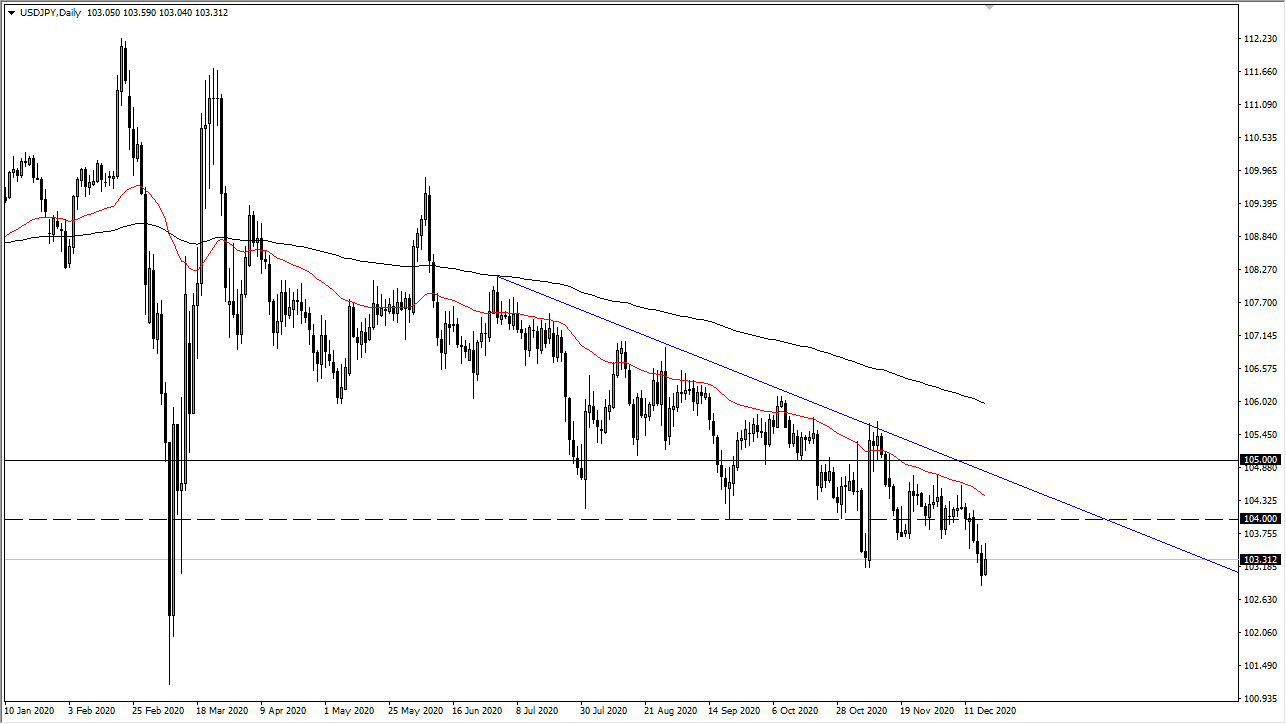

USD/JPY

The US dollar initially fell during trading on Tuesday but found buyers underneath the turnaround of form a bit of a hammer shaped candle. We are pressing the ¥112 level yet again, and this is an area where we continue to struggle. However, there is obvious support underneath, so pullbacks at this point should offer buying opportunities for short-term traders. I would not get overly attached to any position though, because we obviously have struggled to break out. That being said, if we break above the ¥112.25 level, then I think we could make a serious push towards the ¥113.50 level. To the downside, the ¥111.50 level should offer support from what I have seen as of late. It is not until we break down through the moving averages that I would entertain the idea of shorting this market.

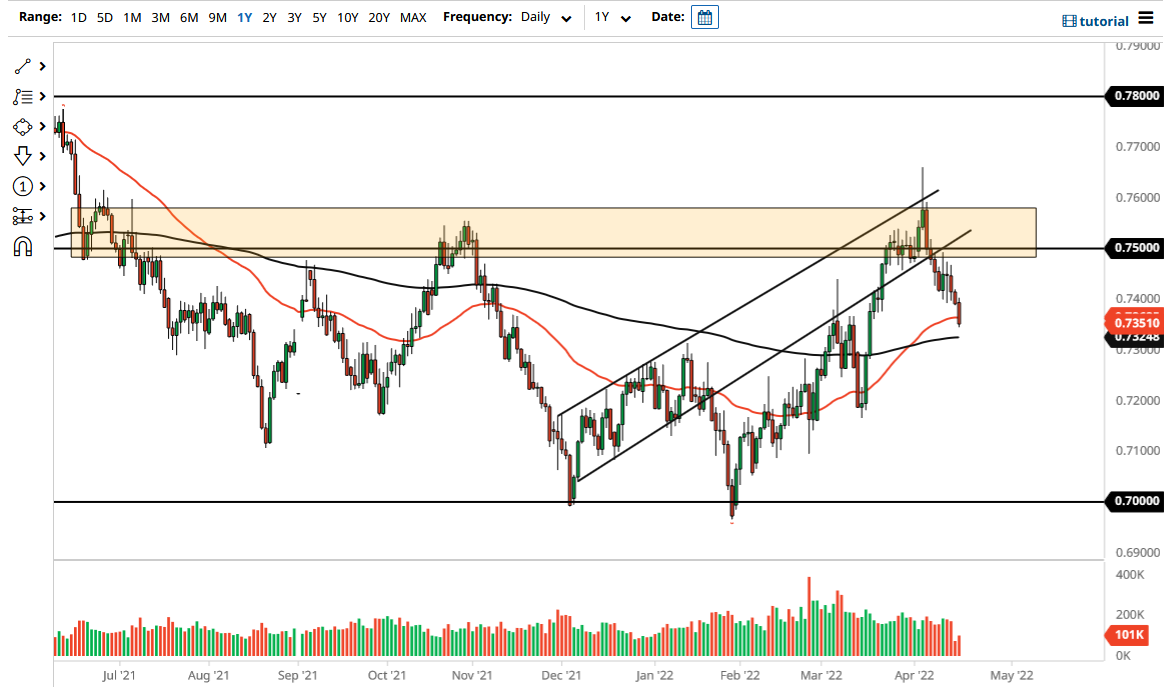

AUD/USD

The Australian dollar initially fell during trading on Tuesday but found enough support just above the 50 day EMA to turn around and form a bit of a hammer. The hammer of course is a bullish sign and it looks as if the buyers are willing to jump in to pick this market back up. Ultimately, this is a market that I think will continue to be choppy but in the end it’s very likely that we are going to see a bit of value hunting on these dips, as the Australian dollar is highly levered to the Chinese economy, and by extension the US/China trade situation. As of late, we have seen a lot of stimulus thrown at the Chinese economy and the Australian dollar could very well benefit from that as well. I have no interest in shorting as I recognize the “hard floor” in this market to be close to the 0.70 level.