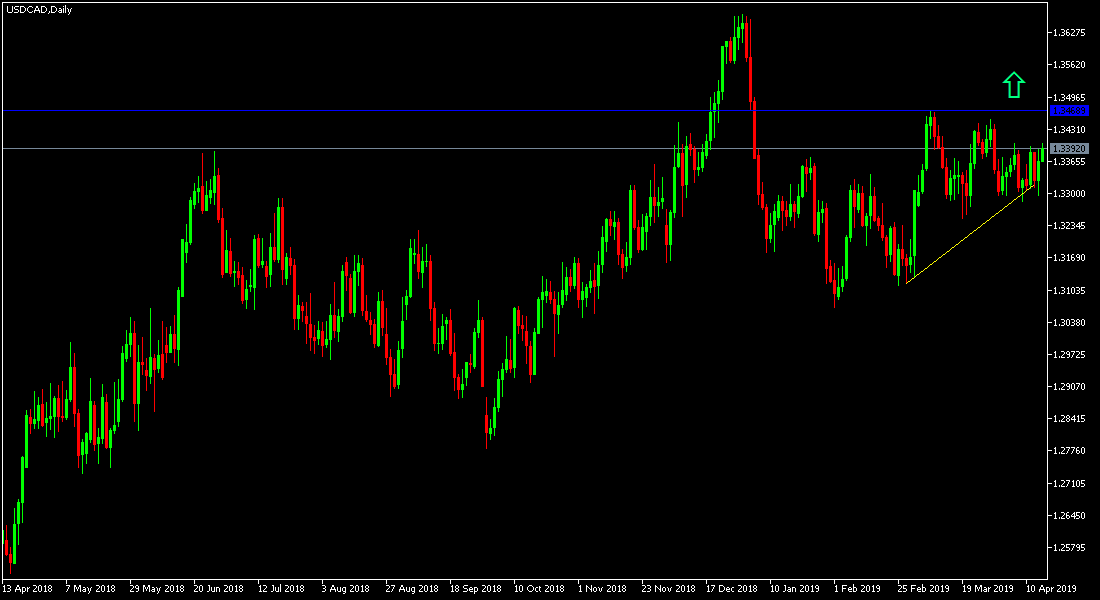

For the second day in a row, the USD/CAD pair is turning up to the resistance level at 1.3402 at the time of writing, after a recent bearish correction that pushed the pair towards the support level of 1.3296, as the recent global oil price rebound boosted the gains of the Canadian dollar. As we have predicted in previous analyzes, we now confirm that the pair's stability above 1.30 still confirms the continuation of the pair's bullish trend. Its gains will monitor the Canadian industrial goods sales data, Canadian bond purchases and US industrial output and NAHB housing index.

The Bank of Canada is still in a pessimistic position and may freeze interest rates until 2020. The Bank of Canada's lack of activity may affect the Canadian dollar as the prospect of higher interest rates will make the Canadian currency more attractive to investors. Last week, the IMF cut economic forecasts around the world, and Canada wasn’t an exception, as the IMF cut its forecast for Canadian economic growth from 1.9% to 1.5%. Canada would be one of the main beneficiaries if the United States and China could reach an agreement and end their fierce trade war, the report said. The IMF also lowered its forecast for global economic growth, from 3.5% to 3.3%.

There was positive news on the US inflation front last week, with key indexes rising in March. The CPI, the main gauge of consumer spending, rose to 0.4%, its highest since January 2018. The PPI also showed a strong rise, rising 0.6%, the highest level in 5 months. Inflation remains well below the Fed's 2.0% target, but stronger inflation figures will strengthen the situation of Federal Reserve officials who prefer to raise interest rates in 2019 if economic prospects improve. The minutes of the Fed from the March meeting left the door open for further interest rate hikes this year, but current market pricing does not signal any increase in US interest rates until 2020, and some analysts expect interest rate cuts later this year.

The most important support levels for the USD/CAD today: 1.3345, 1.3270 and 1.3190, respectively.