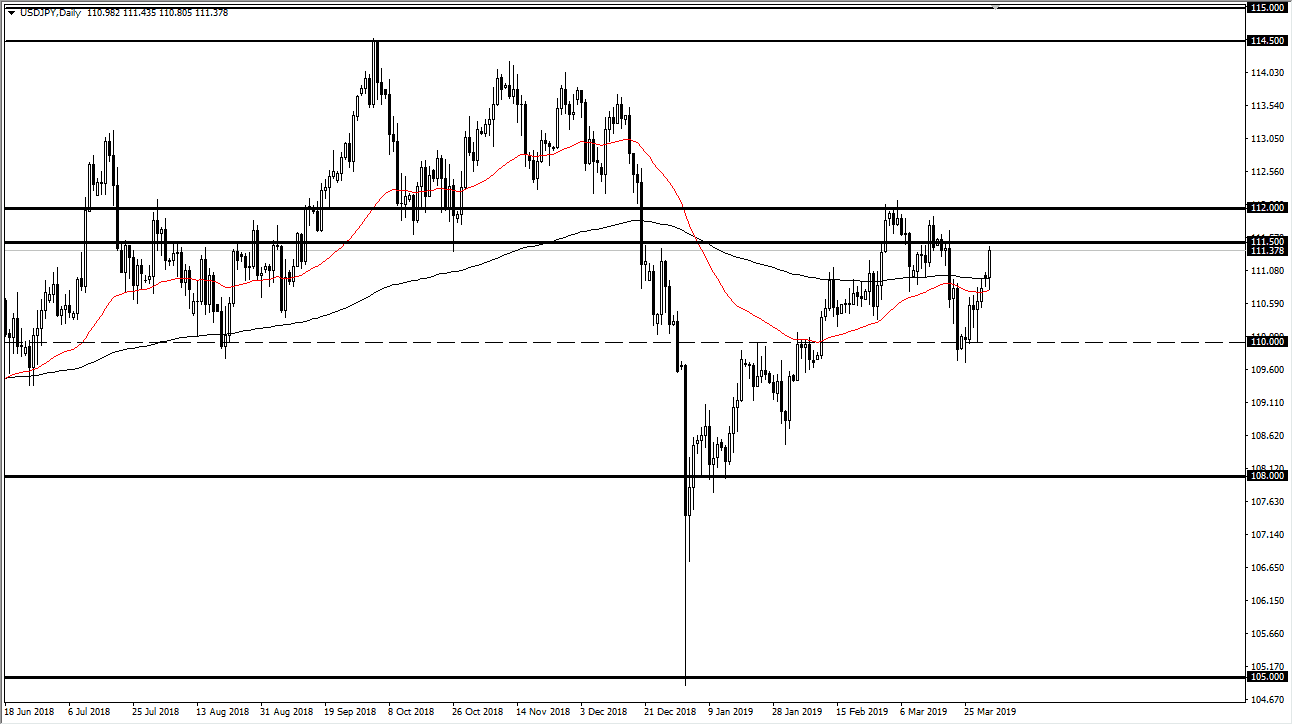

USD/JPY

The US dollar has rallied a bit during the trading session against the Japanese yen, slamming into the ¥111.50 level. This is the beginning of significant resistance all the way to the ¥112 level, and therefore it looks like we are ready to roll over from this point. However, if we break above the ¥112 level, then the market probably goes looking towards the ¥113.50 level. To the downside, I suspect that we are going to go looking towards the ¥110.50 level area, as we continue to bounce around in this overall consolidation area. Expect a lot of choppiness and noise, but at this point I think the one thing that we don’t have as much in the way of conviction either way. However, that day is coming in as soon as we break out of this area and should be a pretty big move. In the short term, we are probably going to continue to bounce around in this range.

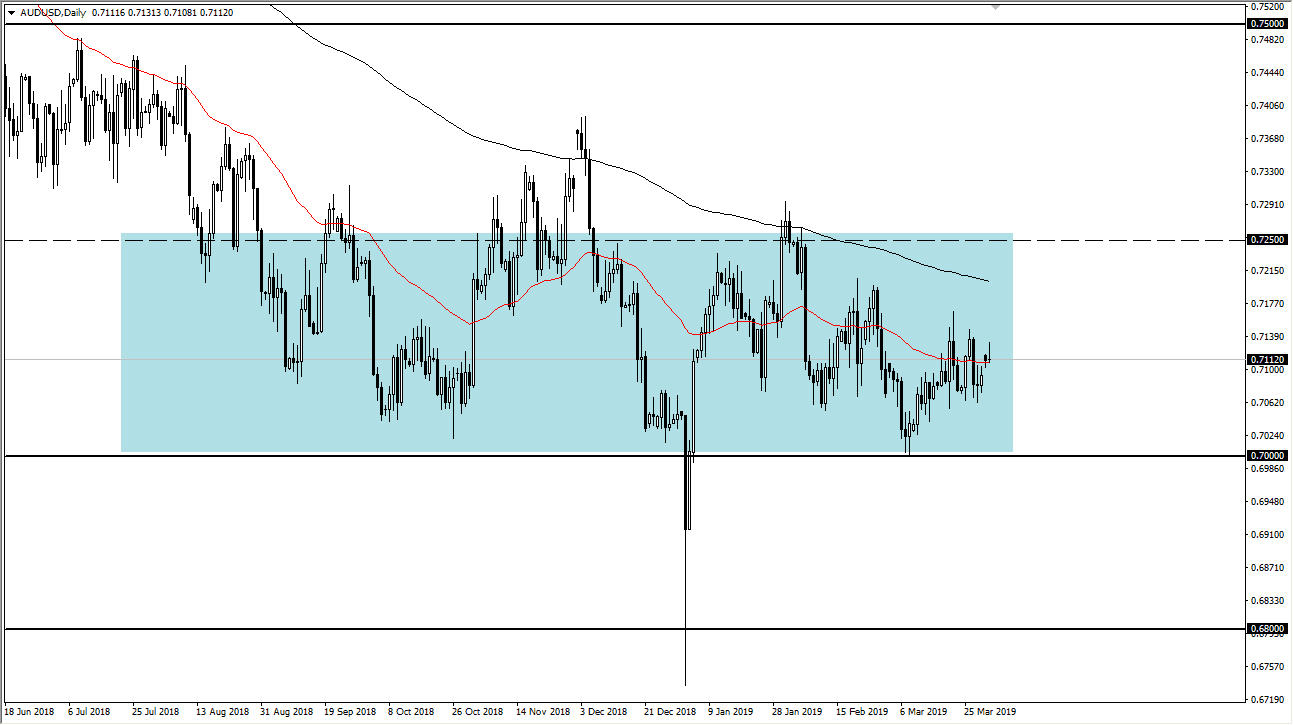

AUD/USD

The Australian dollar gapped higher at the open on Monday but found enough resistance to turn things back around and form a bit of a shooting star. Nonetheless, I still like the idea of buying dips in this market, as we have seen so much in the way of support below at the 0.70 level. I think at this point it’s likely that the market will continue to find plenty of value on these dips as the market continues to try to build a base for a longer-term move. The US/China trade relations continue to play a major factor in whether or not the Australian dollar can get legs, which it looks like it’s trying to.