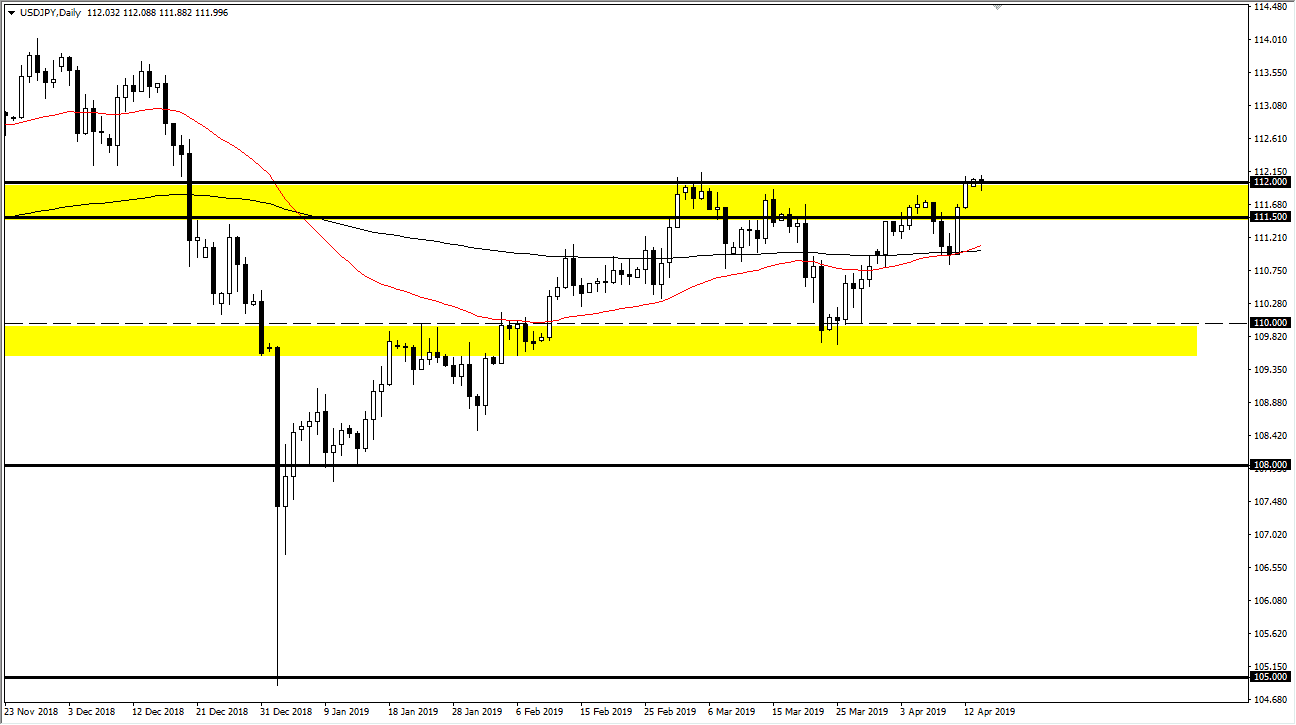

USD/JPY

The US dollar went back and forth against the Japanese yen in a relatively quiet trading on Monday. The market continues to struggle with the idea of where to go next, and that’s a good proxy for what we are seeing around the world right now: mass confusion. Remember, while the US dollar is considered to be a so-called “safety currencies”, in this particular case it’s not as the Japanese yen is considered to be even more of a safety currency.

As the S&P 500 continues to flirt with all-time highs, we now are watching the USD/JPY pair hanging around this area as it’s trying to break out. If we can finally break out from here, perhaps breaking the ¥112.20 level, then I think it opens the door to the ¥113.50 level. Otherwise, there will probably be buyers on dips.

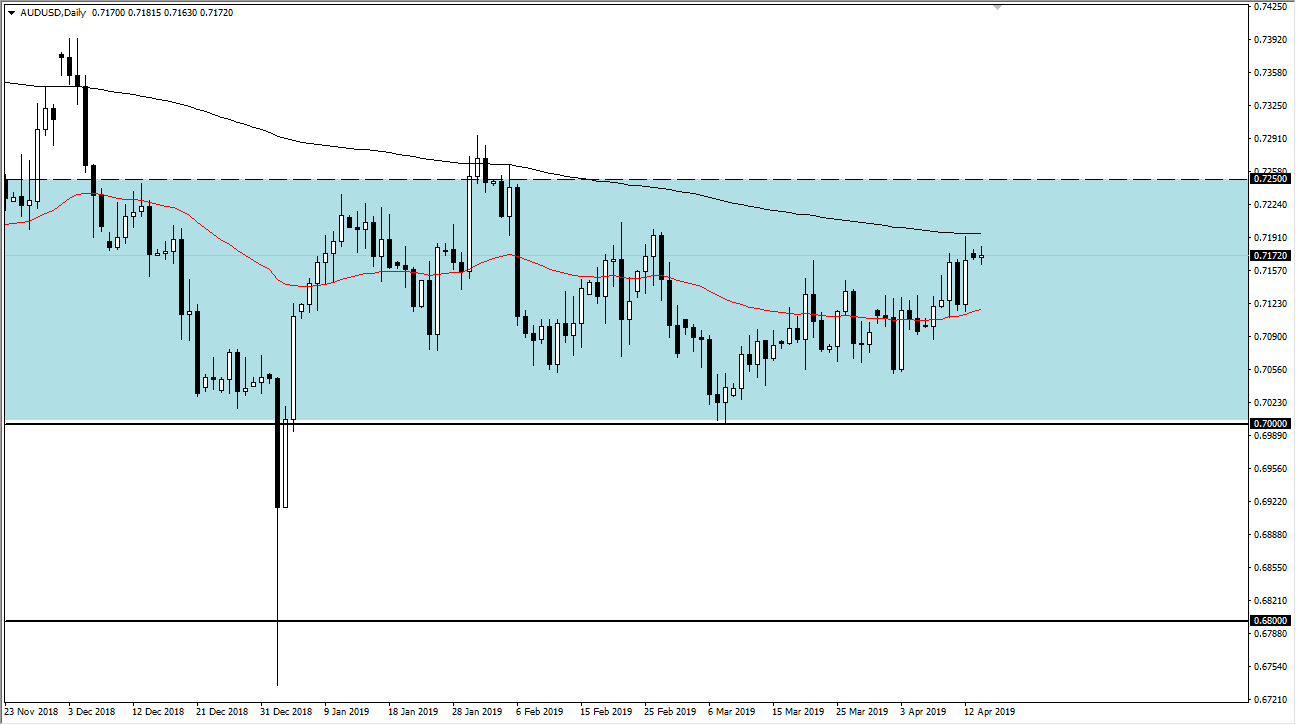

AUD/USD

The Australian dollar went to sleep during the Monday session and never really quite woke up. We are currently trading below the 200 day EMA, and therefore it’s likely that we just drift a little bit lower. The 50 day EMA is down near the 0.7110 level but is turning up. Because of this, I like the idea of buying dips which of course has been the way I’ve been trading this for some time. We have made a little bit of a higher high as of late, so that shows just how much bullish pressure there is under this market.

As I have been saying for some time, it looks as if the 0.70 level underneath is massive support that extends all the way down to the 0.68 level. At this point, this is a market that seems to be a bit of a “one way bet”, but I also recognize that the occasional pullback may occur. It is because of this that I am patiently waiting for value on dips.