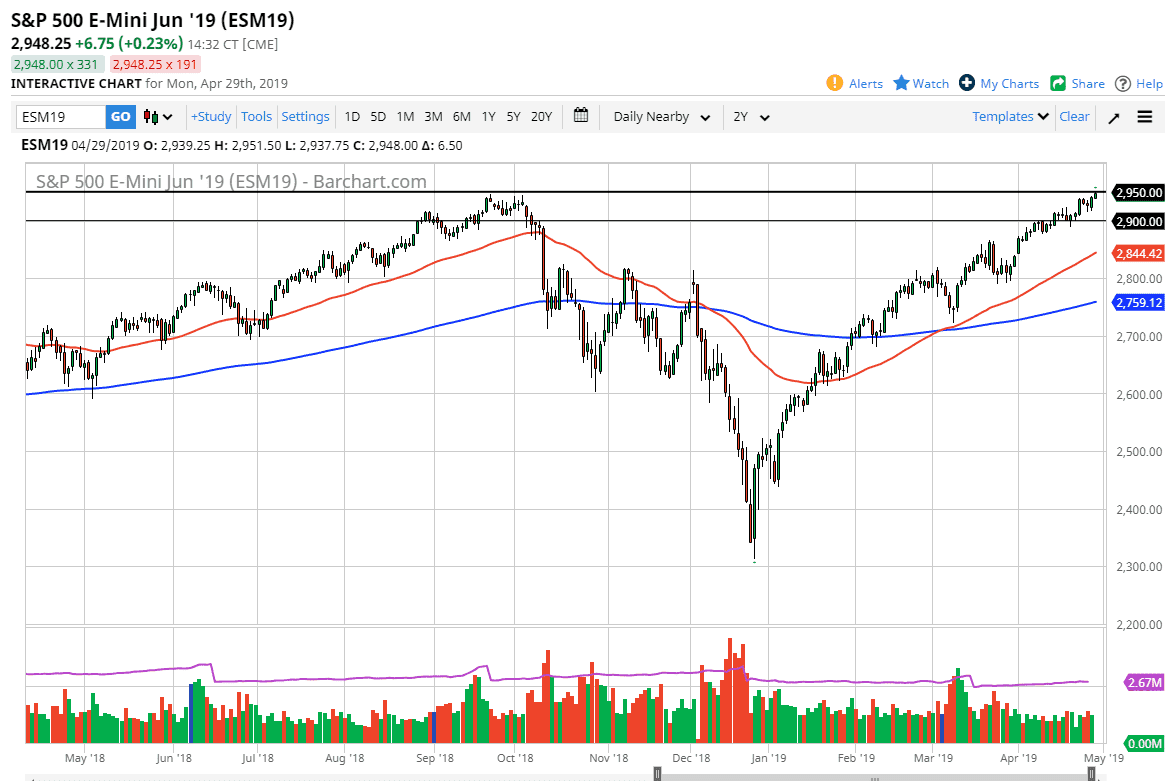

S&P 500

The S&P 500 rallied slightly during the trading session on Monday, breaking above the 2950 level. Ultimately, I do think that the market should continue the overall uptrend, but it is a bit overextended, so don’t be surprised at all if we get a pullback. The essay that markets “climbing a wall of worry”, and this is a perfect example of it. The 2900 level below will be the beginning of a 10 point support barrier that if we were to break down below it, it would be a very negative sign. All things being equal, if we break out to the upside I suspect that we are going towards the 3000 handle.

I would anticipate a lot of resistance at the 3000 level, as it is such a psychologically important figure. It’s also a target by many Wall Street analysts out there, so it will cause quite a bit of interest as well.

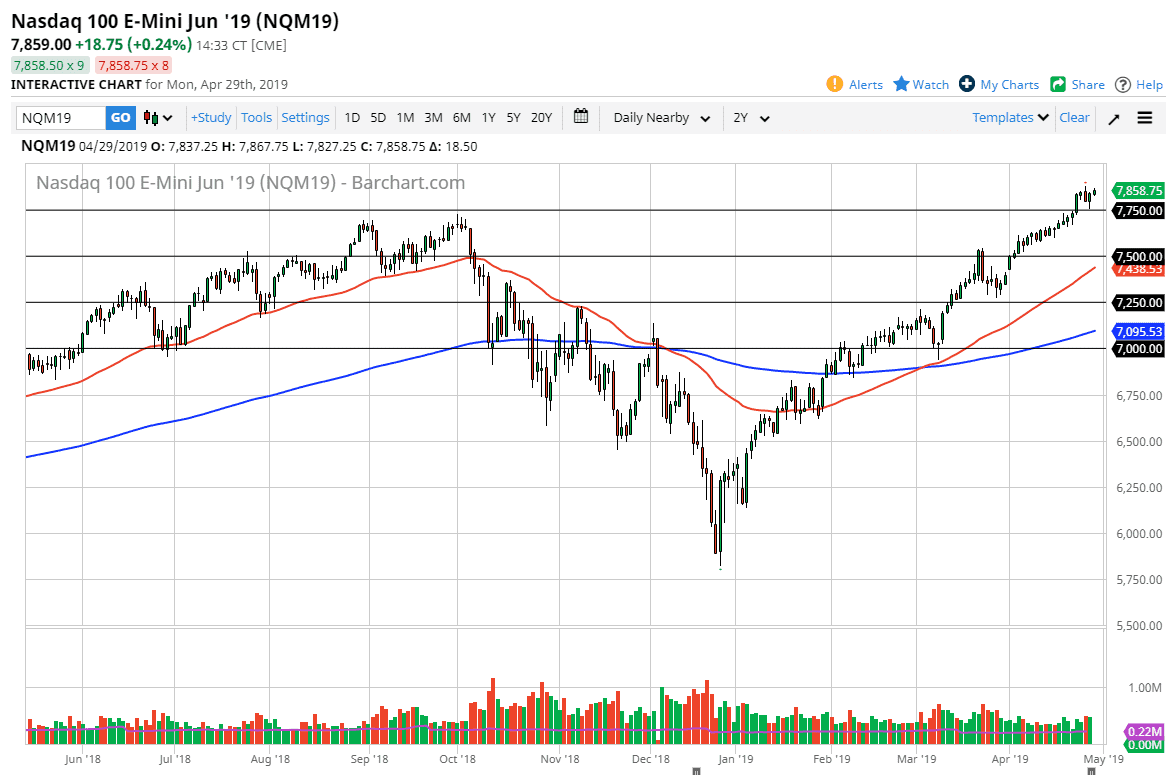

NASDAQ 100

The NASDAQ 100 rallied a bit during the trading session on Monday, as we continue to see bullish pressure overall. As we are in the middle of earnings season you can expect a lot of volatility but it’s obvious that the path of least resistance is higher. The 7750 level should be a bit of a “floor” in the market, so if we were to break down below there, the market probably could unwind quite a bit. If we break to the upside, then we will probably go looking towards the psychologically important figure of 8000 above. That’s an area that will attract a lot of attention, and it should be noted that stocks are starting to get to be a bit overextended in general.