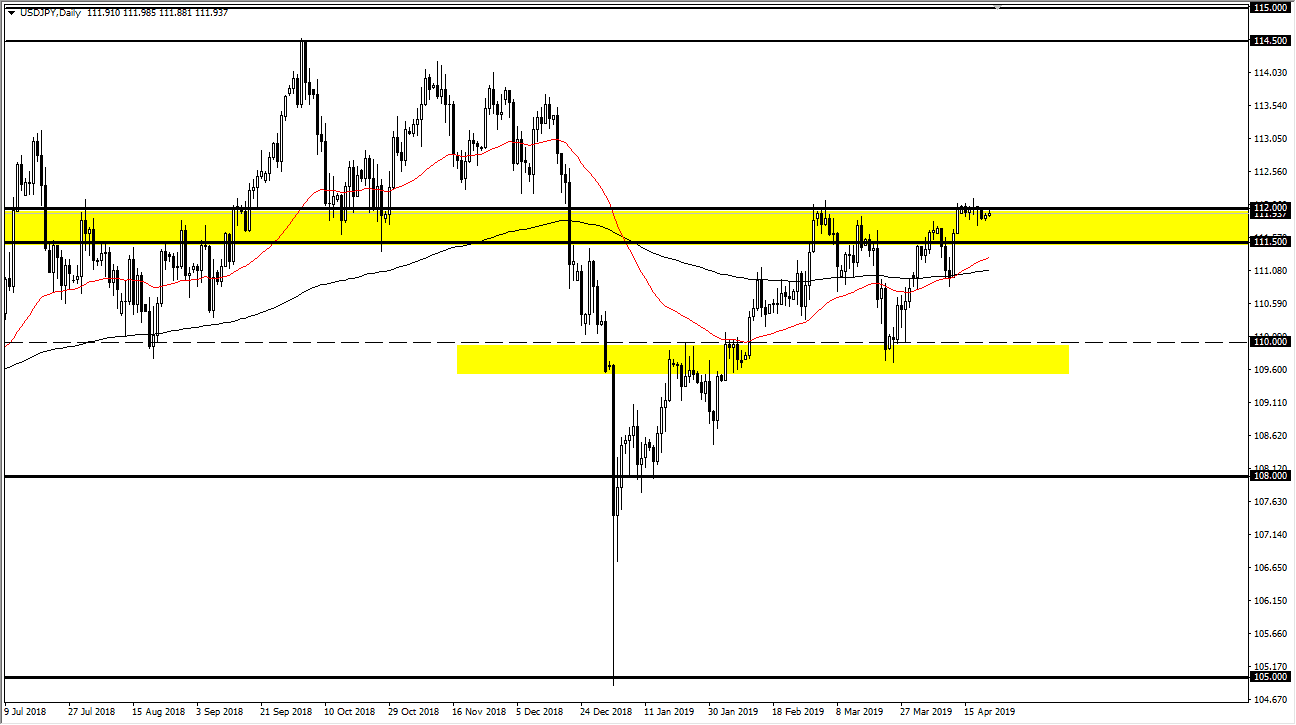

USD/JPY

The US dollar continues to go sideways and nowhere against the Japanese yen, mimicking the action in the S&P 500. We simply have no catalyst to go higher in either market, or as one goes, the other will probably follow. If we can get a daily close above the ¥112.25 level, then I believe that the US dollar can reach towards the ¥113.50 level. To the other side, the ¥111.50 level looks to be rather supportive, just as the ¥111 level is. In the meantime, we're probably just going to simply go back and forth as there is nowhere to go in the short term.

Beyond that, the Europeans were celebrating Eastern Monday, so there would have been a lack of liquidity in general. Ultimately, this is a market that is more or less in a “wait-and-see mode”, just as we were last week.

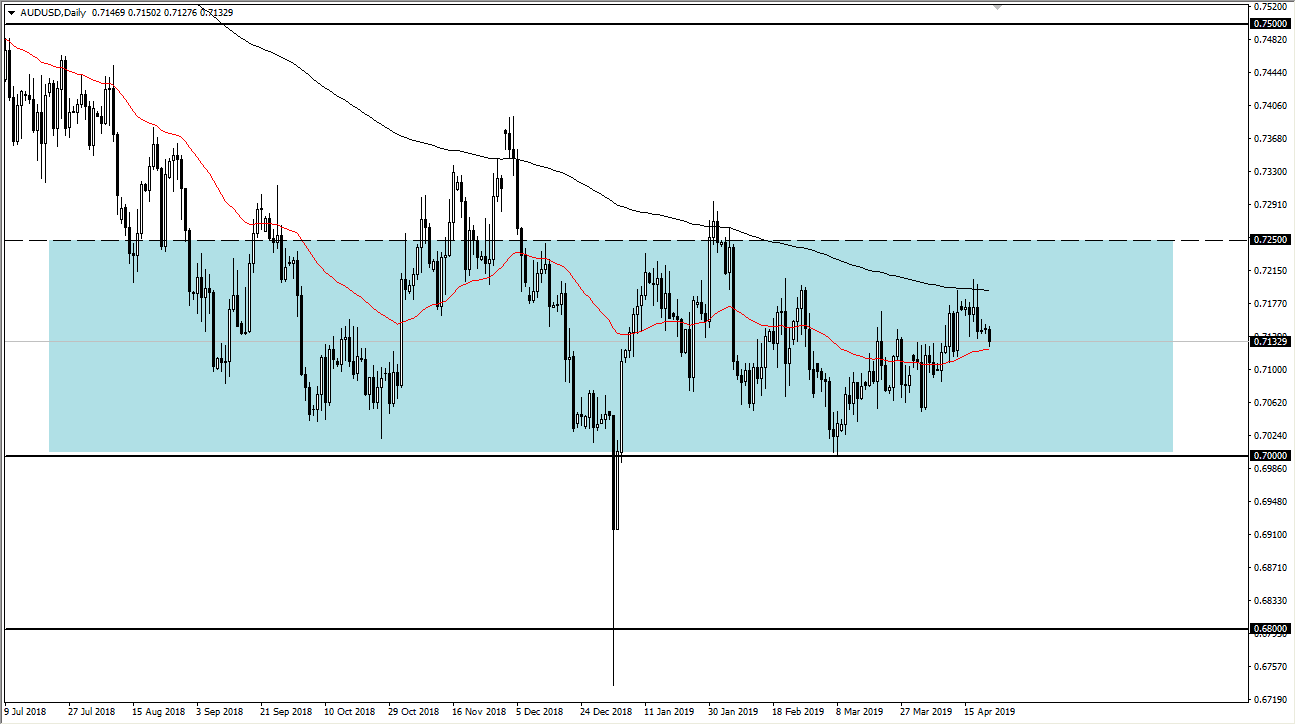

AUD/USD

The Australian dollar fell just a bit during the trading session on Monday, testing the 50 day EMA but bouncing slightly from that level. Overall, it would be more interesting to buy this market if we could drop a little bit further, but I have no interest in shorting in the meantime. The 0.70 level underneath is massive support, and it should continue to attract a lot of buying pressure. To the upside, the 200 day EMA which is pictured in black could cause a bit of resistance.

Keep in mind that the Australian dollar is a bit of a proxy for the Chinese economy, so it will be interesting to see how that plays out in its relation as well. Remember, we have the trade negotiations going on between the Americans and the Chinese which of course can have an effect as well. Either way, I have no interest in shorting and I’m looking to buy short-term pullbacks show signs of a bounce. Beyond that though, I’m not holding onto a trade quite yet because I don’t think we’re going to go drastically higher.