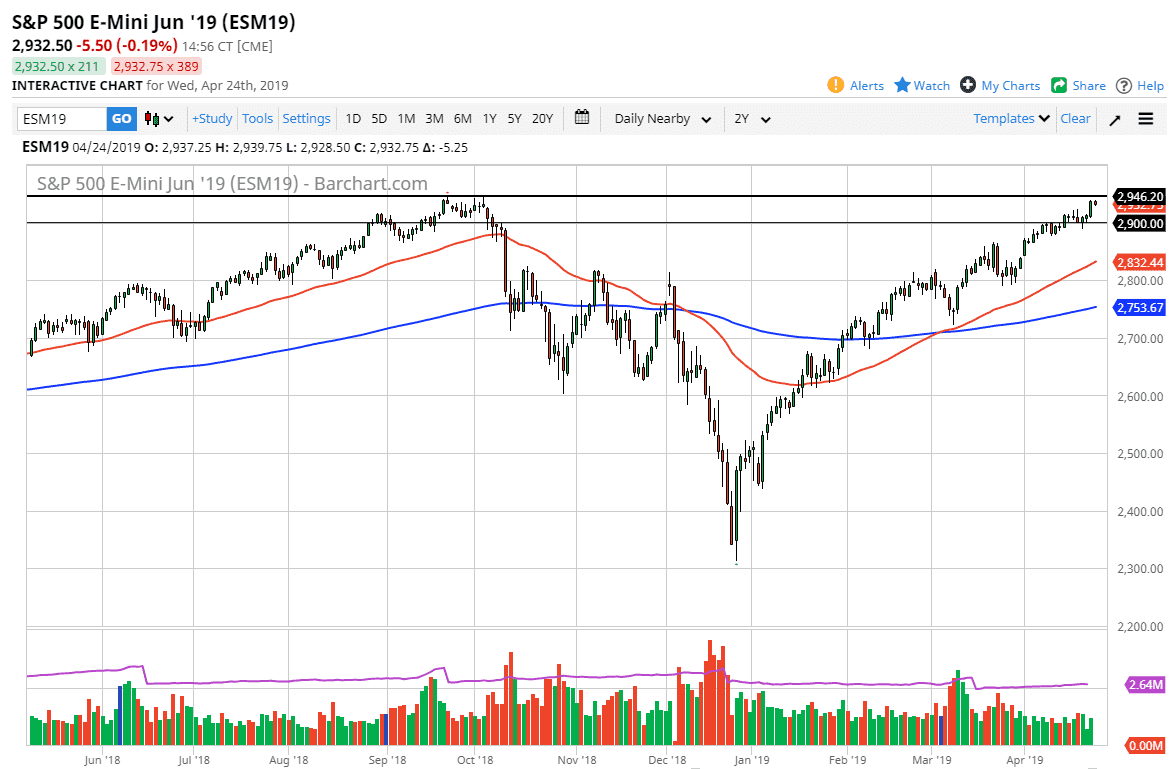

S&P 500

The S&P 500 pulled back a bit during the trading session on Wednesday, as we approached very high levels. At this point, the 2950 level above should be massive resistance, and I think at this point it’s very likely that a pullback will offer value. The 2900 level underneath is support, so it would make sense to find value hunters and longer-term traders looking for lower pricing. At this extreme overbought condition, we may need to consolidate a bit to build up the necessary momentum. The earnings season is in full bore, so that of course will continue to throw this market around. What is starting to change those the fact that the US dollar has strengthened quite drastically. If that keeps up, it may weigh upon stocks. Regardless though, I think that longer-term traders are trying to get to the 3000 handle.

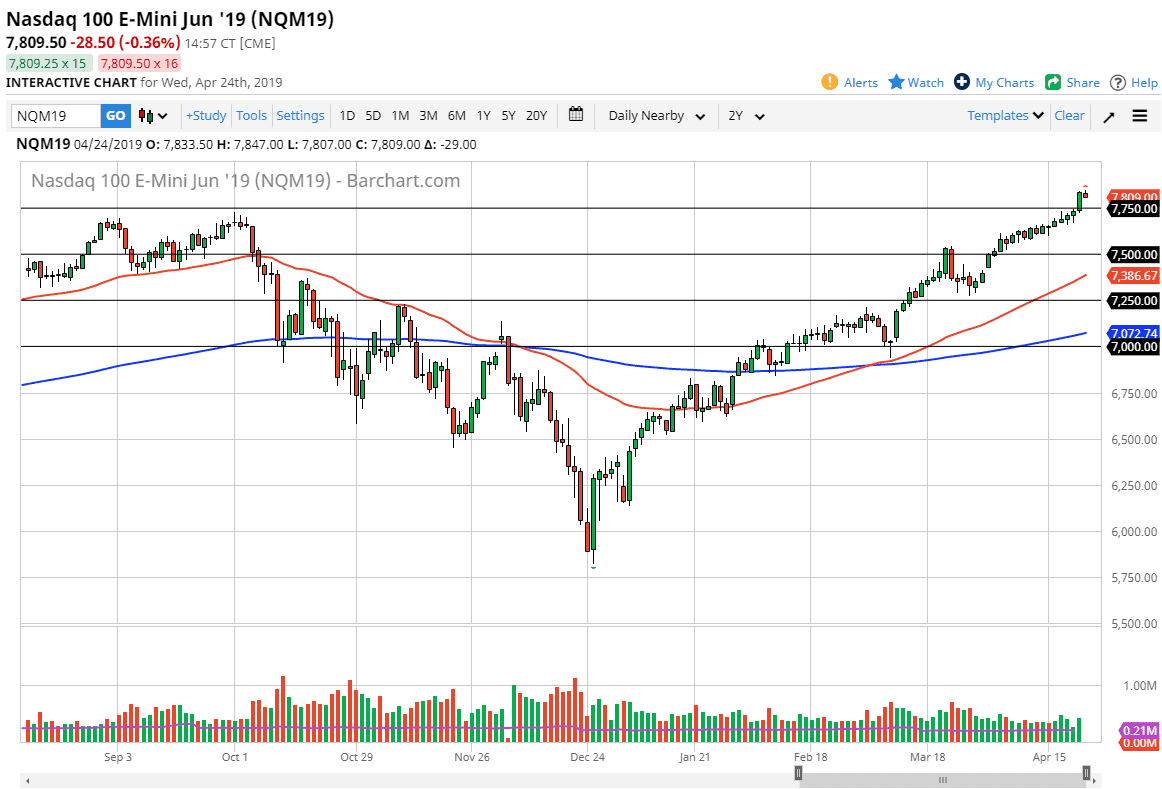

NASDAQ 100

The NASDAQ 100 pulled back a bit as well, but unlike the S&P 500, we have broken out to a fresh, new high recently. The 7750 level underneath is support as it was previous resistance. Looking at this market, I think that we will probably go looking towards the 8000 level over the longer-term just as the S&P 500 should go to the 3000 level. However, we need a good catalyst, and with some of the tech giants reporting earnings soon, it’s likely that the earnings report will be scrutinized by places such as Facebook and Alphabet. If they are good, it’s very likely that the NASDAQ 100 will continue to go higher. However, keep in mind that the NASDAQ is full of companies that do a lot of cross-border transactions, which means that a strengthening greenback can work against the companies in this index.