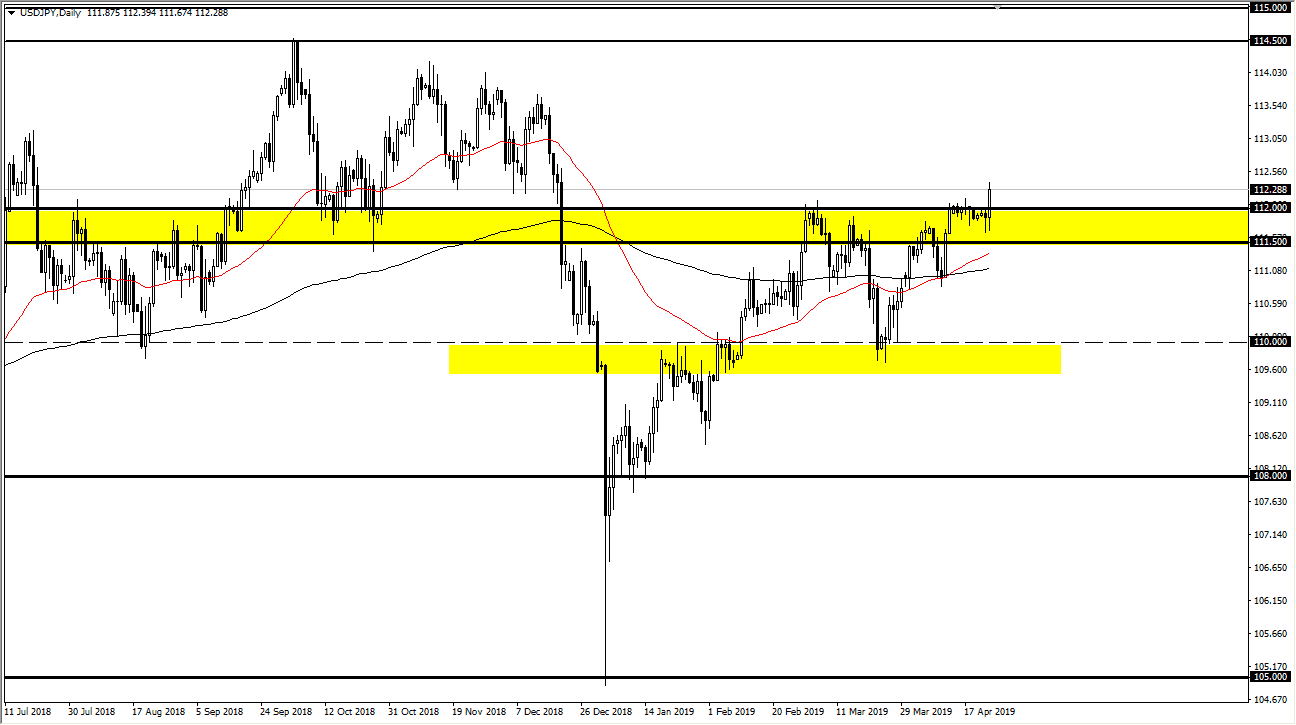

USD/JPY

The US dollar initially pulled back against the Japanese yen but then broke out to the upside. The US dollar has been strengthening in against most currencies around the world, so it makes sense that we see this pair finally break out. The ¥112 level is massive resistance, and it looks like we can continue to go much higher, perhaps the ¥113.50 level. Look at short-term pullbacks as potential buying opportunities, this is a market that could continue to grind higher. I would expect fireworks though; we are simply trying to go to the upside and reach higher. The ¥111.50 level underneath should be a bit of a “floor” in the market. The market suddenly looks very bullish, so if you are patient enough you should be able to pick up value.

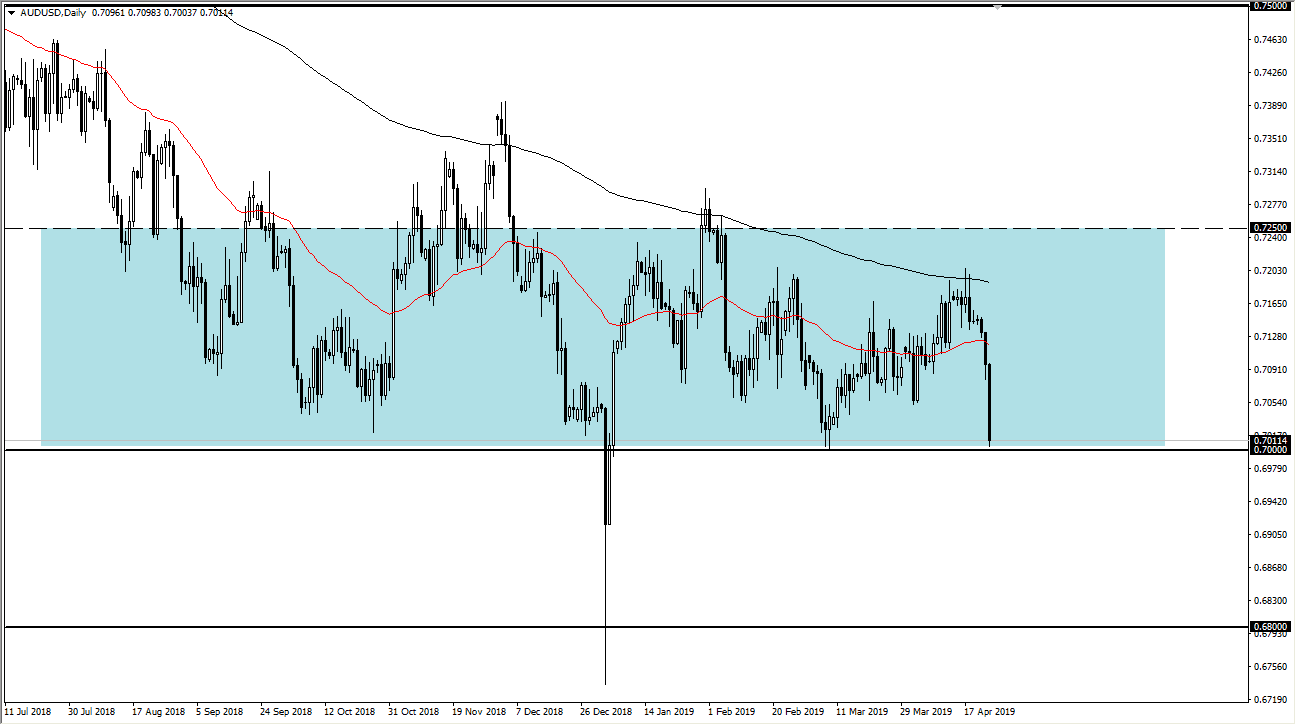

AUD/USD

The Australian dollar has fallen rather hard against the US dollar, reaching down to the 0.70 level again. That is an area where we have seen buyers previously, so a bounce could happen but the US dollar has been strengthen against so many other currencies, that it is going to be difficult for this market to bounce without some type of recovery and other places like the Euro and the British pound. Since they have broken down significantly, it’s very likely that we will see this market struggle to rally. However, the 0.70 level is massive support extending down to the 0.68 level, which even shows up on the monthly charts. It will be interesting to see if we can rally from here, but I would wait to see some type of supportive candle or an impulsive candle to the upside before start buying. This far as shorting is concerned, if you wish to buy the US dollar, you might want to do it against other currencies.