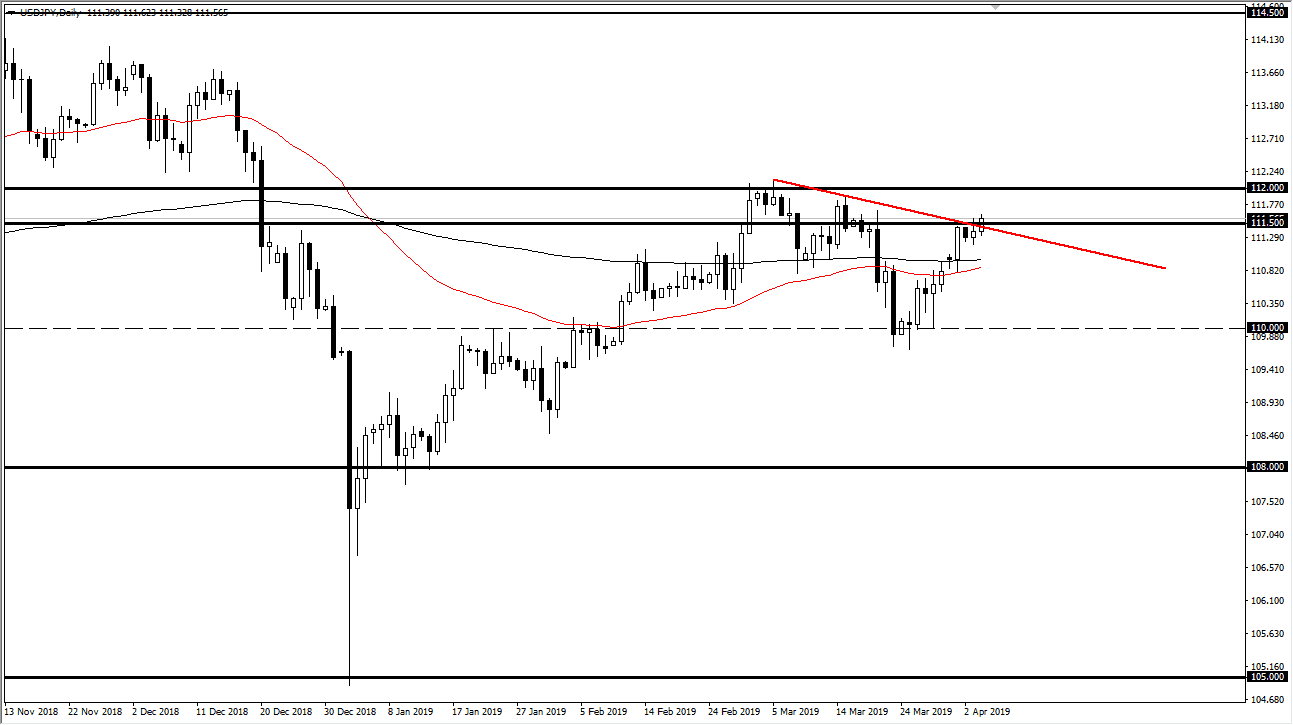

USD/JPY

The US dollar rallied a bit during the trading session on Thursday, breaking above the top of the Wednesday candle stick which of course is a very bullish sign but at this point we still have massive resistance extending from the ¥111.50 level to the ¥112 level. With that in mind and the fact that we have the jobs figure coming out during the day on Friday, it’s likely that we will have enough volatility that is going to be difficult to break out. However, if we do the market will probably go to the ¥113.50 level.

On the other side of the equation, we could drop down to the moving averages on the chart, or possibly even as low as the ¥110 level. In general though, this is a market that will continue to react right along with the stock markets and the risk appetite. With Friday being so crucial, expect a lot of noise but don’t be surprised if we end up going nowhere.

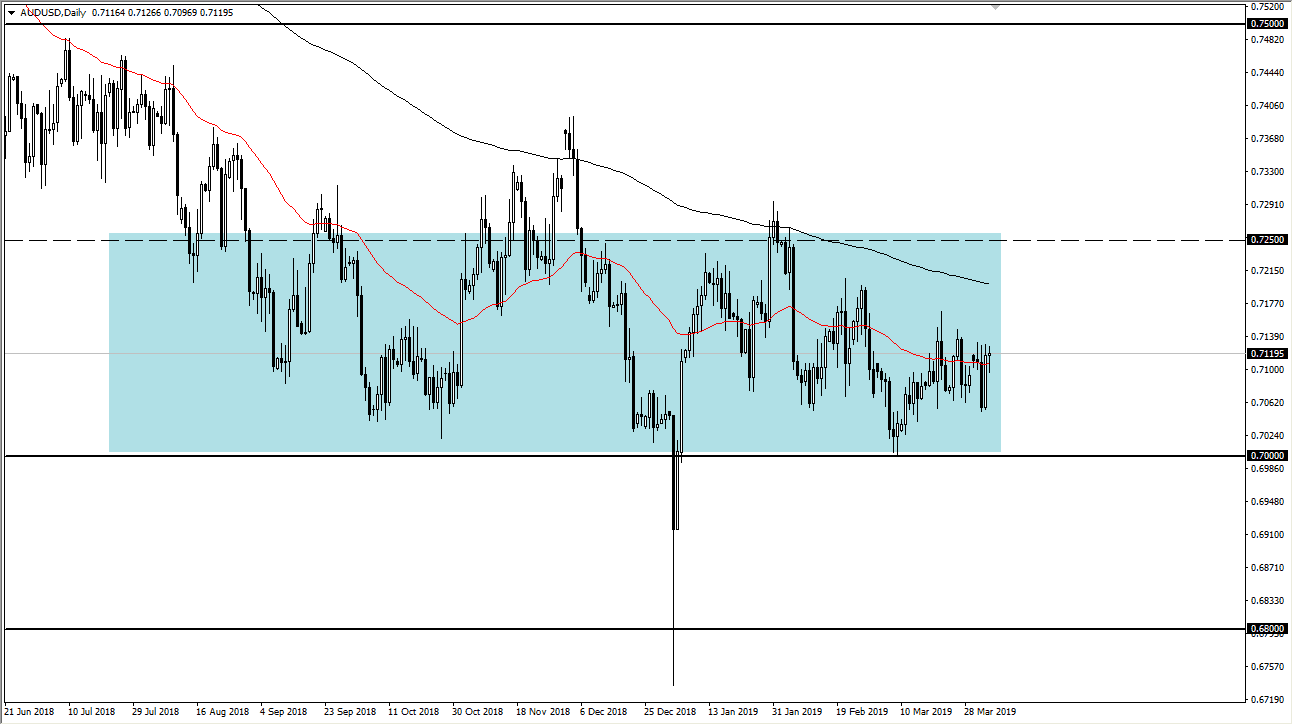

AUD/USD

The Australian dollar did very little during trading on Thursday which of course isn’t much of a surprise as we continue to get a lot of mix to headlines when it comes to the potential US/China trade deal. That being the case it’s going to continue to go back and forth but I think the most important thing to pay attention to is the fact that we have a massive support level underneath at the 0.70 level. With that in mind I like buying pullbacks that show value, and I have no interest in shorting the Aussie as we are at such important levels. That doesn’t mean will break out to the upside but I think that the short-term buying on the dips continues to work.