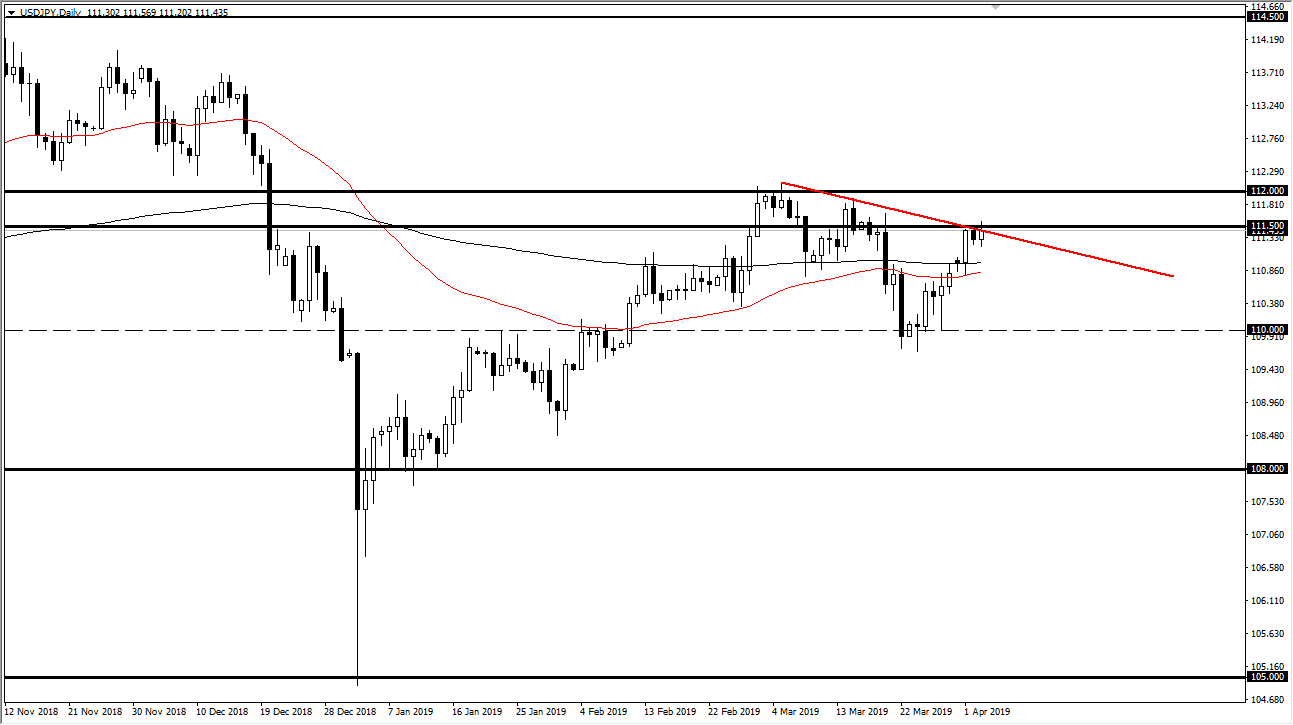

USD/JPY

The US dollar continues to go back and forth against the Japanese yen in an area that is massive resistance. That being the case, it looks as if we are running out of steam, and it’s likely that we could get a pullback based upon a short-term downtrend line, and of course the massive resistance at the ¥111.50 level. This resistance extends all the way to the ¥112 level, so it’s going to be very difficult to continue to go higher. The stock markets look a little iffy as well, so it’s possible we are going to see a pullback in this pair.

The 50 day EMA pictured in red is sitting below the 200 day EMA pictured in black, right around the ¥110.75 level. That will be short-term support, but I think at this point we are probably more likely to bounce between current levels and the ¥110 level underneath.

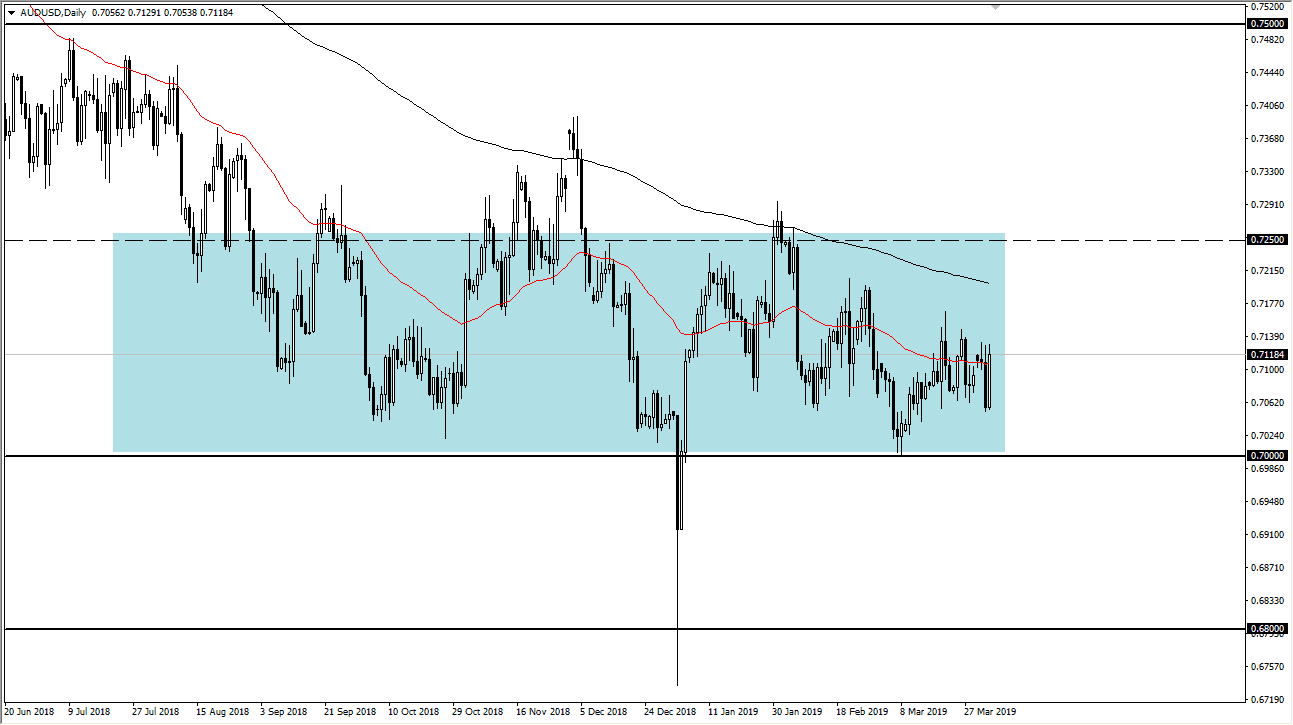

AUD/USD

The Australian dollar rallied rather significantly during trading on Wednesday as early traders in Asia got wind that perhaps the US and China are getting closer to an eminent trade deal which of course would be good for the Aussie dollar itself. Remember, Australia is a major supplier of raw materials to China, and if the Chinese start cranking up exports, that will bring the demand for the Australian dollar as they will be buying copper, iron, and the like from the Aussies.

On the other side of the equation you have the Federal Reserve that is very soft so it makes sense that we continue to see the pair struggle to break down below the massive support level that starts at the 0.70 level. That support extends down to the 0.68 handle.