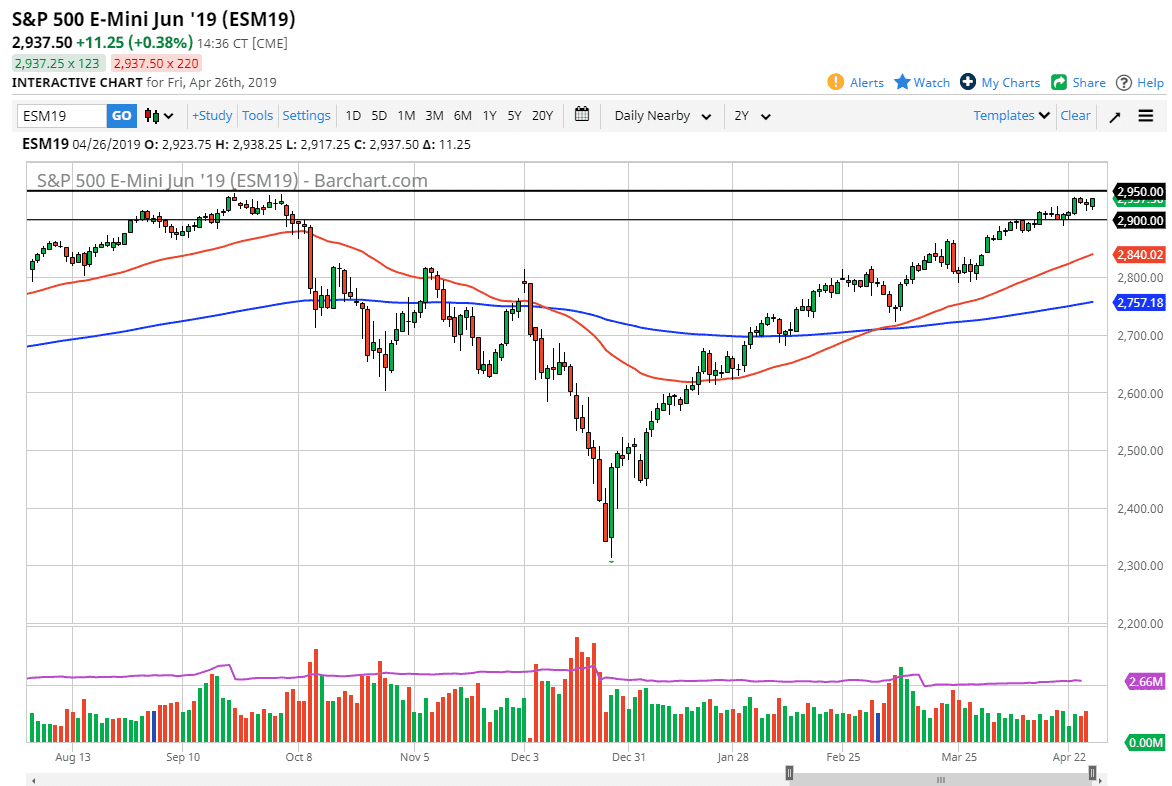

S&P 500

The S&P 500 rallied a bit during the trading session on Friday to close out the week, as we continue to grind sideways in a relatively tight area. At this point, it looks as if the 2950 level above is going to continue to offer significant resistance, just as the 2890 level that extends to the 2900 level looks to be very supportive. Ultimately, we are in the middle of earnings season so that of course has a great influence on what happens next.

All things being equal, we are in and uptrend so a break out to the upside feels much easier to take that a break down to the down, so hopefully we will get that opportunity. Short-term pullbacks continue to be buying opportunities and value in the S&P 500. This is a market that continues to grind right past plenty of global issues.

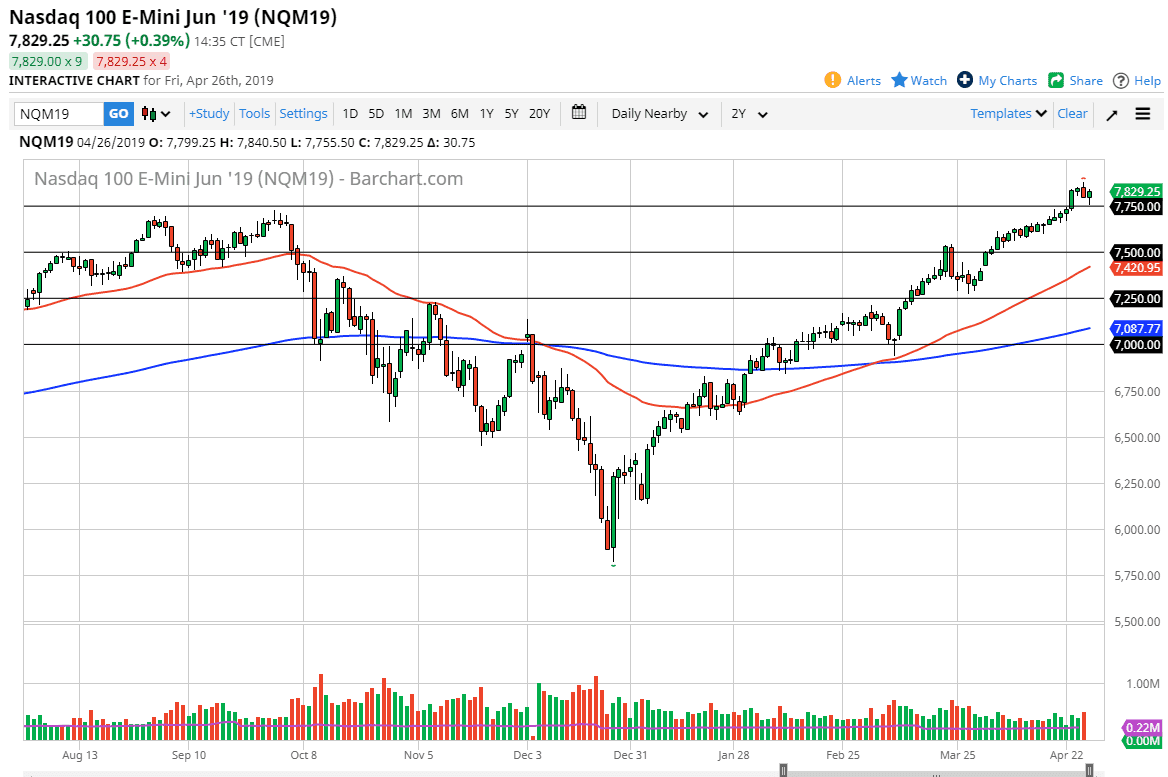

NASDAQ 100

The NASDAQ 100 initially pulled back during the trading session on Friday, but has found plenty of support at the psychologically and structurally important 7750 level. At this point in time it looks like the buyers are going to continue to find value underneath. The NASDAQ 100 of course will be influenced by the big players out there, as per usual. We are in and uptrend so it’s difficult to sell this market, but if we broke down below the 7700 level, it’s possible that we could drift down towards the 7500 level.

If we were to break down below the 7500 level, then that could change a lot of things but I would need to see a general “risk off” situation to get involved in shorting this index, as although it looks a bit overbought, the reality is that it’s hard to kill a bull.