Gold markets tried to rally initially during the trading session on Monday but gave back the gains to form a shooting star. A shooting star at this level is of course very interesting, as it is major support based upon the $1275 level. The market initially shot higher but as we have fallen it shows a return to what we had seen on Friday. Simply put, the buyers cannot hang on to the market long enough to push things significantly to the upside.

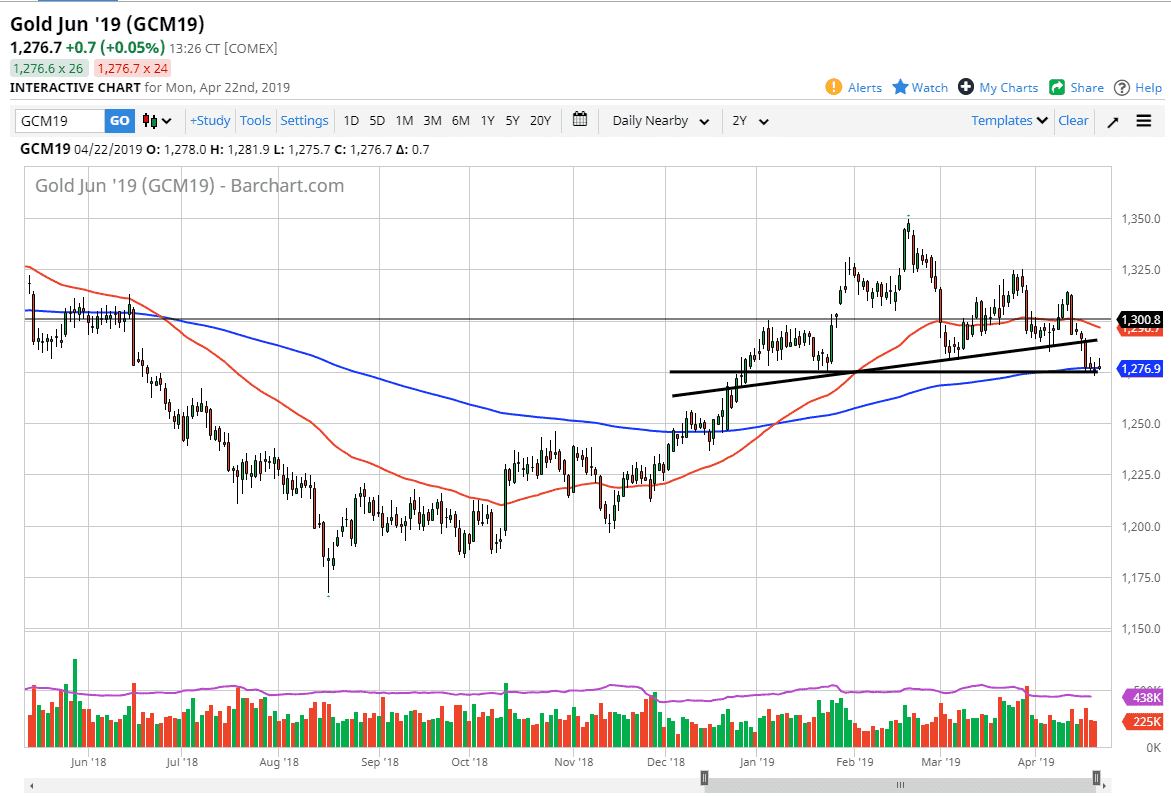

However, the $1275 level is rather stringent when it comes to support, so it’s likely that this will be a bit of a fight. If we do clear that level though, the market will almost undoubtedly continue to drop and perhaps even pick up a bit of momentum. The gold market has looked very soft as of late, and as you can see I have a couple of trendlines on the chart that dictate turning points in the market.

The initial uptrend line suggests that we had formed a bit of a head and shoulders pattern, which of course we have already broken to the downside. The horizontal trend line suggests that simply the $1275 level is going to be important, which makes sense considering that the 200 day EMA is sitting right there, and of course the market does tend to move in $25 increments. Either way, neither one of these is a good look for gold going forward. If we were to rally from here, we would need to clear the Tuesday candle stick from last week to wipe out the previous neckline of the head and shoulders, it’s not until then that I would consider buying. All things being equal, I suspect that rallies will continue to be faded on short-term charts, waiting for the trap door to open up below us to send the market much lower.