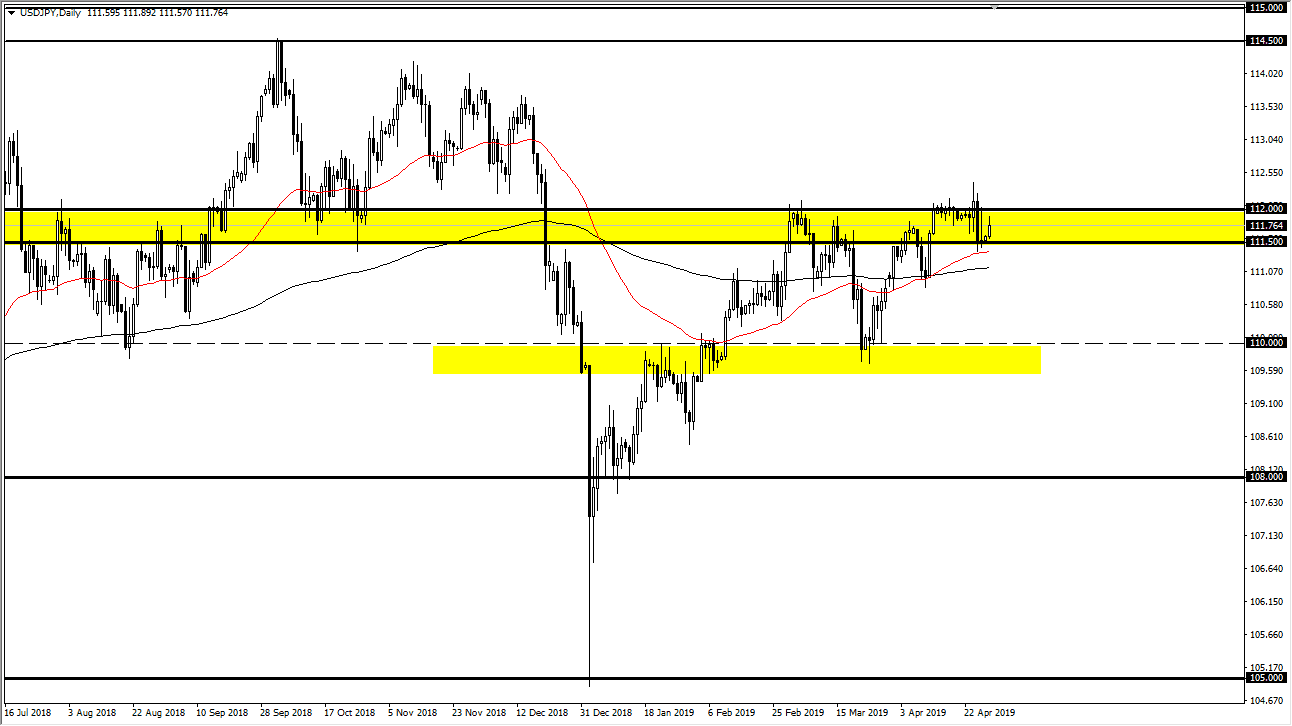

USD/JPY

The US dollar rallied a bit during the trading session on Monday to kick off the week, but as you can see we are still stuck in the same region. The ¥112 level above is significant resistance that extends to the ¥112.50 level. Underneath, I see the ¥111.50 level as support, so it’s very possible that we will simply continue to bounce around in this general vicinity. The 50 day EMA is just below, so we could experience a bit of support underneath. Ultimately, I do think that the market is trying to build up enough momentum to break down, but it’s going to take a certain amount of momentum building to make it happen. If we do break down below the 200 day EMA, which is basically the ¥111 level, then it opens the door to the ¥110 level. However, if we break out to the upside which I believe is much more likely, we could be seeing this market reach towards the ¥113.50 level.

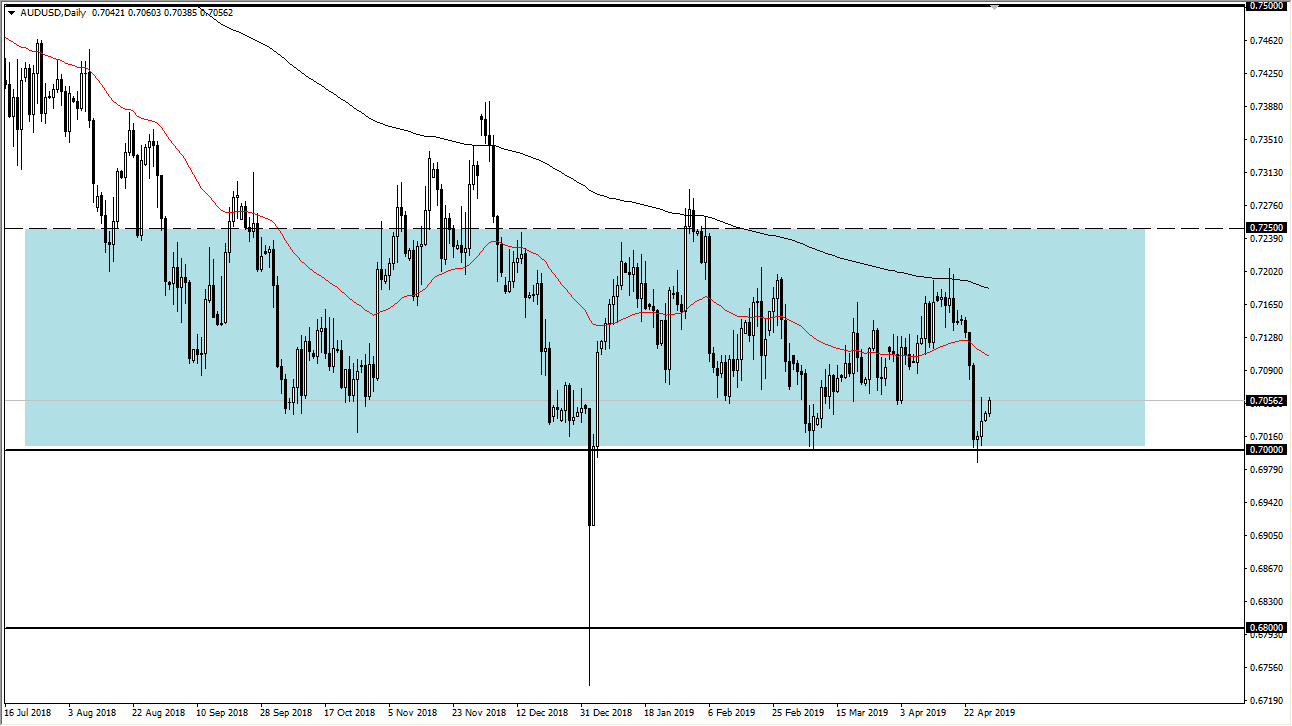

AUD/USD

The Australian dollar continues to rally, testing the highs of Friday. Now that we are breaking above there it’s very likely that the Australian dollar will continue to see plenty of buying pressure as not only are we breaking the top of the long wick, but we are also reevaluating the 0.70 level as a bit of a “floor.” If that’s the reality, then it’s very likely that we will continue to see buyers on these pullbacks. The support level underneath extends all the way down to the 0.68 handle, so it’s going to be very difficult to continue to break down.

To the upside I believe that the market will probably make a run towards the 0.7125 handle, possibly even the 0.72 level after that. If the US dollar does start to strengthen around the world, I will not be shorting this market as it will simply be much more difficult to break down than many of the other currency pairs.