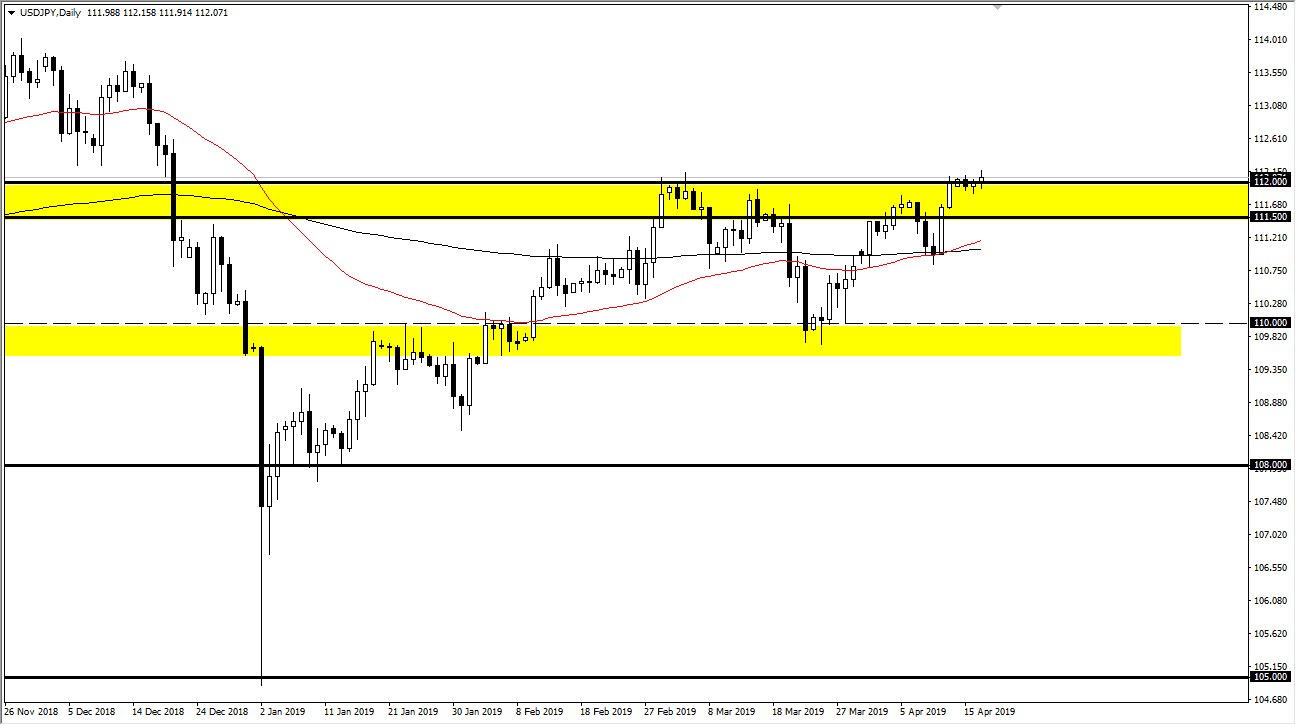

USD/JPY

The US dollar went back and forth against the Japanese yen during trading on Wednesday, as we continue to juggle around the ¥112 level. This is an area that has been difficult to crack, and at this point we have shown a little bit more of a proclivity to go higher but if we can break above the highs of the Wednesday session, we could go much higher. I think at this point there is a thick “layer of support” that extends down to the ¥111.50 level

Keep in mind that this market continues to model risk appetite, which is all over the place right now. Quite frankly there’s a lack of volume and many other markets so I would assume that there is a lack of volume here. If we can break above the highs though, then we could go to the ¥113.50 level. To the downside, I believe there is support not only at the ¥111.50 level but also at the moving averages below there.

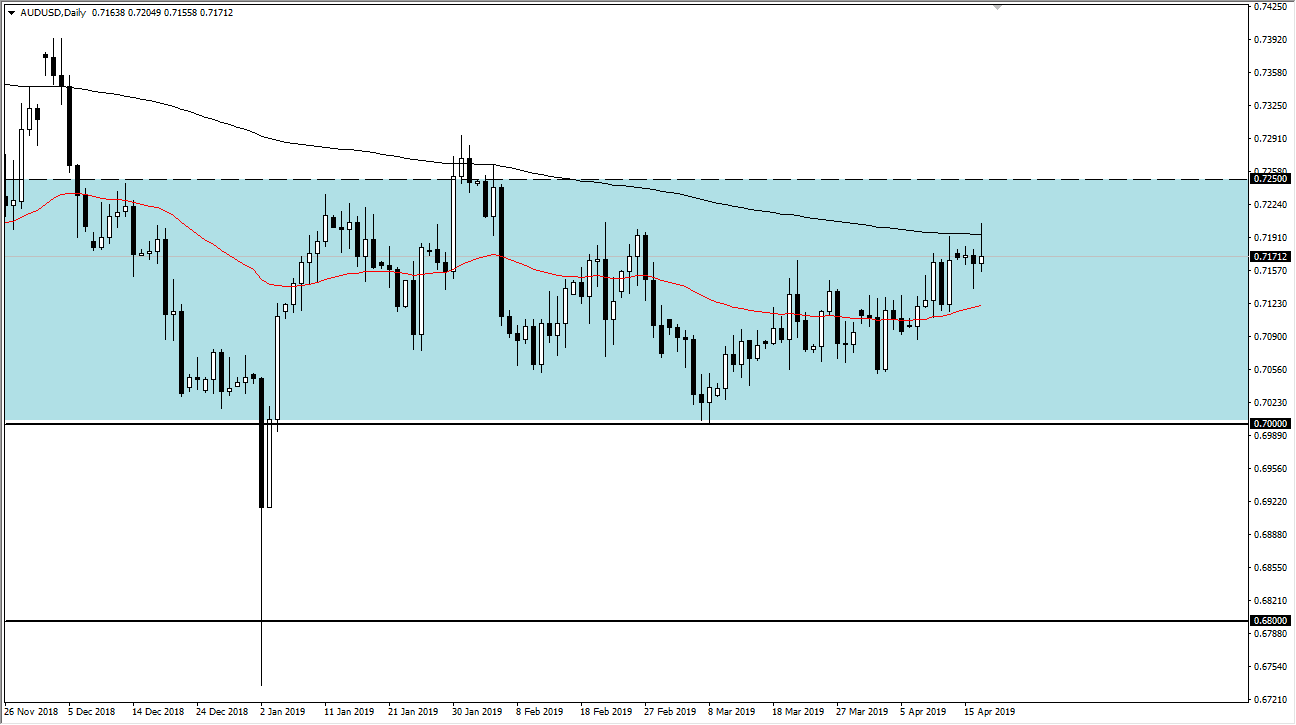

AUD/USD

The Australian dollar initially tried to rally during the trading session but found the 200 day moving average to be a bit resistive to overcome. At this point, we are forming a bit of a shooting star which is preceded by a hammer. That hammer of course is supportive but at the end of the day the one thing that I’m paying attention to is that we are gradually moving higher. The 50 day moving average is starting to turn higher, so I think it’s only a matter time before the buyers get involved, so I am a buyer of value in this market. I believe the 0.70 level underneath is massive support, and at this point I do not think it gets broken.